Question: Help People Window Bookmarks History View Chrome Edit File mathxl.com BU-3210-02-Fall Homework: Assignment 2 Save HW Score: 55%, 55 of... 8 of 8 (5 complete)

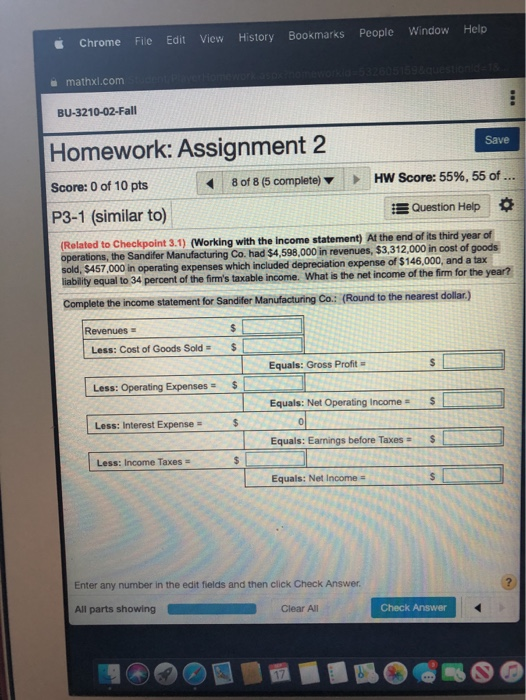

Help People Window Bookmarks History View Chrome Edit File mathxl.com BU-3210-02-Fall Homework: Assignment 2 Save HW Score: 55%, 55 of... 8 of 8 (5 complete) Score: 0 of 10 pts Question Help P3-1 (similar to) (Related to Checkpoint 3.1) (Working with the income statement) At the end of its third year of operations, the Sandifer Manufacturing Co. had $4,598,000 in revenues, $3,312,000 in cost of goods sold, $457,000 in operating expenses which included depreciation expense of $146,000, and a tax liability equal to 34 percent of the firm's taxable income. What is the net income of the firm for the year? Complete the income statement for Sandifer Manufacturing Co.: (Round to the nearest dollar.) Revenues Less: Cost of Goods Sold Equals: Gross Profit $ Less: Operating Expenses Equals: Net Operating Income Less: Interest Expense 0 Equals: Earnings before Taxes $ Less: Income Taxes Equals: Net Income= Enter any number in the edit fields and then click Check Answer All parts showing Clear All Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts