Question: Help on B 1 & 2 and C 1 & 2. Drop down choices are the Roman numerals. As an equity analyst you are concerned

Help on B 1 & 2 and C 1 & 2. Drop down choices are the Roman numerals.

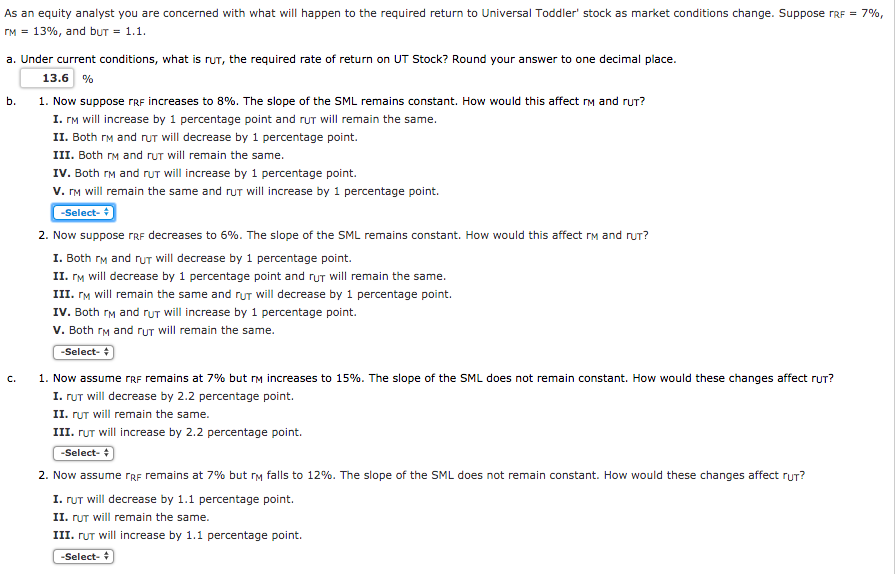

As an equity analyst you are concerned with what will happen to the required return to Universal Toddler' stock as market conditions change. Suppose rRF = 7%, IM 13%, and but = 1.1. a. Under current conditions, what is rut, the required rate of return on UT Stock? Round your answer to one decimal place. 13.6 % b. 1. Now suppose rrf increases to 8%. The slope of the SML remains constant. How would this affect rm and rur? I. rm will increase by 1 percentage point and rut will remain the same. II. Both rm and run will decrease by 1 percentage point. III. Both rm and rut will remain the same. IV. Both rm and run will increase by 1 percentage point. V. I will remain the same and rut will increase by 1 percentage point. -Select- 2. Now suppose rrf decreases to 5%. The slope of the SML remains constant. How would this affect rm and rur? 1. Both rm and nut will decrease by 1 percentage point. II. TM will decrease by 1 percentage point and run will remain the same. III. M will remain the same and run will decrease by 1 percentage point. IV. Both rm and rut will increase by 1 percentage point. V. Both rm and rut will remain the same. -Select- 1. Now assume rre remains at 7% but rm increases to 15%. The slope of the SML does not remain constant. How would these changes affect rur? 1. Put will decrease by 2.2 percentage point. II. Cut will remain the same. III. Cut will increase by 2.2 percentage point. -Select- 2. Now assume tre remains at 7% but im falls to 12%. The slope of the SML does not remain constant. How would these changes affect rut? I. Cut will decrease by 1.1 percentage point. II. rus will remain the same. III. Cut will increase by 1.1 percentage point. -Select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts