Question: help page 2 help page 3 help page 4 journal ledger page 7 ledger page 8 worksheet so there is total 6 worksheets to do

help page 2

help page 3

help page 4

journal

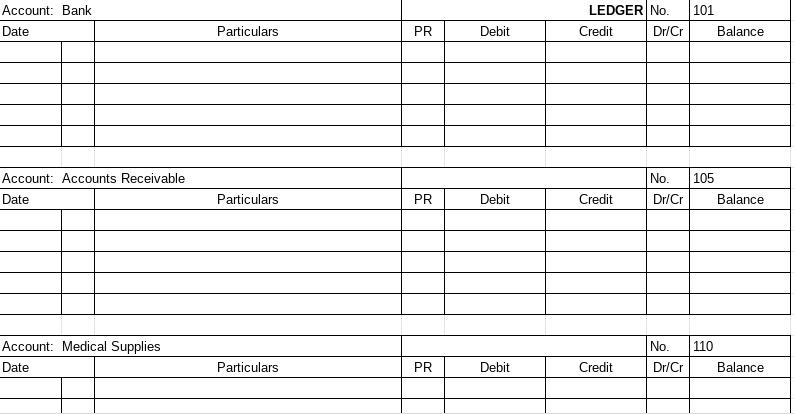

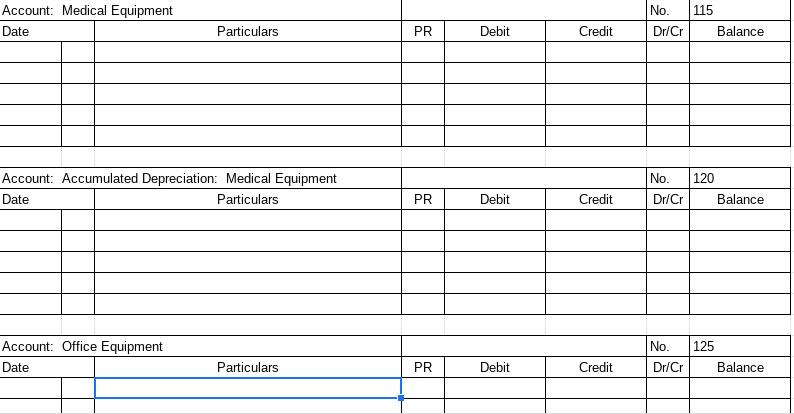

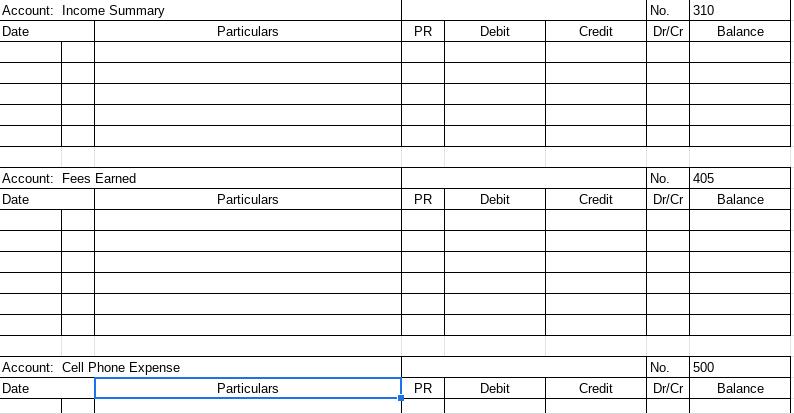

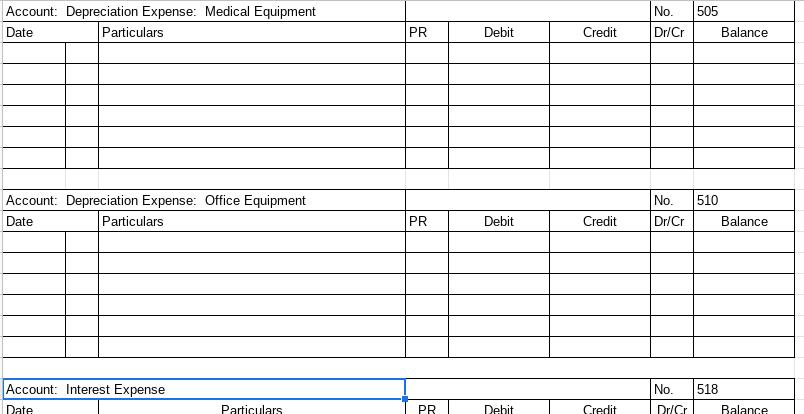

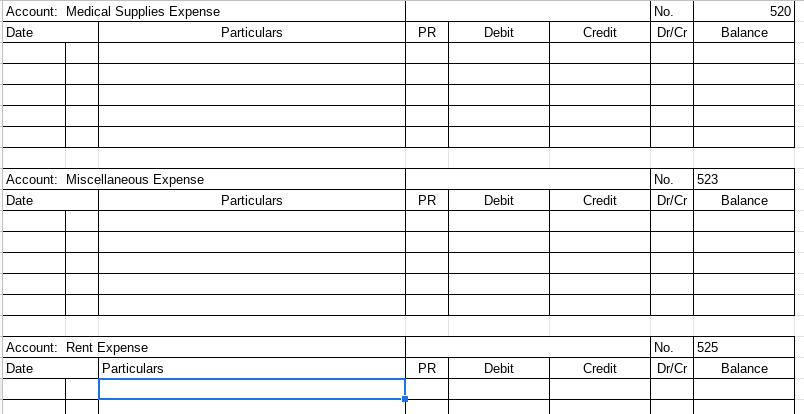

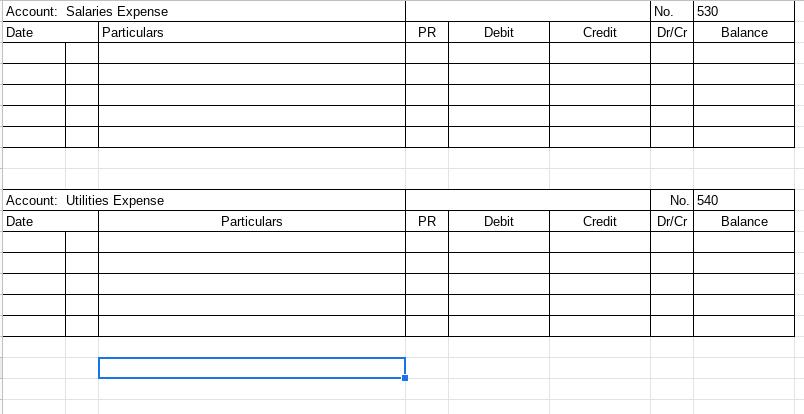

ledger page 7

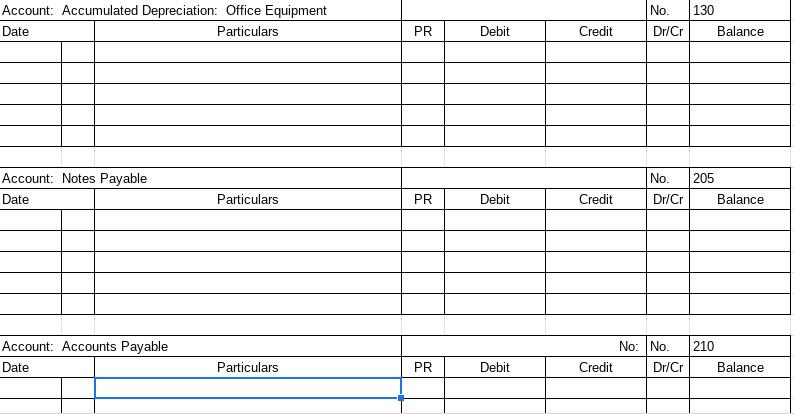

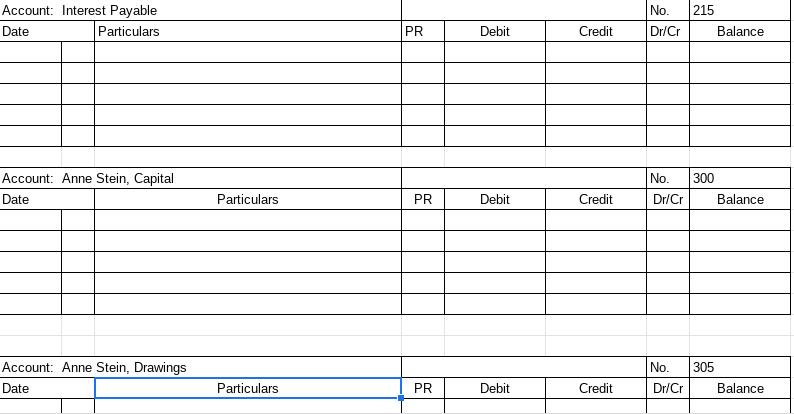

ledger page 8

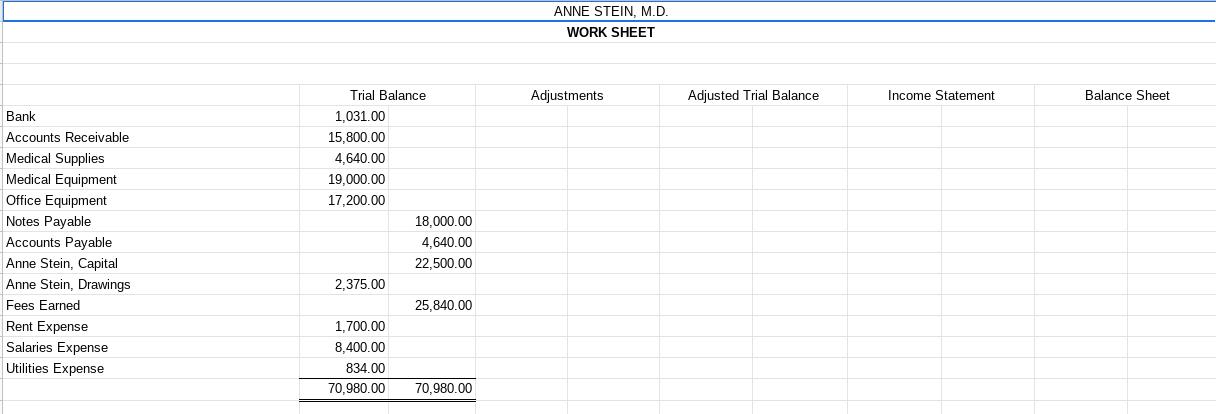

worksheet

so there is total 6 worksheets to do -

journal, ledger, worksheet, income statement, balance sheet, and adjusted trial balance

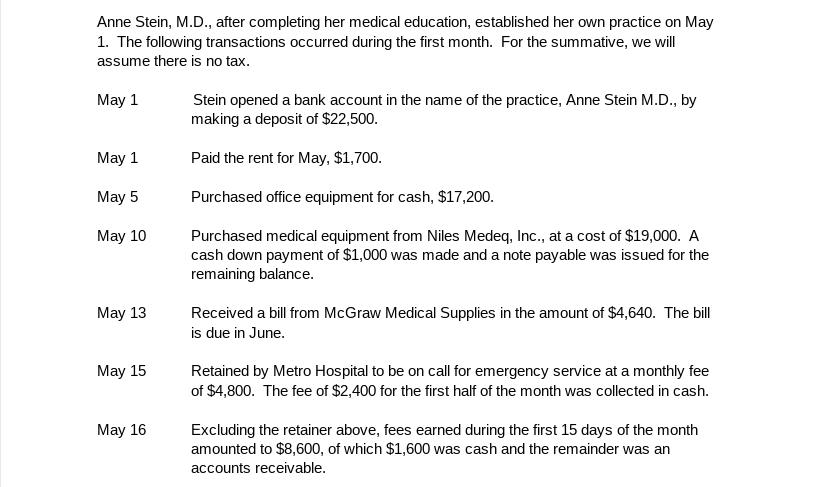

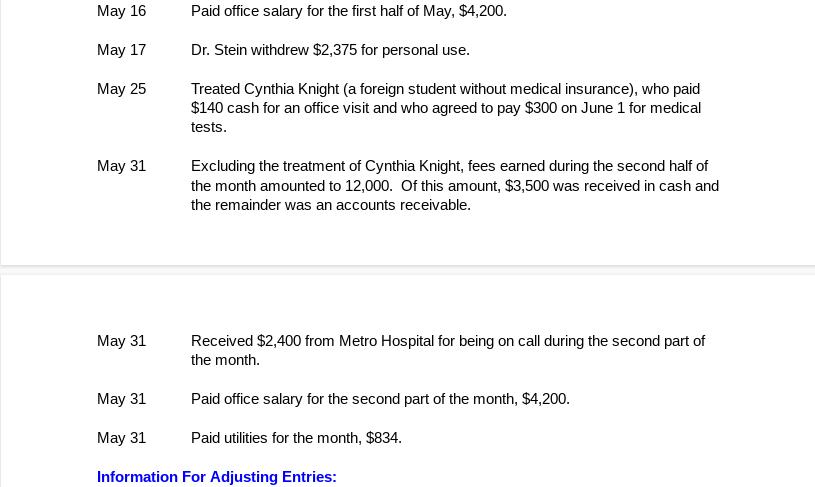

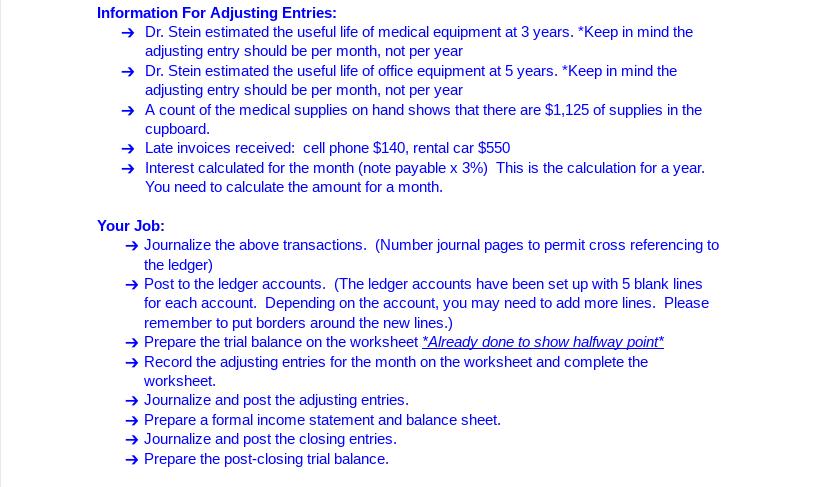

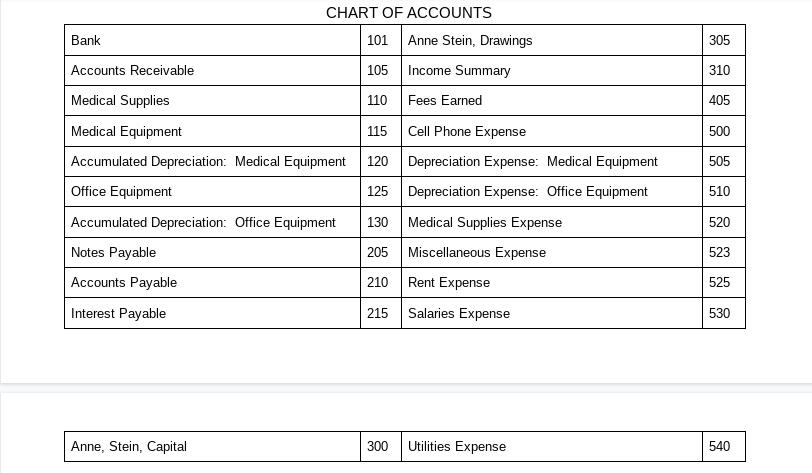

Anne Stein, M.D., after completing her medical education, established her own practice on May 1. The following transactions occurred during the first month. For the summative, we will assume there is no tax. May 1 Stein opened a bank account in the name of the practice, Anne Stein M.D., by making a deposit of $22,500. May 1 Paid the rent for May, $1,700. May 5 Purchased office equipment for cash, $17,200. Purchased medical equipment from Niles Medeq, In., at a cost of $19,000. A cash down payment of $1,000 was made and a note payable was issued for the remaining balance. May 10 May 13 Received a bill from McGraw Medical Supplies in the amount of $4,640. The bill is due in June. May 15 Retained by Metro Hospital to be on call for emergency service at a monthly fee of $4,800. The fee of $2,400 for the first half of the month was collected in cash. May 16 Excluding the retainer above, fees earned during the first 15 days of the month amounted to $8,600, of which $1,600 was cash and the remainder was an accounts receivable.

Step by Step Solution

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Date Particulars Debit Credit May 1 Bank account Capital account 22500 22500 May 1 Rent account bank account 1700 1700 May 5 Office equipment bank account 17200 17200 May 10 Medical equipment bank acc... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

6261273224f43_tttt.xlsx

300 KBs Excel File