Question: help on Increase (decrease) in fair value adjustment for 12/31/2025 & journal entry anounts for Dec 31, 2025 Federal Semiconductors issued 11% bonds, dated January

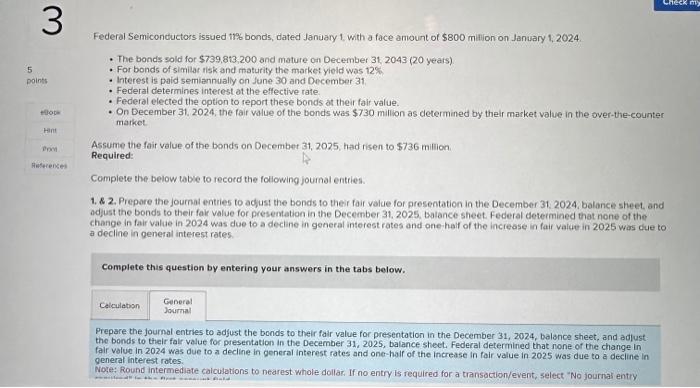

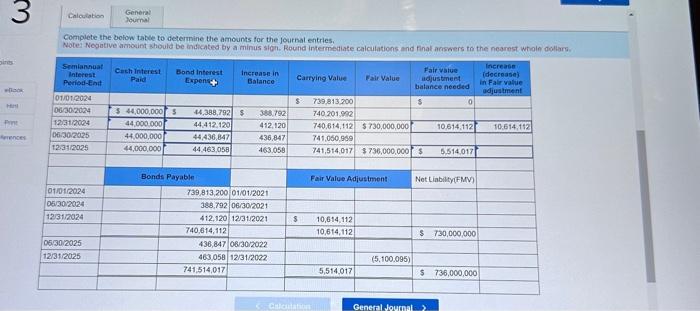

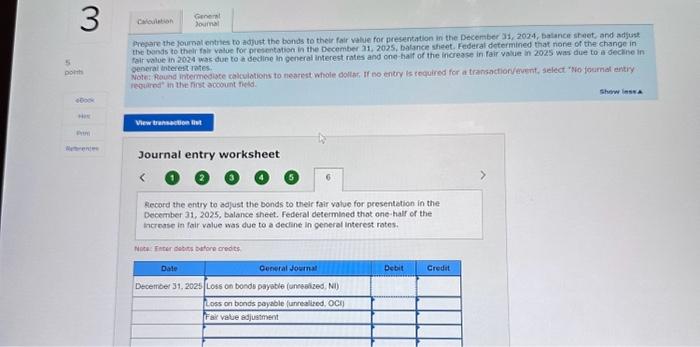

Federal Semiconductors issued 11\% bonds, dated January 1, with a face amount of $800 milion on January 1,2024. - The bonds sold for $739,813,200 and mature on December 31, 2043 (20 years) - For bonds of similar risk and maturity the market yieid was 12% - Interest is paid semiannualy on June 30 and December 31 . - Federal determines interest at the effective rate. - Federal elected the option to report these bonds at their fair value. - On December 31. 2024, the fair value of the bonds was $730 million as determined by their market value in the over-the-counter matket. Assume the fair value of the bonds on December 31, 2025, had risen to $736 million. Required: Complete the below tabe to record the following jounal entries. 1. \& 2. Prepare the journat entries to adjust the bonds to their fair value for presentation in the December 31. 2024, balance sheet, and adjust the bonds to their fak value for presentation in the December 31, 2025, balance sheet. Federal determined that none of the change in fair value in 2024 was due to a decline in general interest rates and one-haf of the increase in fair value in 2025 was due to a decline in general interest rates. Complete this question by entering your answers in the tabs below. Prepare the joumal entries to adfust the bonds to their fair value for presentation in the December 31,2024 , balance sheet, and adjust the bonds to their falr value for presentation in the December 31,2025 , balance sheet. Federal determined that none of the change in fair volue in 2024 was due to a decline in general interest rates and one-half of the increase in fair value in 2025 was due to a decine in qeneral interest rates. Note: Round intermediate calculations to nedrest whole dollar. If no entry is required for a transoction/event, select "No journal entry Complete the botow tabue to determine the amounts for the joarnal entries. Notea Negative amosint should be thdicated by a minus sign. Round intermetiate calculations and finat acsiners th the nearest wholn gollars Phesare the rournol entres to adjuct the bonds to their fair value for presentation in the December 31, 2024, batance sheet, and adfust the bonds to their foli value for presentation in the December 31,2025 . balance sheet. Federal determined that nonet of the change in penerai tnterest-1ates. Note: Paund intermediste colculotions to nearst whole dollas, If no entry is rocuired for a transactionvevent, select " Ho fournat entirs reverered" in the nint acosent fies. Journal entry worksheet 1 3. (3) (4) 5 Secord the entry to adjust the bonds to thelr fair value for presentation in the Decernber 31,2025 , balance theet. Federal determined that one-hall of the increase in fair value was due to a dechine in general interest rates. Nista fiter debits tufore oredts Federal Semiconductors issued 11\% bonds, dated January 1, with a face amount of $800 milion on January 1,2024. - The bonds sold for $739,813,200 and mature on December 31, 2043 (20 years) - For bonds of similar risk and maturity the market yieid was 12% - Interest is paid semiannualy on June 30 and December 31 . - Federal determines interest at the effective rate. - Federal elected the option to report these bonds at their fair value. - On December 31. 2024, the fair value of the bonds was $730 million as determined by their market value in the over-the-counter matket. Assume the fair value of the bonds on December 31, 2025, had risen to $736 million. Required: Complete the below tabe to record the following jounal entries. 1. \& 2. Prepare the journat entries to adjust the bonds to their fair value for presentation in the December 31. 2024, balance sheet, and adjust the bonds to their fak value for presentation in the December 31, 2025, balance sheet. Federal determined that none of the change in fair value in 2024 was due to a decline in general interest rates and one-haf of the increase in fair value in 2025 was due to a decline in general interest rates. Complete this question by entering your answers in the tabs below. Prepare the joumal entries to adfust the bonds to their fair value for presentation in the December 31,2024 , balance sheet, and adjust the bonds to their falr value for presentation in the December 31,2025 , balance sheet. Federal determined that none of the change in fair volue in 2024 was due to a decline in general interest rates and one-half of the increase in fair value in 2025 was due to a decine in qeneral interest rates. Note: Round intermediate calculations to nedrest whole dollar. If no entry is required for a transoction/event, select "No journal entry Complete the botow tabue to determine the amounts for the joarnal entries. Notea Negative amosint should be thdicated by a minus sign. Round intermetiate calculations and finat acsiners th the nearest wholn gollars Phesare the rournol entres to adjuct the bonds to their fair value for presentation in the December 31, 2024, batance sheet, and adfust the bonds to their foli value for presentation in the December 31,2025 . balance sheet. Federal determined that nonet of the change in penerai tnterest-1ates. Note: Paund intermediste colculotions to nearst whole dollas, If no entry is rocuired for a transactionvevent, select " Ho fournat entirs reverered" in the nint acosent fies. Journal entry worksheet 1 3. (3) (4) 5 Secord the entry to adjust the bonds to thelr fair value for presentation in the Decernber 31,2025 , balance theet. Federal determined that one-hall of the increase in fair value was due to a dechine in general interest rates. Nista fiter debits tufore oredts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts