Question: help on these two questions please. I MARKED THE STUCK ONES WITH AN ARROW Question 1 Partially correct Mark 47.92 out of 50.00 V Flag

help on these two questions please. I MARKED THE STUCK ONES WITH AN ARROW

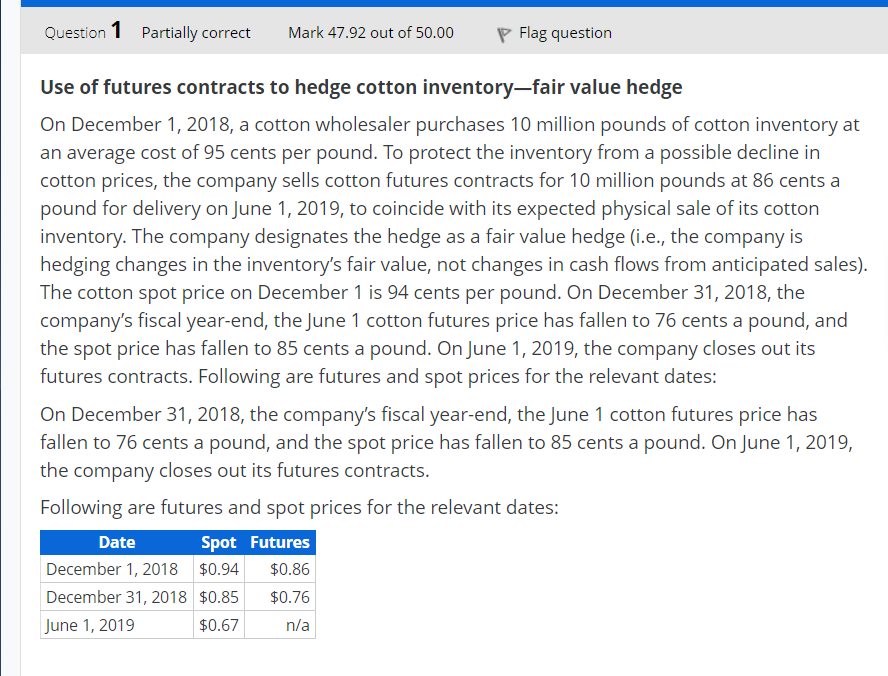

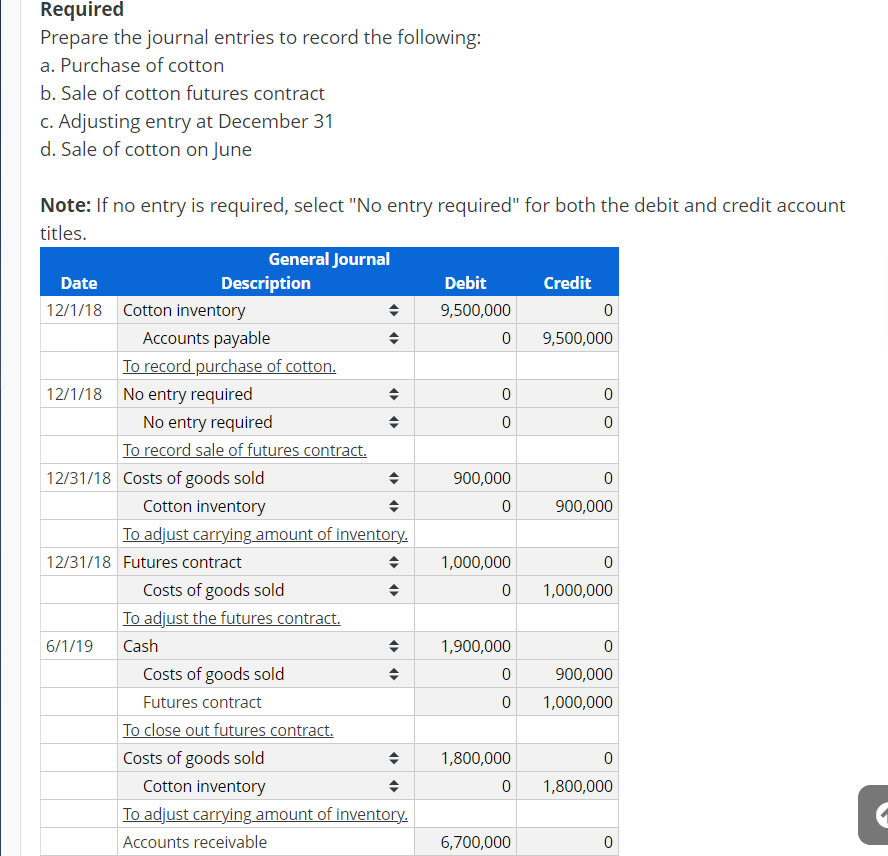

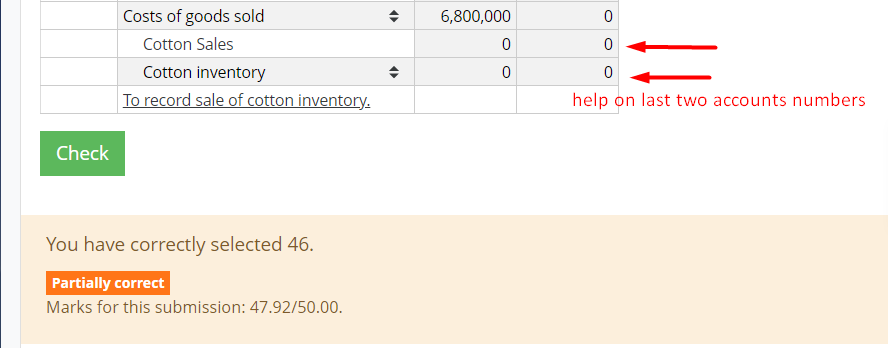

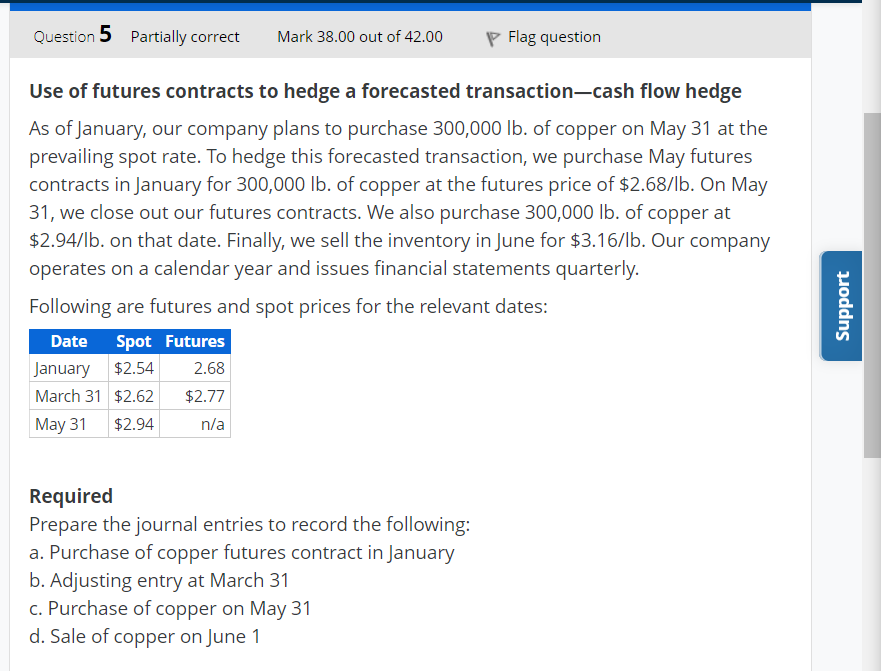

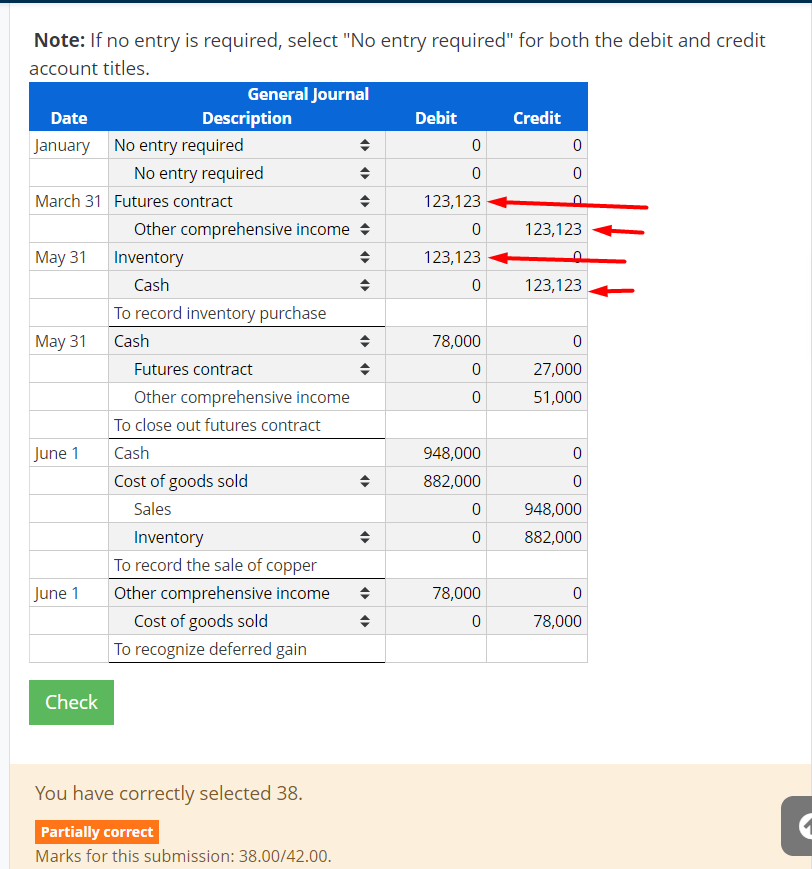

Question 1 Partially correct Mark 47.92 out of 50.00 V Flag question Use of futures contracts to hedge cotton inventoryfair value hedge On December 1, 2018, a cotton wholesaler purchases 10 million pounds of cotton inventory at an average cost of 95 cents per pound. To protect the inventory from a possible decline in cotton prices, the company sells cotton futures contracts for 10 million pounds at 86 cents a pound for delivery on June 1, 2019, to coincide with its expected physical sale of its cotton inventory. The company designates the hedge as a fair value hedge (i.e., the company is hedging changes in the inventory's fair value, not changes in cash flows from anticipated sales]. The cotton spot price on December 1 is 94 cents per pound. On December 31, 2018, the company's fiscal yearend, thejune 1 cotton futures price has fallen to 26 cents a pound, and the spot price has fallen to 85 cents a pound. lDnjune 1, 2019, the company closes out its futures contracts. Following are futures and spot prices for the relevant dates: On December 31, 2018, the company's fiscal yearend, thejune 1 cotton futures price has fallen to 26 cents a pound, and the spot price has fallen to 85 cents a pound. lDnjune 1, 2019, the company closes out its futures contracts. Following are futures and spot prices for the relevant dates: Date Spot Futures December 1, 2018 $0.95r $0.86 December 31, 2018 $0.85 $0.76 June 1, 2019 $0.67 nra Required Prepare the journal entries to record the following: a. Purchase of cotton b. Sale of cotton futures contract c. Adjusting entry at December 31 d. Sale of cotton onjune Note: If no entry is required, select "No entry required" for both the debit and credit account titles. Date 12f1f18 12f1p'18 12f31f18 12f31f18 6f1f19 General Journal Description Debit Cotton inventory 9,500,000 Accounts payable 0 To record purchase of cotton. No entry required 0 No entry required 0 To record sale of futures contract. Costs of goods sold 900,000 Cotton inventory 0 To adjust carrying amount of inventory. Futures contract 1,000,000 Costs of goods sold 0 To adjust the futures contract. Cash 1,900,000 Costs of goods sold 0 Futures contract 0 To close out futures contract. Costs of goods sold 1,800,000 Cotton inventory 0 To adjust carrying amount of inventory. Accounts receivable 6,?00,000 Credit 0 9,500,000 0 900,000 0 1 ,000,000 0 900,000 1 ,000,000 0 1 00,000 Costs of goods sold 6.800.000 0 Cotton Sales '3' '3' h Cotton inventory 0 0 .1 To record sale of cotton inventory; help n last two accounts numbers You have correctly selected 46. Partially correct Marks for this submission: 419350.00. Question 5 Partially correct Mark 38.00 out of 42.00 V Flag question Use of futures contracts to hedge a forecasted transactioncash flow hedge As ofJanuary, our company plans to purchase 300,000 lb. of copper on May 31 at the prevailing spot rate. To hedge this forecasted transaction, we purchase May futures contracts in January for 300,000 lb. of copper at the futures price of $2.68flb. On May 31, we close out our futures contracts. We also purchase 300,000 lb. of copper at $2.94flb. on that date. Finally, we sell the inventory in June for $3.16r'lb. Our company operates on a calendar year and issues financial statements quarterly. Following are futures and spot prices for the relevant dates: Date Spot Futures January $2.5-'r 2.68 March 31 $2.62 $2.77 May 31 $2.94 nfa Required Prepare the Journal entries to record the following: a. Purchase of copper futures contract in January b. Adjusting entry at March 31 c. Purchase of copper on May 31 d. Sale of copper on June 1 Note: If no entry is required, select "No entry required" for both the debit and credit account titles. General Journal Date Description Debit Credit January No entry required 0 No entry required 0 0 March 31 Futures contract 123,123 b Other comprehensive income + 0 123,123 May 31 Inventory 123,123 Cash 0 123,123 To record inventory purchase May 31 Cash 78,000 0 Futures contract 0 27,000 Other comprehensive income 0 51,000 To close out futures contract June 1 Cash 948,000 0 Cost of goods sold 882,000 0 Sales 0 948,000 Inventory 0 882,000 To record the sale of copper June 1 Other comprehensive income 78,000 0 Cost of goods sold 0 78,000 To recognize deferred gain Check You have correctly selected 38. Partially correct Marks for this submission: 38.00/42.00