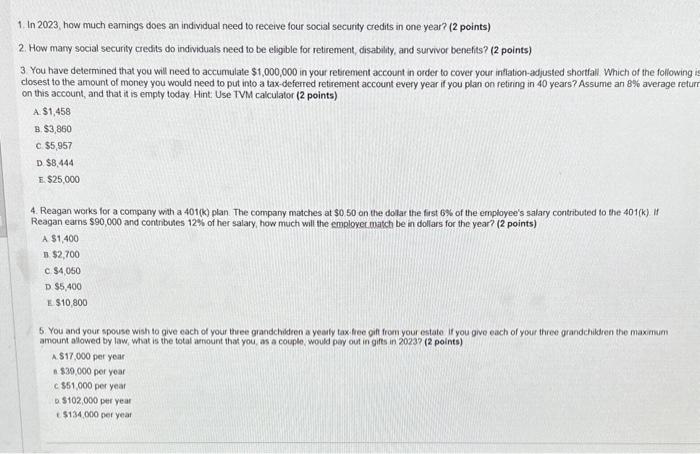

Question: Help please! 2. How many social security credits do individuals need to be eligible for retirement, disability, and survivor benefits? (2 points) 3. You have

2. How many social security credits do individuals need to be eligible for retirement, disability, and survivor benefits? (2 points) 3. You have determined that you will need to accumulate $1,000,000 in your retrement account in order to cover your intlation-adjusted shortfall Which of the following closest to the amount of money you would need to put into a tax-deferred retirement account every year if you plan on retining in 40 years? Assume an 8% average retu on this account, and that it is empty today Hint: Use TVM calculator (2 points) A. $1,458 B. $3,860 C. $5,957 D. $8,444 E. $25,000 4. Reagan works for a company with a 401(k) plan. The company matches at $0.50 on the dolar the fist 6% of the employee's salary contributed to the 401(k) it Reagan earns $90,000 and contributes 12% of her salary, how much will the employec match be in dollars for the year? (2 points) A $1,400 n $2,700 c. $4,050 D $5,400 E $10,800 5. You and your spouse wish to give each of your thee grandchidien a yeaty tax thee gin from your estato if you give each of your three grandchildien the maximim amount allowed by law, what is the total aunount that you, as a couple, would pay out in gits in 2023 ? (2 points) A $17,000 per year is $30,000 per year 0 $102,000 per year e $134,000 per yeat

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts