Question: Help? Part 4 a. c. a.c Additional Information a. Budgeted sales are 1,000 laptops for the first quarter and are expected to increase by 200

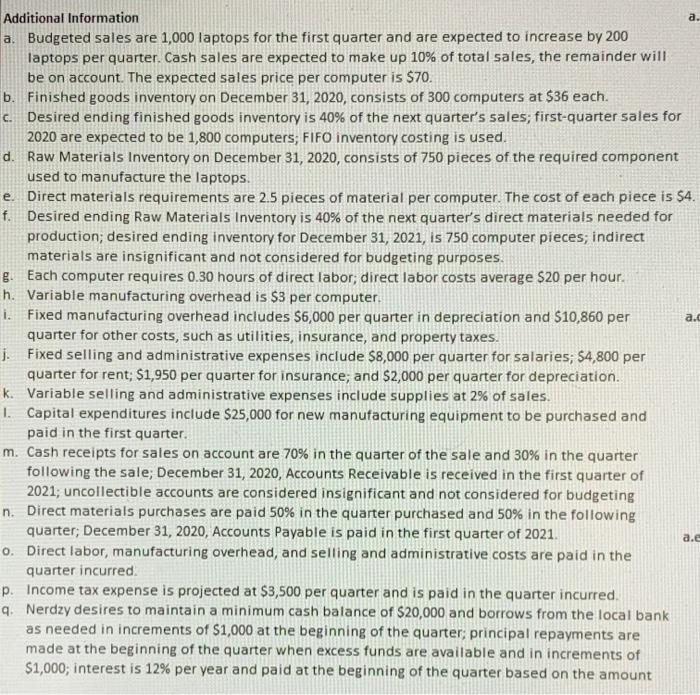

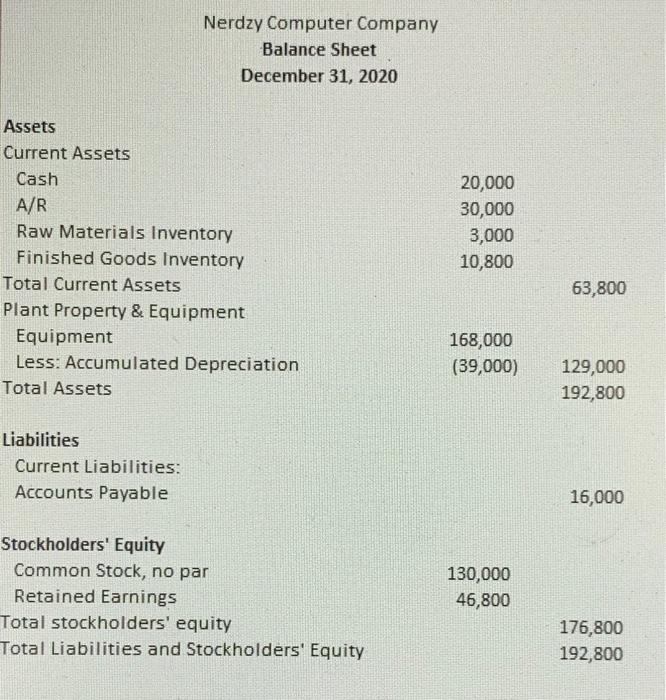

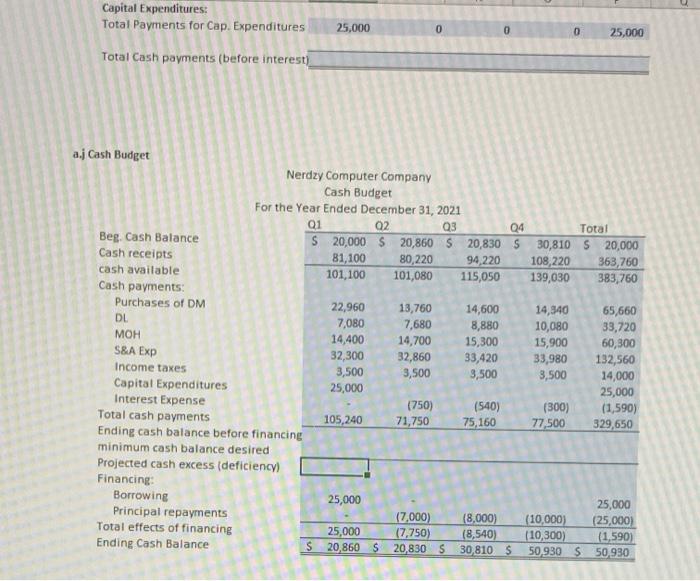

a. c. a.c Additional Information a. Budgeted sales are 1,000 laptops for the first quarter and are expected to increase by 200 laptops per quarter. Cash sales are expected to make up 10% of total sales, the remainder will be on account. The expected sales price per computer is $70. b. Finished goods inventory on December 31, 2020, consists of 300 computers at $36 each. Desired ending finished goods inventory is 40% of the next quarter's sales; first-quarter sales for 2020 are expected to be 1,800 computers; FIFO inventory costing is used. d. Raw Materials Inventory on December 31, 2020, consists of 750 pieces of the required component used to manufacture the laptops. e. Direct materials requirements are 25 pieces of material per computer. The cost of each piece is $4. f. Desired ending Raw Materials Inventory is 40% of the next quarter's direct materials needed for production; desired ending inventory for December 31, 2021, is 750 computer pieces; indirect materials are insignificant and not considered for budgeting purposes. 8. Each computer requires 0.30 hours of direct labor; direct labor costs average $20 per hour. h. Variable manufacturing overhead is $3 per computer. i. Fixed manufacturing overhead includes $6,000 per quarter in depreciation and $10,860 per quarter for other costs, such as utilities, insurance, and property taxes. 1. Fixed selling and administrative expenses include $8,000 per quarter for salaries; 54,800 per quarter for rent; $1,950 per quarter for insurance; and $2,000 per quarter for depreciation. k. Variable selling and administrative expenses include supplies at 2% of sales. 1. Capital expenditures include $25,000 for new manufacturing equipment to be purchased and paid in the first quarter. m. Cash receipts for sales on account are 70% in the quarter of the sale and 30% in the quarter following the sale; December 31, 2020, Accounts Receivable is received in the first quarter of 2021; uncollectible accounts are considered insignificant and not considered for budgeting n. Direct materials purchases are paid 50% in the quarter purchased and 50% in the following quarter December 31, 2020, Accounts Payable is paid in the first quarter of 2021. 0. Direct labor, manufacturing overhead, and selling and administrative costs are paid in the quarter incurred. p. Income tax expense is projected at $3,500 per quarter and is paid in the quarter incurred. q. Nerdzy desires to maintain a minimum cash balance of $20,000 and borrows from the local bank as needed in increments of $1,000 at the beginning of the quarter; principal repayments are made at the beginning of the quarter when excess funds are available and in increments of $1,000; interest is 12% per year and paid at the beginning of the quarter based on the amount a.e Nerdzy Computer Company Balance Sheet December 31, 2020 Assets Current Assets Cash A/R Raw Materials Inventory Finished Goods Inventory Total Current Assets Plant Property & Equipment Equipment Less: Accumulated Depreciation Total Assets 20,000 30,000 3,000 10,800 63,800 168,000 (39,000) 129,000 192,800 Liabilities Current Liabilities: Accounts Payable 16,000 Stockholders' Equity Common Stock, no par Retained Earnings Total stockholders' equity Total Liabilities and Stockholders' Equity 130,000 46,800 176,800 192,800 Capital Expenditures: Total Payments for Cap. Expenditures 25,000 0 0 0 25,000 Total Cash payments (before interest) a.j Cash Budget Nerdzy Computer Company Cash Budget For the Year Ended December 31, 2021 01 02 03 Q4 Total Beg Cash Balance S 20,000 $20,860 S 20,830 S 30,810 5 20,000 Cash receipts 81,100 80,220 94,220 108,220 363,760 cash available 101,100 101,080 115,050 139,030 383,760 Cash payments: Purchases of DM 22,960 13,760 14,600 14,340 65,660 DL 7,080 7,680 8,880 10,080 33,720 MOH 14,400 14,700 15,300 15,900 60,300 S&A Exp 32,300 32,860 33,420 33,980 132,560 Income taxes 3,500 3,500 3,500 3,500 14,000 Capital Expenditures 25,000 25,000 Interest Expense (750) (540) (300) (1,590) Total cash payments 105,240 71,750 75,160 77,500 329,650 Ending cash balance before financing minimum cash balance desired Projected cash excess deficiency) Financing: Borrowing 25,000 25,000 Principal repayments (7,000) (8,000) (10,000) (25,000 Total effects of financing 25,000 (7,750) (8,540) (10,300) (1.590) Ending Cash Balance S 20,860 S 20,830 S 30,810 $ 50,930 S 50.930

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts