Question: help please !!!! A machine that cost $486,800, with a four-year life and an estimated $50,000 residual value, was installed in Haley Company's factory on

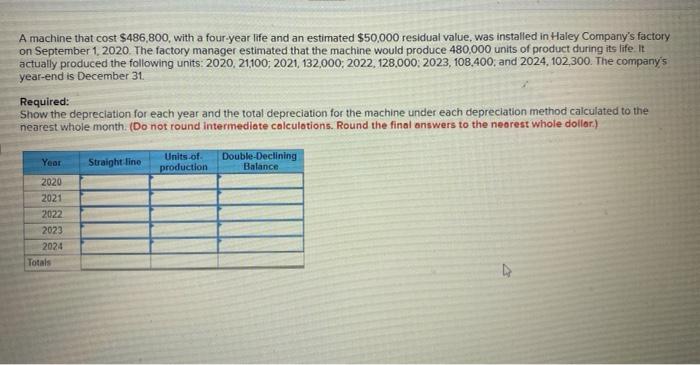

A machine that cost $486,800, with a four-year life and an estimated $50,000 residual value, was installed in Haley Company's factory on September 1, 2020. The factory manager estimated that the machine would produce 480,000 units of product during its life It actually produced the following units: 2020, 21,100; 2021, 132,000, 2022. 128,000, 2023. 108.400, and 2024, 102,300. The company's year-end is December 31 Required: Show the depreciation for each year and the total depreciation for the machine under each depreciation method calculated to the nearest whole month (Do not round intermediate calculations. Round the final answers to the nearest whole dollar.) Year Straight line Units of production Double Declining Balance 2020 2021 2022 2023 2024 Totals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts