Question: HELP pleas!!! asap!!! this is for a study guide i desperstely need to fill in to study for tonight. thank you so much 1. SEC

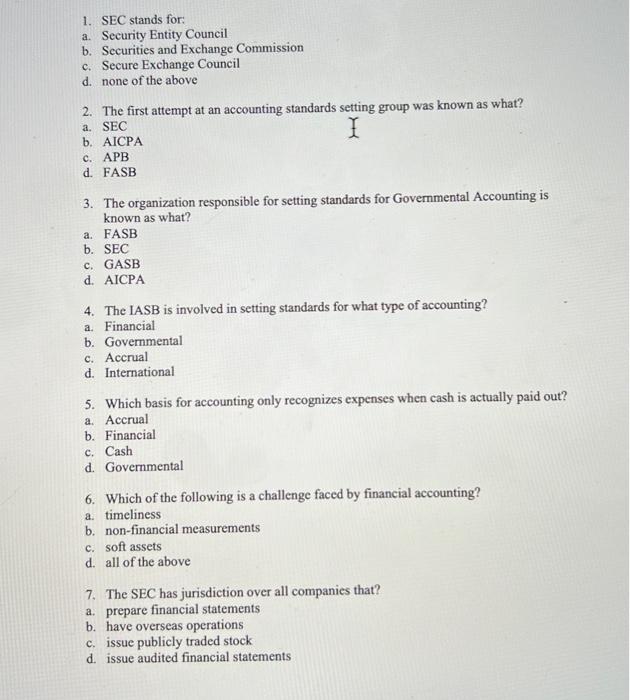

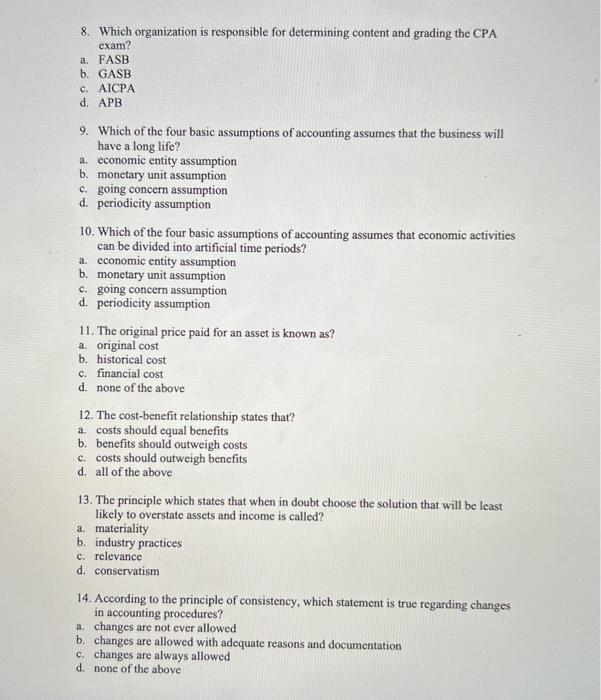

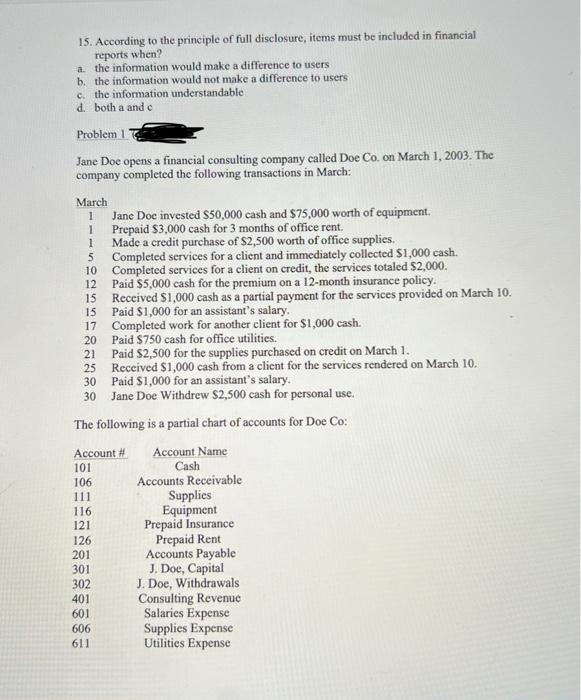

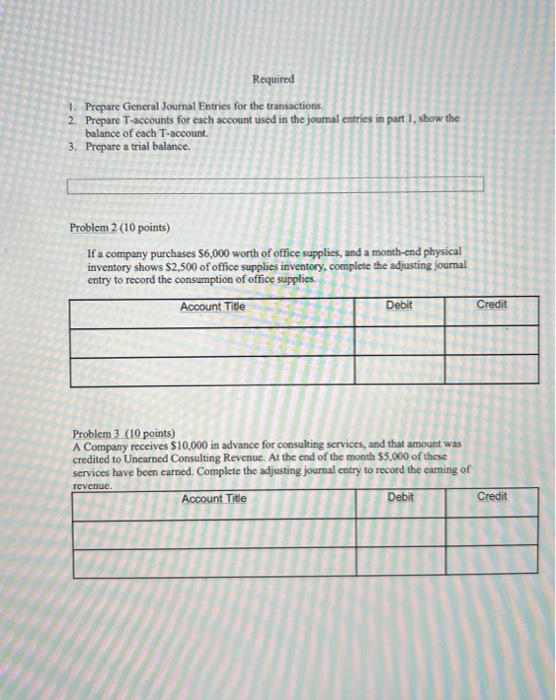

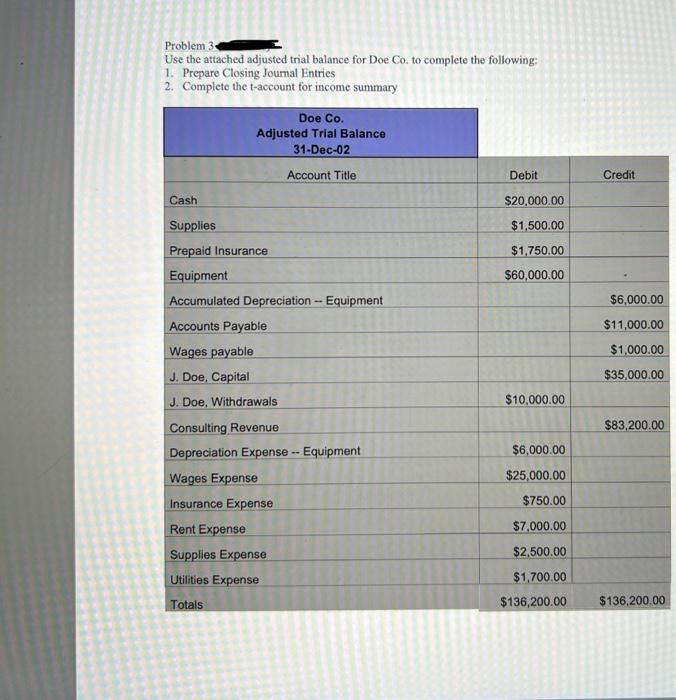

1. SEC stands for: a. Security Entity Council b. Securities and Exchange Commission c. Secure Exchange Council d. none of the above 2. The first attempt at an accounting standards setting group was known as what? a. SEC b. AICPA c. APB d. FASB 3. The organization responsible for setting standards for Governmental Accounting is known as what? a. FASB b. SEC c. GASB d. AICPA 4. The IASB is involved in setting standards for what type of accounting? a. Financial b. Governmental c. Accrual d. International 5. Which basis for accounting only recognizes expenses when cash is actually paid out? a. Accrual b. Financial c. Cash d. Governmental 6. Which of the following is a challenge faced by financial accounting? a. timeliness b. non-financial measurements c. soft assets d. all of the above 7. The SEC has jurisdiction over all companies that? a. prepare financial statements b. have overseas operations c. issue publicly traded stock d. issue audited financial statements 8. Which organization is responsible for determining content and grading the CPA exam? a. FASB b. GASB c. AICPA d. APB 9. Which of the four basic assumptions of accounting assumes that the business will have a long life? a. economic entity assumption b. monetary unit assumption c. going concern assumption d. periodicity assumption 10. Which of the four basic assumptions of accounting assumes that economic activities can be divided into artificial time periods? a. economic entity assumption b. monetary unit assumption c. going concern assumption d. periodicity assumption 11. The original price paid for an asset is known as? a. original cost b. historical cost c. financial cost d. none of the above 12. The cost-benefit relationship states that? a. costs should equal benefits b. benefits should outweigh costs c. costs should outweigh benefits d. all of the above 13. The principle which states that when in doubt choose the solution that will be least likely to overstate assets and income is called? a. materiality b. industry practices c. relevance d. conservatism 14. According to the principle of consistency, which statement is true regarding changes in accounting procedures? a. changes are not ever allowed b. changes are allowed with adequate reasons and documentation c. changes are always allowed d. none of the above 15. According to the principle of full disclosure, items must be included in financial reports when? a. the information would make a difference to users b. the information would not make a difference to users c. the information understandable d. both a and c Problem 1 Jane Doe opens a financial consulting company called Doe Co. on March 1, 2003. The company completed the following transactions in March: March 1 Jane Doe invested $50,000cash and $75,000 worth of equipment. 1 Prepaid $3,000 cash for 3 months of office rent. 1 Made a credit purchase of $2,500 worth of office supplies. 5 Completed services for a client and immediately collected $1,000cash. 10 Completed services for a client on credit, the services totaled $2,000. 12 Paid $5,000 cash for the premium on a 12 -month insurance policy. 15 Received $1,000 cash as a partial payment for the services provided on March 10. 15 Paid $1,000 for an assistant's salary. 17 Completed work for another client for $1,000 cash. 20 Paid $750 cash for office utilities. 21 Paid \$2,500 for the supplies purchased on credit on March 1. 25 Received $1,000 cash from a client for the services rendered on March 10 . 30 Paid $1,000 for an assistant's salary. 30 Jane Doe Withdrew $2,500 cash for personal use. The following is a partial chart of accounts for Doe Co: 1. Prepare General Journal Entries for the transactions. 2. Prepare T-accounts for each account used in the joumal entries in part 1, show the balance of each T-account. 3. Prepare a trial balance. Problem 2 (10 points) If a company purchases $6,000 worth of office supplies, and a month-end physical inventory shows $2,500 of office supplies inventery, complete the adjusting joumal entry to record the consumption of office supplies. Problem 3 (10 points) A Company receives $10,000 in advance for consulting services, and that amount was credited to Unearned Consulting Revenue. At the end of the month $5,000 of these services have been earned. Complete the adjusting journal entry to record the earning of Problem 3 Use the attached adjusted trial balance for Doe Co, to complete the following: 1. Prepare Closing Joumal Entries 2. Complete the t-account for income summary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts