Question: help please 1) In your own words, explain in simple terms: a. the components involved in valuing stocks and b. how you use these components

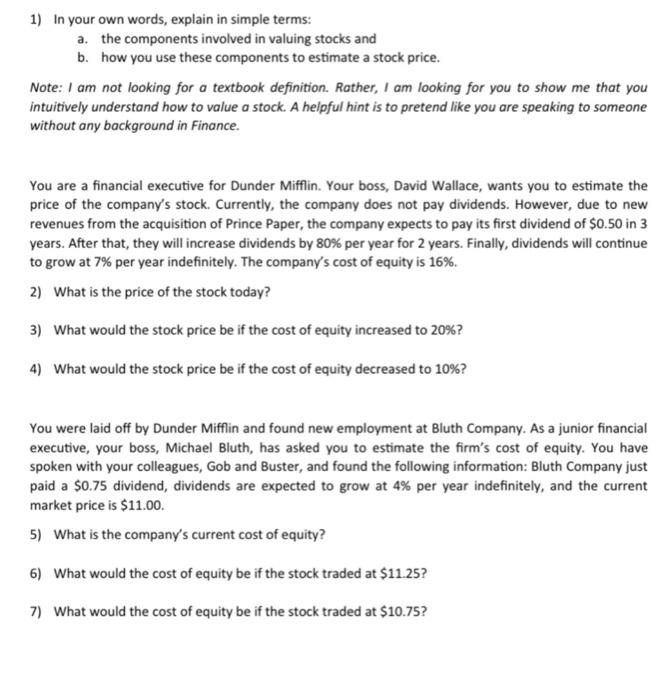

1) In your own words, explain in simple terms: a. the components involved in valuing stocks and b. how you use these components to estimate a stock price. Note: I am not looking for a textbook definition. Rather, I am looking for you to show me that you intuitively understand how to value a stock. A helpful hint is to pretend like you are speaking to someone without any background in Finance. You are a financial executive for Dunder Mifflin. Your boss, David Wallace, wants you to estimate the price of the company's stock. Currently, the company does not pay dividends. However, due to new revenues from the acquisition of Prince Paper, the company expects to pay its first dividend of $0.50 in 3 years. After that, they will increase dividends by 80% per year for 2 years. Finally, dividends will continue to grow at 7% per year indefinitely. The company's cost of equity is 16%. 2) What is the price of the stock today? 3) What would the stock price be if the cost of equity increased to 20%? 4) What would the stock price be if the cost of equity decreased to 10%? You were laid off by Dunder Mifflin and found new employment at Bluth Company. As a junior financial executive, your boss, Michael Bluth, has asked you to estimate the firm's cost of equity. You have spoken with your colleagues, Gob and Buster, and found the following information: Bluth Company just paid a $0.75 dividend, dividends are expected to grow at 4% per year indefinitely, and the current market price is $11.00. 5) What is the company's current cost of equity? 6) What would the cost of equity be if the stock traded at $11.25? 7) What would the cost of equity be if the stock traded at $10.75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts