Question: help please 1. Holding all else constant interest rates are than long-term interest rates. a short-term, greater b. short-term, less c. long-term, less d. real,

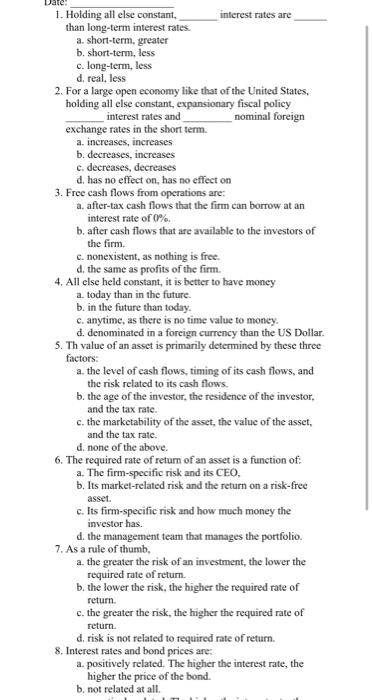

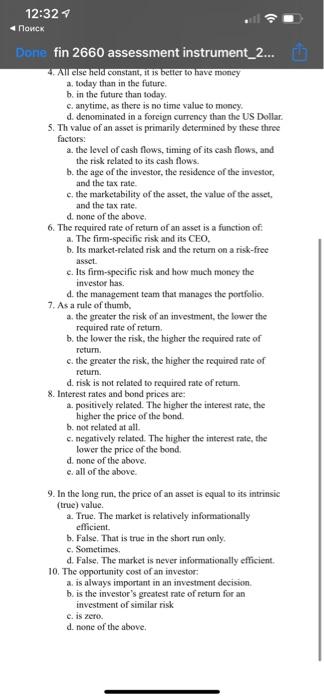

1. Holding all else constant interest rates are than long-term interest rates. a short-term, greater b. short-term, less c. long-term, less d. real, less 2. For a large open economy like that of the United States, holding all else constant, expansionary fiscal policy interest rates and nominal foreign exchange rates in the short term. a. increases, increases b. decreases, increases c. decreases, decreases d. has no effect on, has no effect on 3. Free cash flows from operations are: a. after-tax cash flows that the firm can borrow at an interest rate of 0% b. after cash flows that are available to the investors of the firm. c. nonexistent, as nothing is free d. the same as profits of the firm. 4. All else held constant, it is better to have money a today than in the future. b. in the future than today. c. anytime, as there is no time value to money. d. denominated in a foreign currency than the US Dollar. 5. Th value of an asset is primarily determined by these three factors: a. the level of cash flows, timing of its cash flows, and the risk related to its cash flows. b. the age of the investor, the residence of the investor, and the tax rate. c. the marketability of the asset, the value of the asset, and the tax rate. d. none of the above. 6. The required rate of return of an asset is a function of a. The firm-specific risk and its CEO, b. Its market-related risk and the return on a risk-free asset c. Its firm-specific risk and how much money the investor has. d. the management team that manages the portfolio. 7. As a rule of thumb a. the greater the risk of an investment, the lower the required rate of return. b. the lower the risk, the higher the required rate of return. c. the greater the risk, the higher the required rate of return d. risk is not related to required rate of return. 8. Interest rates and bond prices are: a. positively related. The higher the interest rate, the higher the price of the bond. b, not related at all 12:32 Done fin 2660 assessment instrument_2... Allelse held constant, it is better to have money a today than in the future. b. in the future than today, c. anytime, as there is no time value to money. d. denominated in a foreign currency than the US Dollar 5. Th value of an asset is primarily determined by these three factors: a the level of cash flows, timing of its cash flows, and the risk related to its cash flows. b. the age of the investor, the residence of the investor, and the tax rate c. the marketability of the asset, the value of the asset, and the tax rate d. none of the above 6. The required rate of return of an asset is a function of a. The firm-specific risk and its CEO, b. Its market-related risk and the return on a risk-free asset c. Its firm-specific risk and how much money the investor has. 4. the management team that manages the portfolio 7. As a rule of thumb a the greater the risk of an investment, the lower the required rate of return. b. the lower the risk, the higher the required rate of retur. c. the greater the risk, the higher the required rate of return. d. risk is not related to required rate of retum. 8. Interest rates and bond prices are: a. positively related. The higher the interest rate, the higher the price of the bond. b. not related at all. c. negatively related. The higher the interest rate, the lower the price of the bond d. none of the above c. all of the above 9. In the long run, the price of an asset is equal to its intrinsic (true) value. a. True. The market is relatively informationally efficient b. False. That is true in the short run only. c. Sometimes d. False. The market is never informationally efficient. 10. The opportunity cost of an investor a is always important in an investment decision b. is the investor's greatest rate of retum for an investment of similar risk e. is zero. d. none of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts