Question: Help please. A 2 0 2 4 1 0 4 0 has to be prepared with the appropriate schedules, schedules listed bellow. Thank you Assume

Help please. A has to be prepared with the appropriate schedules, schedules listed bellow. Thank you

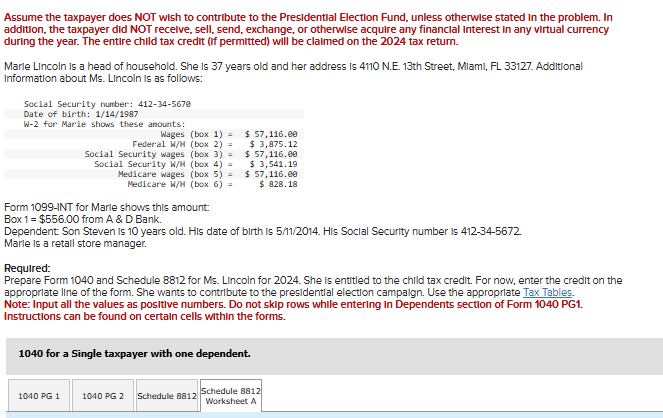

Assume the taxpayer does NOT wish to contribute to the Presidential Election Fund, unless otherwise stated in the problem. In

addition, the taxpayer did NOT receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency

during the year. The entire child tax credit if permitted will be claimed on the tax return.

Marie Lincoln is a head of household. She is years old and her address is NEth Street, Miami, FL Additional

information about Ms Lincoln is as follows:

Social Security number:

Date of birth:

W for Marie shows these amounts:

Wages box $

Federal WH box $

Social Security wages box $ $

Social Security WH box $

Medicare wages box $

Medicare WH box $

Form INT for Marie shows this amount:

Box $ from A & D Bank.

Dependent Son Steven is years old. His date of birth is His Social Security number is

Marie is a retail store manager.

Required:

Prepare Form and Schedule for Ms Lincoln for She is entitled to the child tax credit. For now, enter the credit on the appropriate line of the form. She wants to contribute to the presidential election campaign. Use the appropriate Tax Tables.

Note: Input all the values as positive numbers. Do not skip rows while entering in Dependents section of Form PG

Instructions can be found on certain cells within the forms.

for a Single taxpayer with one dependent.

Enter the amount from line of your Form SR or mathrmNR

a Enter income from Puerto Rico that you excluded

b Enter the amounts from lines and of your Form

c Enter the amount from line of your Form

d Add lines a through c

Add lines and d

Number of qualfying children under age with the required social security number

Multiply line by $

Number of other dependents, including any qualifying children who are not under age or who do not have the required social security number

Caution: Do not include yourself, your spouse, or anyone who is not a US citizen, US national, or US resident alien. Also, do not include anyone you included on line

Multiply line by $

Add lines and

Enter the amount shown below for your filing status.

Married filing jointly$

All other filing statuses$

Subtract line from line

If zero or less, enter

If more than zero and not a multiple of $ enter the next multiple of $ For example, if the result is $ enter $ ; if the result is $ enter $ etc.

Multiply line by

Is the amount on line more than the amount on line

No STOP. You cannot take the child tax credit, credit for other dependents, or additional child tax credit. Skip Parts IIA and IIB Enter on lines and

Yes. Subtract line from line Enter the result.

Enter the amount from the Credit LImit Worksheat A

Enter the smaller of line or Thls ls your child tax credit and credit for other dependents

Enter this amount on Form SR or NR Ilne Subtract line from line

Complete the Credit Limit Warksheet B only if you meet all of the following.

You are claiming one or more of the following credits.

a Mortgage interest credit, Form

b Adoption credit, Form

c Residential clean energy credit, Form Part I.

d District of Calumbia firsttime homebuyer credit, Form

You are not filing Form

Line of Schedule is more than zero.

If you are not completing Credit Limit Worksheet B enter ; otherwise, enter the amount from the Credit Limit Worksheet B

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock