Question: help on this would be great :) The following table summarizes prices of various default tree zero-coupon bonds (expressed as a percontage of the face

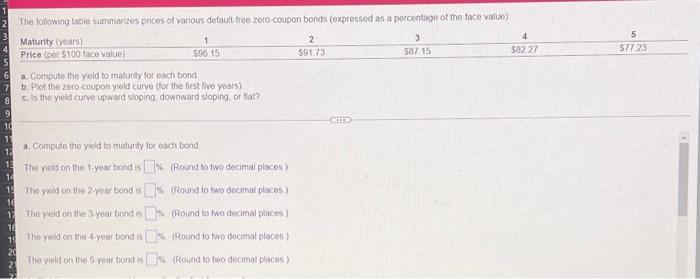

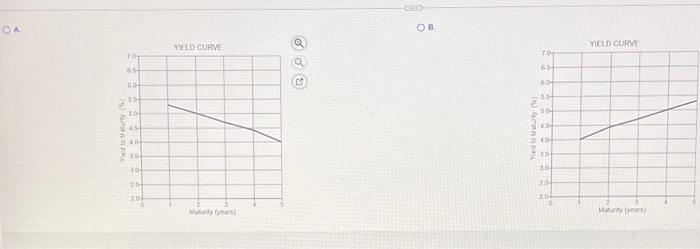

The following table summarizes prices of various default tree zero-coupon bonds (expressed as a percontage of the face value) Maturity (years) Price (per S100 face value 1 596 15 2 $91.73 3 587 15 5 $7722 $8227 6 a. Compute the yield to maturity for each bond b. Plot the 200 coupon yield curve for the first five years) c. Is the yield curve upward sloping downward sloping, or lat? 8 9 10 GLEDE 10 a. Compute the old to maturdy for each bond The yield on the year bond is % (Round to two decimal places 1 The yuld on the 2-pole bond is x Raund to two docitial places) The yield on the 3 year bond is 10% (Round to two decimal places) The yield on the 4 year bond is 0.3%. (Round to two decimal places) 20 The yield on the 5 your bond in E (Round to two decimal places) 17 12 19 . OB YIELD CURVE YIELD CURVE oo TO 10 65 SO 50 GUR 31 10 25 15 20 Watu Myeon 5.0- to Maturity 4.5- 9401 upward sloping flat. 3 Maturity (years) c. Is the yield curve downward sloping oping, or flat? (Select from the drop The yield curve is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts