Question: help please 26. With a VA loan, it is possible to have a release of liability without a restoration of entitement. a. True b. False

help please

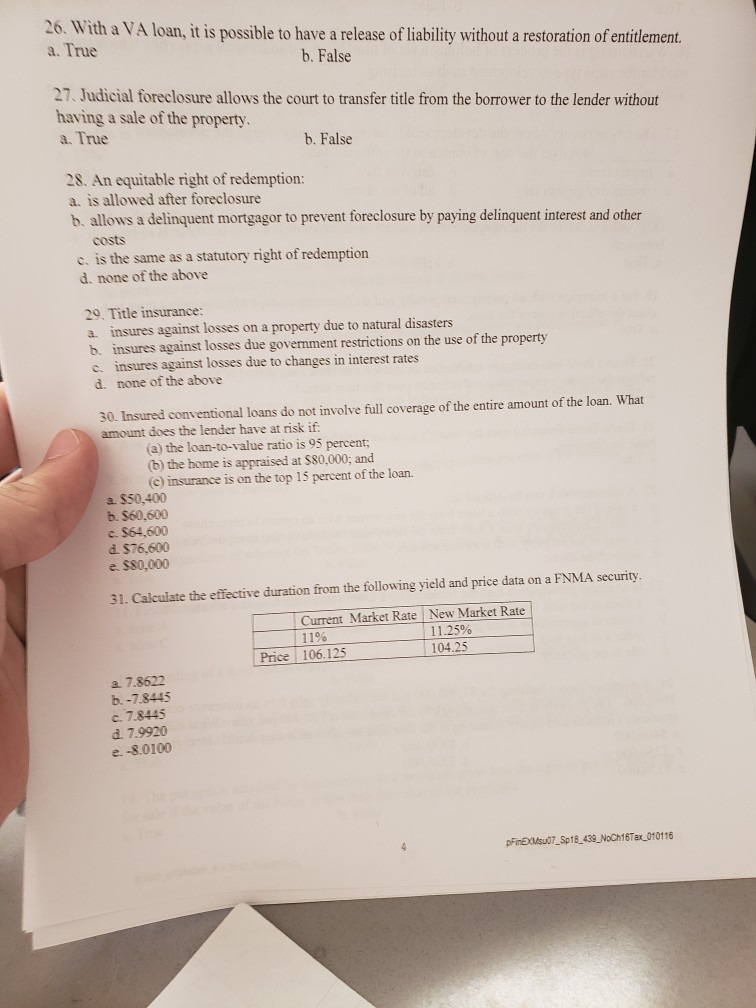

26. With a VA loan, it is possible to have a release of liability without a restoration of entitement. a. True b. False 27. Judicial foreclosure allows the court to transfer title from the borrower to the lender without having a sale of the property a. True b. False 28. An equitable right of redemption: a. is allowed after foreclosure b. allows a delinquent mortgagor to prevent foreclosure by paying delinquent interest and other costs c. is the same as a statutory right of redemption d. none of the above 29. Title insurance: a. insures against losses on a property due to natural disasters b. insures against losses due government restrictions on the use of the property c. insures against losses due to changes in interest rates d. none of the above 30. Insured conventional loans do not involve full coverage of the entire amount of the loan. What amount does the lender have at risk if (a) the loan-to-value ratio is 95 percent; (b) the home is appraised at $80,000; and (c) insurance is on the top 15 percent of the loan. a $50,400 b. $60,600 c $64,600 d $76,600 e. $80,000 31. Calculate the effective duration from the following yield and price data on a FNMA security. Current Market Rate New Market Rate 119% 11.25% 104.25 Price 106.125 a. 7.8622 b. -7.8445 c. 7.8445 d. 7.9920 e. -8.0100 pFinExMsu07 Sp18 439 NoCh16Tax 010116

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts