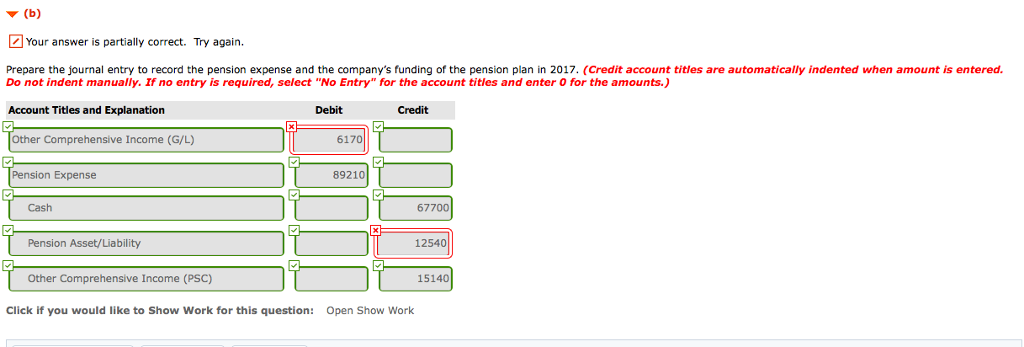

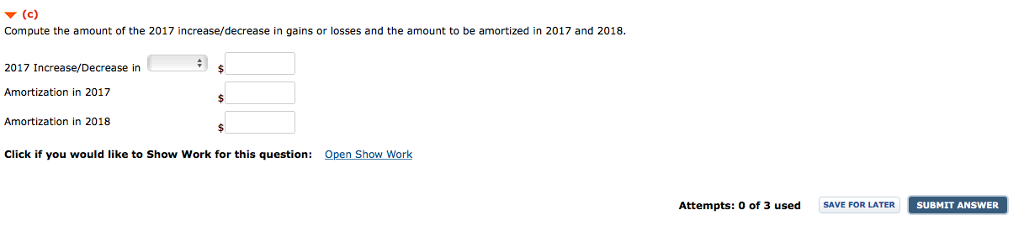

Question: Help on part C. The correct answer for part B is Other Comprehensive Income G/L 23,630 and Pension Asset/Liability 30,000 Problem 20-3 (Part Level Submission)

Help on part C. The correct answer for part B is Other Comprehensive Income G/L 23,630 and Pension Asset/Liability 30,000

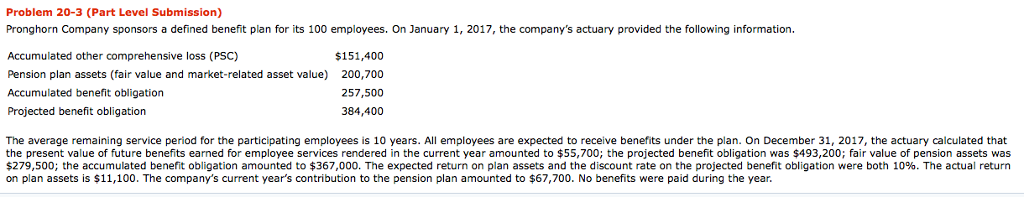

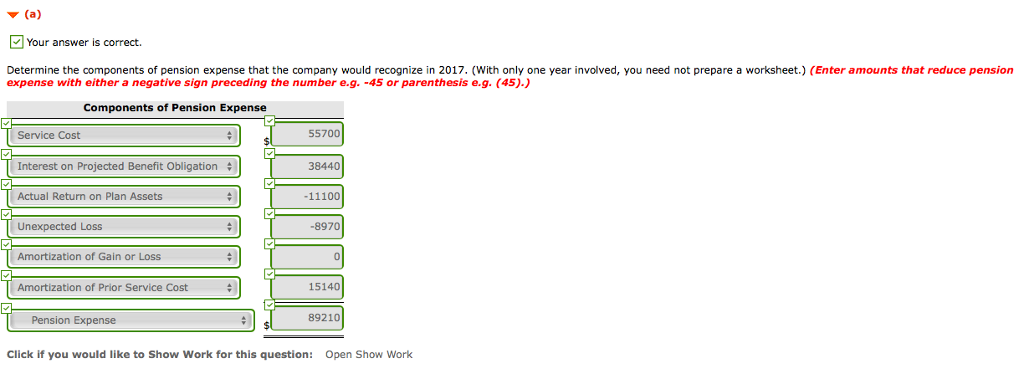

Problem 20-3 (Part Level Submission) Pronghorn Company sponsors a defined benefit plan for its 100 employees. On January 1, 2017, the company's actuary provided the following information. Accumulated other comprehensive loss (PSC) $151,400 200,700 257,500 384,400 Pension plan assets (fair value and market-related asset value) Accumulated benefit obligation Projected benefit obligation The average remaining service period for the participating employees is 10 years. All employees are expected to receive benefits under the plan. On December 31, 2017, the actuary calculated that the present value of future benefits earned for employee services rendered in the current year amounted to $55,700; the projected benefit obligation was $493,200; fair value of pension assets was $279,500; the accumulated benefit obligation amounted to $367,000. The expected return on plan assets and the discount rate on the projected benefit obligation were both 10%. The actual return on plan assets is $11,100. The company's current year's contribution to the pension plan amounted to $67,700. No benefits were paid during the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts