Question: help please |aecon1.|yryx.com ,cl _ Lab 7 (Question 3) ~ Lyryx Learning Inc Prim Preferences Help Lab 7 (Question 3) Name: Joaquin Guerrero Date: 2021-03-28

help please

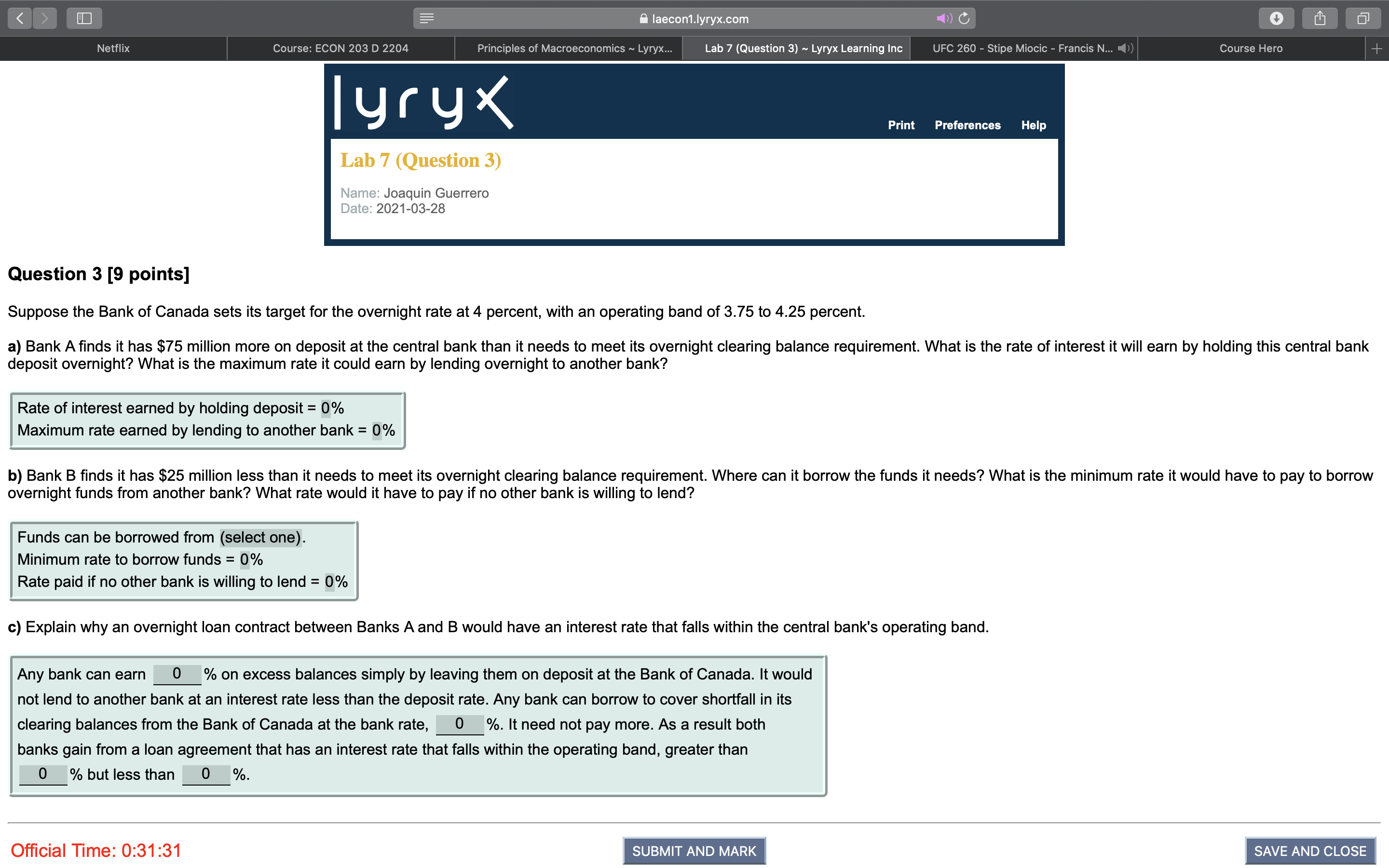

|aecon1.|yryx.com ,cl _ Lab 7 (Question 3) ~ Lyryx Learning Inc Prim Preferences Help Lab 7 (Question 3) Name: Joaquin Guerrero Date: 2021-03-28 Question 3 [9 points] Suppose the Bank of Canada sets its target for the overnight rate at 4 percent, with an operating band of 3.75 to 4.25 percent. a) Bank Ands it has $75 million more on deposit at the central bank than it needs to meet its overnight clearing balance requirement. What is the rate of interest it will earn by holding this central bank deposit overnight? What is the maximum rate it could earn by lending overnight to another bank? Rate of interest earned by holding deposi = 0% Maximum rate earned by lending to another bank = 0% b) Bank B nds it has $25 million less than it needs to meet its overnight clearing balance requirement. Where can it borrow the funds it needs? What is the minimum rate it would have to pay to borrow overnight funds from another bank? What rate would it have to pay if no other bank is willing to lend? Funds can be borrowed from (select one). Minimum rate to borrow funds = 0% Rate paid if no other bank is willing to lend = 0% c) Explain why an overnight loan contract between Banks Aand B would have an interest rate that falls within the central bank's operating band. Any bank can earn 0 % on excess balances simply by leaving them on deposit at the Bank of Canada. It would not lend to another bank at an interest rate less than the deposit rate. Any bank can borrow to cover shortfall in its clearing balances from the Bank of Canada at the bank rate, 0 %. It need not pay more. As a result both banks gain from a loan agreement that has an interest rate that falls within the operating band, greater than % but less than ofcial nme: 0:31:31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts