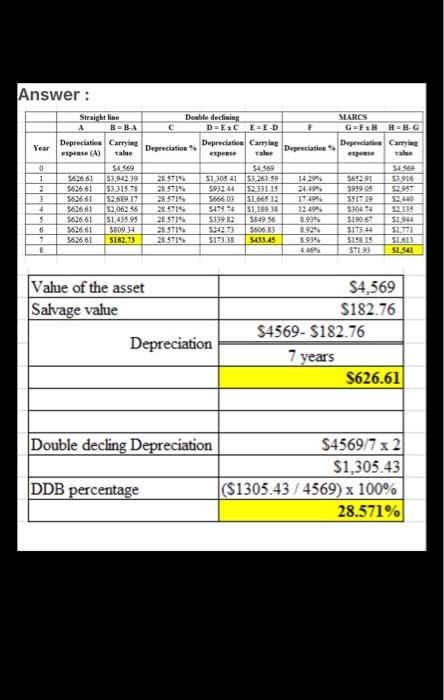

Question: help pleae use chartvro help me answer the questions Answer: Year 0 1 2 3 4 $ 6 7 8 Straight line A BEBA Depreciation

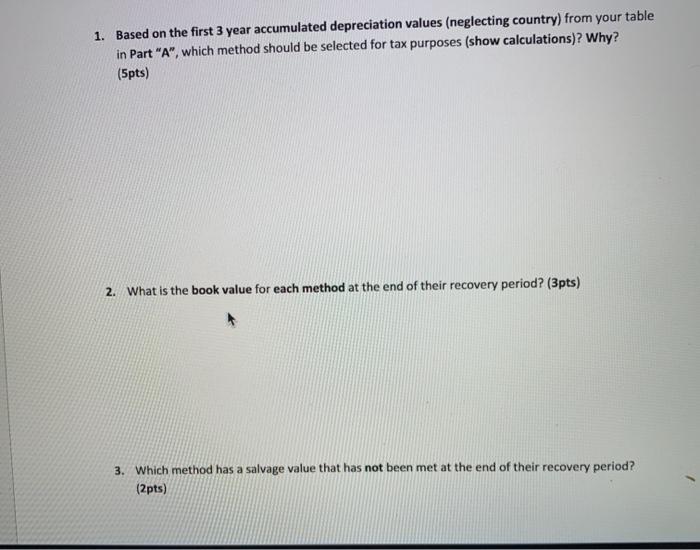

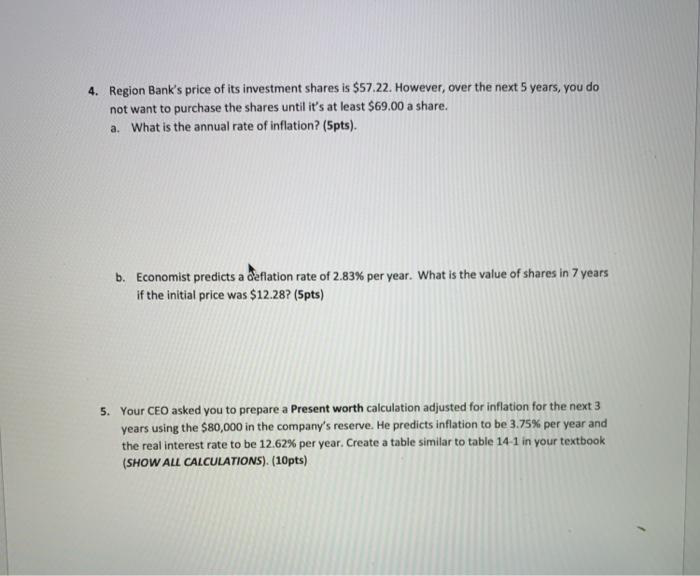

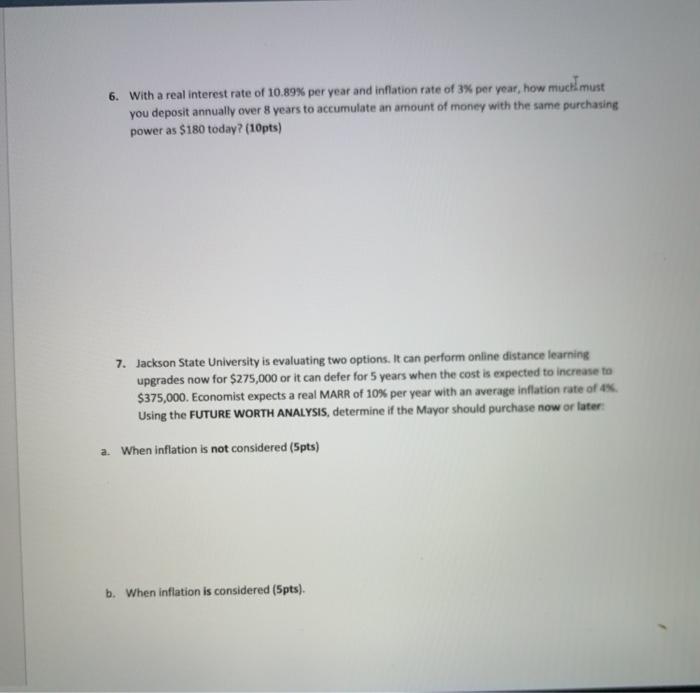

Answer: Year 0 1 2 3 4 $ 6 7 8 Straight line A BEBA Depreciation Carrying exprese (A) value $4869 $626 61 $3,942 39 5626.61 53,31578 5626.61 52.689.17 5626 61 $2,062.56 562661 $1,43595 5626 61 5809 34 5626.61 S182.73 Deable declining C D=EXCEED F Depreciation Depreciation Carrying Depreciatia expense 54.369 28.5719 51 305 41 153.263 59 285719 5932.44 52331 15 285919 $666 03 51.665.12 28.5719 $495.14 S1189 38 12494 28 $719 533982 $949 56 8.99% 28.5715 5242.73 5606.83 8929 28.57% 517338 5433.45 $939 MARCS G=FH HEEG Depreciati Carrying pe 54 569 565291 53916 $99905 551719 $2.40 SMO $2135 $190 67 $1944 5173.44 51.771 $198.15 $1.613 S7293 SISA Value of the asset Salvage value $4,569 $182.76 $4569- $182.76 7 years $626.61 Depreciation Double decling Depreciation $4569/7 x 2 $1,305.43 (S1305.43/4569) x 100% 28.571% DDB percentage 1. Based on the first 3 year accumulated depreciation values (neglecting country) from your table in Part "A", which method should be selected for tax purposes (show calculations)? Why? (5pts) 2. What is the book value for each method at the end of their recovery period? (3pts) 3. Which method has a salvage value that has not been met at the end of their recovery period? (2pts) 4. Region Bank's price of its investment shares is $57.22. However, over the next 5 years, you do not want to purchase the shares until it's at least $69.00 a share. a. What is the annual rate of inflation? (5pts). b. Economist predicts a deflation rate of 2.83% per year. What is the value of shares in 7 years if the initial price was $12.28? (5pts) 5. Your CEO asked you to prepare a Present worth calculation adjusted for inflation for the next 3 years using the $80,000 in the company's reserve. He predicts inflation to be 3.75% per year and the real interest rate to be 12.62% per year. Create a table similar to table 14-1 in your textbook (SHOW ALL CALCULATIONS). (10pts) 6. With a real interest rate of 10.89% per year and inflation rate of 3% per year, how much must you deposit annually over 8 years to accumulate an amount of money with the same purchasing power as $180 today? (10pts) 7. Jackson State University is evaluating two options. It can perform online distance learning upgrades now for $275,000 or it can defer for 5 years when the cost is expected to increase to $375,000. Economist expects a real MARR of 10% per year with an average inflation rate of ex Using the FUTURE WORTH ANALYSIS, determine if the Mayor should purchase now or later: a. When inflation is not considered (5pts) b. When inflation is considered (5pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts