Question: help out 4. A security analyst forecasts that each of three scenarios for the next year is equally likely: (1) a boom, (2) controlled growth

help out

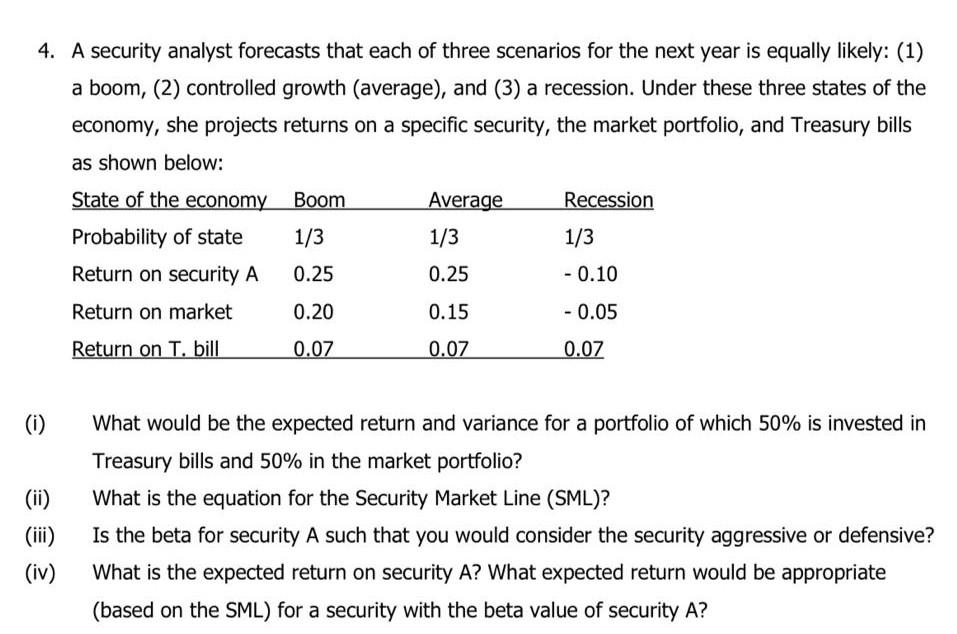

4. A security analyst forecasts that each of three scenarios for the next year is equally likely: (1) a boom, (2) controlled growth (average), and (3) a recession. Under these three states of the economy, she projects returns on a specific security, the market portfolio, and Treasury bills as shown below: (i) What would be the expected return and variance for a portfolio of which 50% is invested in Treasury bills and 50% in the market portfolio? (ii) What is the equation for the Security Market Line (SML)? (iii) Is the beta for security A such that you would consider the security aggressive or defensive? (iv) What is the expected return on security A ? What expected return would be appropriate (based on the SML) for a security with the beta value of security A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts