Question: help pease. where does the tax return number come from ? See Table 25 showing financial statement data and stock price data for Mydeco Corp.

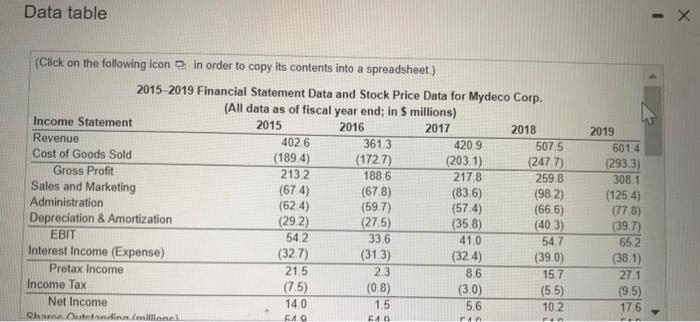

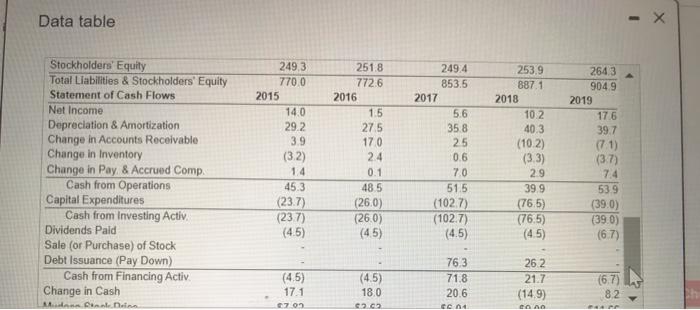

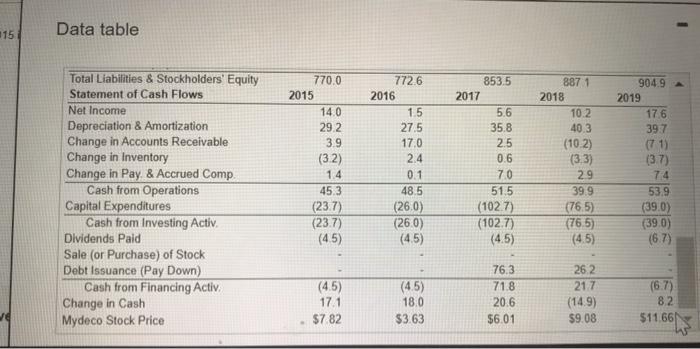

See Table 25 showing financial statement data and stock price data for Mydeco Corp. Was Mydeco able to improve its return on invested capital (ROC) 2015 relative to what was in 2015 The ROIC 10 2015 ) Round to be decimal places Data table - X (Click on the following icon in order to copy its contents into a spreadsheet.) 2015 2019 Financial Statement Data and Stock Price Data for Mydeco Corp. (All data as of fiscal year end; in $ millions) Income Statement 2015 2016 2017 2018 Revenue 4026 361.3 420.9 5075 Cost of Goods Sold (189.4) (172.7) (203.1) (2477) Gross Profit 2132 188,6 217.8 259.8 Sales and Marketing (674) (678) (836) (982) Administration (624) (597) (574) (66.6) Depreciation & Amortization (292) (27.5) (358) (403) EBIT 542 336 41.0 54 7 Interest Income (Expense) (32.7) (31.3) (324) (39.0) Pretax Income 21.5 2.3 8.6 15.7 Income Tax (75) (0.8) (3.0) (5.5) Net Income 14.0 1.5 5,6 10 2 Outdin millione RAQ 540 2019 6014 (2933) 308.1 (1254) (778) (39.7) 65 2 (38.1) 271 (9.5) 176 2015 Data table 59.9 SO 26 2015 54.9 $0.03 2016 54,9 $0.10 2017 9 $0.19 2018 $0.32 2019 Shares Outstanding ( mons Earnings per Share Balance Sheet Assets Cash Accounts Receivable Inventory Total Current Assets Net Property Plant & Equipment Goodwill & Intangibles Total Assets Liabilities & Stockholders' Equity Accounts Payable Accrued Compensation Total Current Liabilities Long-Term Debt Total Liabilities 49.6 878 332 170.6 2419 3575 770.0 676 70.8 30.8 169,2 2459 3575 7726 882 68.3 302 1867 309 3 3575 853.5 733 785 33.5 185 3 3443 3575 8871 81.5 856 37 2 2043 343.1 3575 9049 16.9 6.7 23.6 4971 5207 164 7.3 23,7 4971 520.8 232 75 30.7 5734 6041 262 74 33.6 599.6 6332 30.6 10.4 410 5996 6406 sive Check Data table Stockholders' Equity Total Liabilities & Stockholders' Equity Statement of Cash Flows Net Income Depreciation & Amortization Change in Accounts Receivable Change in Inventory Change in Pay & Accrued Comp. Cash from Operations Capital Expenditures Cash from Investing Activ Dividends Pald Sale (or Purchase) of Stock Debt Issuance (Pay Down) Cash from Financing Activ Change in Cash 2493 7700 2015 14.0 29.2 3.9 (3.2) 14 45.3 (23.7) (237) (4.5) 251.8 7726 2016 15 27.5 170 2.4 0.1 48.5 (26.0) (260) (4.5) 249.4 853.5 2017 5.6 358 25 0.6 70 51.5 (1027) (102.7) (4.5) 253,9 8871 2018 102 40.3 (102) (3.3) 2.9 39.9 (76.5) (765) (4.5) 2643 9049 2019 176 39.7 (71) (3.7) 74 539 (39.0) (390) (6.7) (4.5) 17.1 (4.5) 18.0 763 71.8 20.6 262 21.7 (14.9) (6,7) 8.2 in Den 070 ce CA A 115 Data table Total Liabilities & Stockholders' Equity Statement of Cash Flows Net Income Depreciation & Amortization Change in Accounts Receivable Change in Inventory Change in Pay & Accrued Comp. Cash from Operations Capital Expenditures Cash from Investing Activ Dividends Paid Sale (or Purchase) of Stock Debt Issuance (Pay Down) Cash from Financing Activ Change in Cash Mydeco Stock Price 770.0 2015 14.0 29.2 39 (32) 1.4 45.3 (237) (23.7) (45) 7726 2016 1.5 27.5 17.0 2.4 0.1 48.5 (26.0) (26.0) (4.5) 853.5 2017 5.6 35.8 2.5 0.6 70 51.5 (1027) (102.7) (4.5) 8871 2018 10.2 40.3 (10.2) (3.3) 29 39.9 (76.5) (76.5) (4.5) 904.9 2019 176 39.7 (71) (37) 74 53.9 (39.0) (39.0) (67) (4.5) 76.3 71.8 20.6 $6.01 (4.5) 18.0 $3.63 17.1 $782 26 2 21 7 (149) $9.08 (67) 82 $11661

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts