Question: Help please. Activity and Assignment. Other info is on the link ACTIVITY 1: ADJUSTING ENTRIES (Q2) Directions: Refer to the Trial Balance of Sure Repair

Help please. Activity and Assignment. Other info is on the link

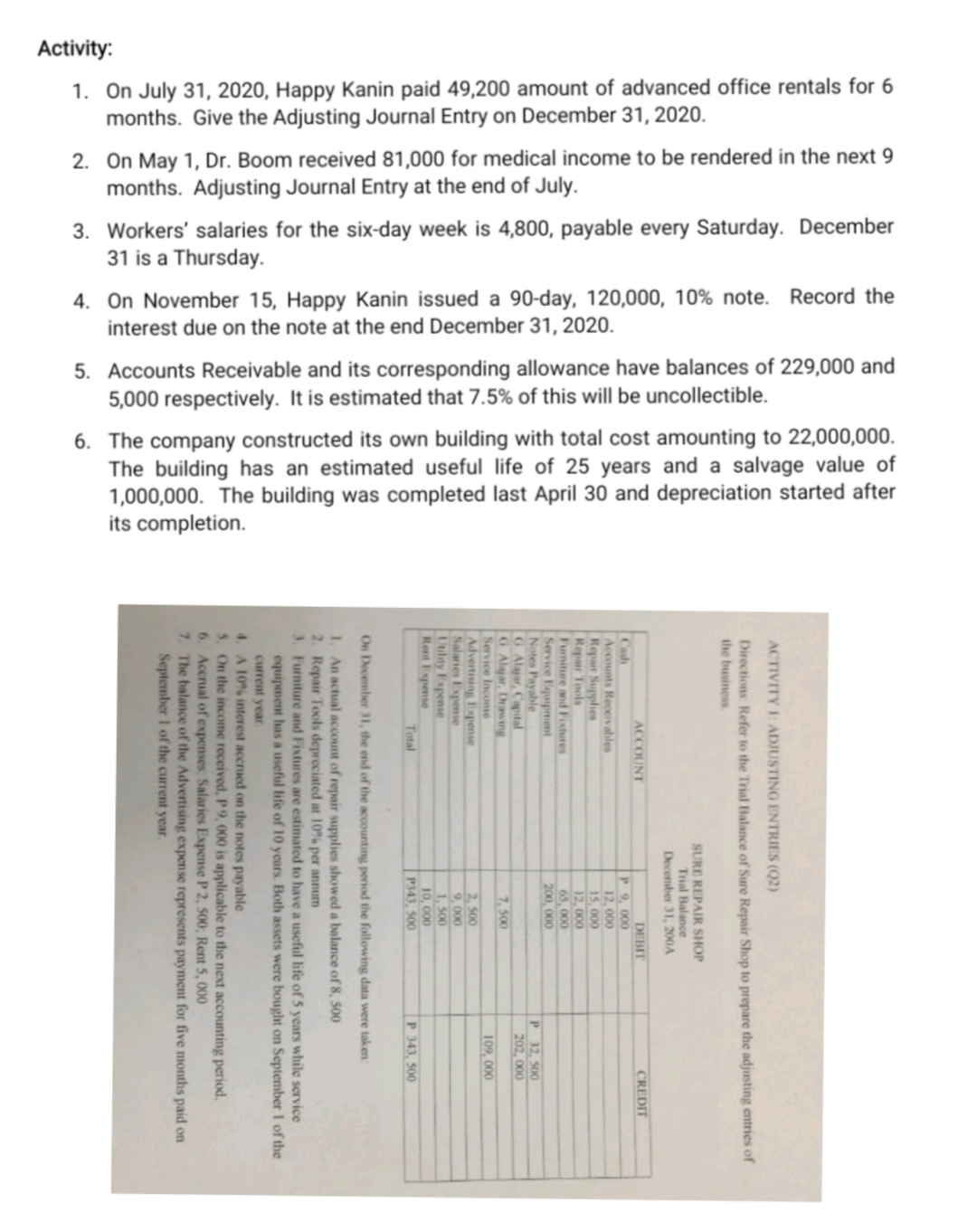

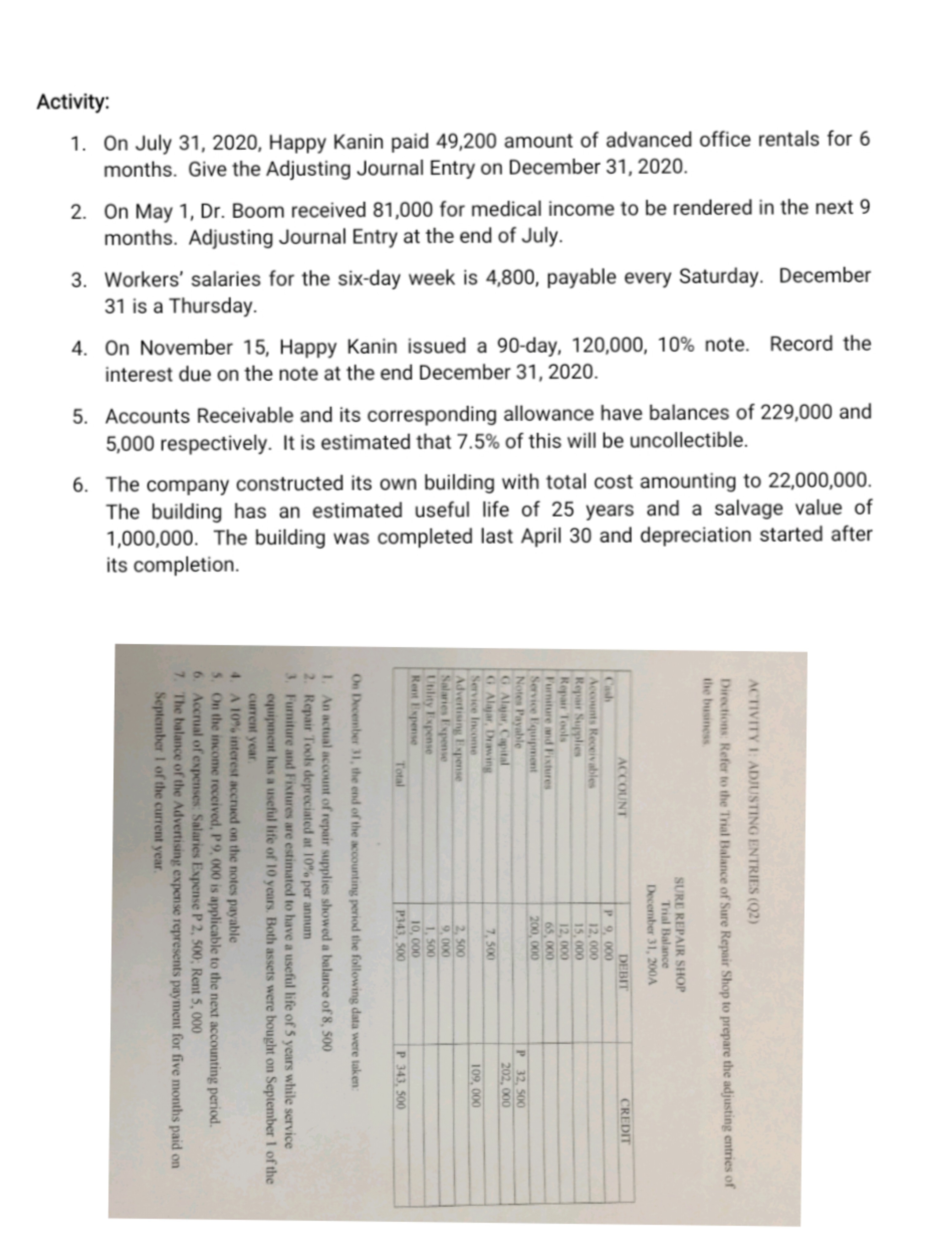

ACTIVITY 1: ADJUSTING ENTRIES (Q2) Directions: Refer to the Trial Balance of Sure Repair Shop to prepare the adjusting entries of the business. SURE REPAIR SHOP Trial Balance December 31, 200A ACCOUNT DEBIT CREDIT P 9, 000 Accounts Receivables 12, 000 Repair Supplies 15, 000 Repair Tools 12, 000 Furniture and Fixtures 65, 000 Service Equipment 200, 000 Notes Payable P 32, 500 G. Alajar, Capital 202, 000 The building has an estimated useful life of 25 years and a salvage value of 1,000,000. The building was completed last April 30 and depreciation started after G Alagar, Drawing 5. Accounts Receivable and its corresponding allowance have balances of 229,000 and 4. On November 15, Happy Kanin issued a 90-day, 120,000, 10% note. Record the 3. Workers' salaries for the six-day week is 4,800, payable every Saturday. December 6. The company constructed its own building with total cost amounting to 22,000,000. 1. On July 31, 2020, Happy Kanin paid 49,200 amount of advanced office rentals for 6 Service Income 109, 000 2. On May 1, Dr. Boom received 81,000 for medical income to be rendered in the next 9 Advertising Expense 2, 500 Salaries Expense 9, 000 5,000 respectively. It is estimated that 7.5% of this will be uncollectible. Utility Expense 1. 500 Rent Expense 10, 000 Total P343, 500 P 343, 500 months. Give the Adjusting Journal Entry on December 31, 2020. interest due on the note at the end December 31, 2020. On December 31, the end of the accounting period the following data were taken: months. Adjusting Journal Entry at the end of July. An actual account of repair supplies showed a balance of 8, 500 Repair Tools depreciated at 10% per annum Furniture and Fixtures are estimated to have a useful life of 5 years while service equipment has a useful life of 10 years. Both assets were bought on September 1 of the current year. A 10% interest accrued on the notes payable 5. On the income received, P 9, 000 is applicable to the next accounting period. 6. Accrual of expenses: Salaries Expense P 2, 500; Rent 5, 000 31 is a Thursday. 7. The balance of the Advertising expense represents payment for five months paid on its completion. September 1 of the current year. Activity:ACTIVITY 1: ADJUSTING ENTRIES (Q2) Directions: Refer to the Trial Balance of Sure Repair Shop to prepare the adjusting entries of the business SURE REPAIR SHOP Trial Balance December 31, 200A ACCOUNT DEBIT CREDIT P 9, 000 Accounts Receivables 12, 000 Repair Supplies 15, 000 Repair Tools 12, 000 Furniture and Fixtures 65, 000 Service Equipment 200, 000 Notes Payable P 32, 500 G. Alajar, Capital 202, 000 The building has an estimated useful life of 25 years and a salvage value of 1,000,000. The building was completed last April 30 and depreciation started after G Alajar, Drawing 7, 500 4. On November 15, Happy Kanin issued a 90-day, 120,000, 10% note. Record the 5. Accounts Receivable and its corresponding allowance have balances of 229,000 and 3. Workers' salaries for the six-day week is 4,800, payable every Saturday. December 6. The company constructed its own building with total cost amounting to 22,000,000. 1. On July 31, 2020, Happy Kanin paid 49,200 amount of advanced office rentals for 6 109, 000 2. On May 1, Dr. Boom received 81,000 for medical income to be rendered in the next 9 Service Income Advertising Expense 2, 500 Salaries Expense 9. 000 5,000 respectively. It is estimated that 7.5% of this will be uncollectible. Utility Expense 1, 500 Rent Expense 10, 000 Total P343, 500 P 343, 500 months. Give the Adjusting Journal Entry on December 31, 2020. On December 31, the end of the accounting period the following data were taken interest due on the note at the end December 31, 2020. months. Adjusting Journal Entry at the end of July. An actual account of repair supplies showed a balance of 8, 500 2. Repair Tools depreciated at 10% per annum 3. Furniture and Fixtures are estimated to have a useful life of 5 years while service equipment has a useful life of 10 years. Both assets were bought on September 1 of the current year. A 10% interest accrued on the notes payable . On the income received, P 9, 000 is applicable to the next accounting period. 6. Accrual of expenses: Salaries Expense P 2, 500; Rent 5, 000 31 is a Thursday. its completion. 7. The balance of the Advertising expense represents payment for five months paid on September 1 of the current year. Activity