Question: Help Please! 1. Does Maddie take the standard deduction or itemized deductions? why? 2. Does Maddie get any tax benefit from her unreimbursed medical expenses?

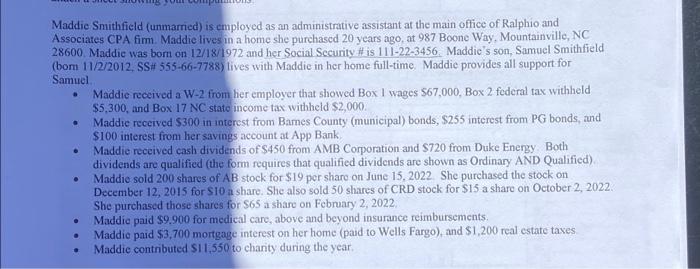

Maddie Smithfield (unmarried) is cmployed as an administrative assistant at the main office of Ralphio and Associates CPA firm. Maddie lives in a home she purchased 20 years ago, at 987 Boone Way, Mountainville, NC 28600. Maddie was bom on 12/18/1972 and her Social Sccurity it is 111223456. Maddie's 5on, Samuel Smithfield (bom 11/2/2012, SSit 555-66-7788) lives with Maddie in her home full-time. Maddie provides all support for Samuel. - Maddie received a W-2 from her employer that showed Box I wages $67,000, Box 2 federal tax withheld $5,300, and Box 17 NC state income tax withheld \$2,000. - Maddie received \$300 in interest from Bames County (municipal) bonds, \$255 interest from PG bonds, and $100 interest from her savings account at App Bank. - Maddie received cash dividends of \$450 from AMB Corporation and \$720 from Duke Energy. Both dividends are quatified (the form requires that qualified dividends are shown as Ordinary AND Qualified) - Maddie sold 200 shares of AB stock for $19 per share on June 15,2022. She purchased the stock on December 12, 2015 for $10 a share. She also sold 50 shares of CRD stock for $15 a share on Oetober 2, 2022 She purchased those shares for $65 a share on February 2, 2022 - Maddic paid $9.900 for medical care, above and beyond insurance reimbursements. - Maddie paid \$3,700 mortgage interest on her home (paid to Wells Fargo), and \$1,200 real estate taxes. - Maddie contributed $11,550 to chanity during the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts