Question: Help please all this quiestions!!! I need a solutions!!! Pleasee 2.45 Chicago Paints Corporation has a target capital structure of 40 percent debt and 60

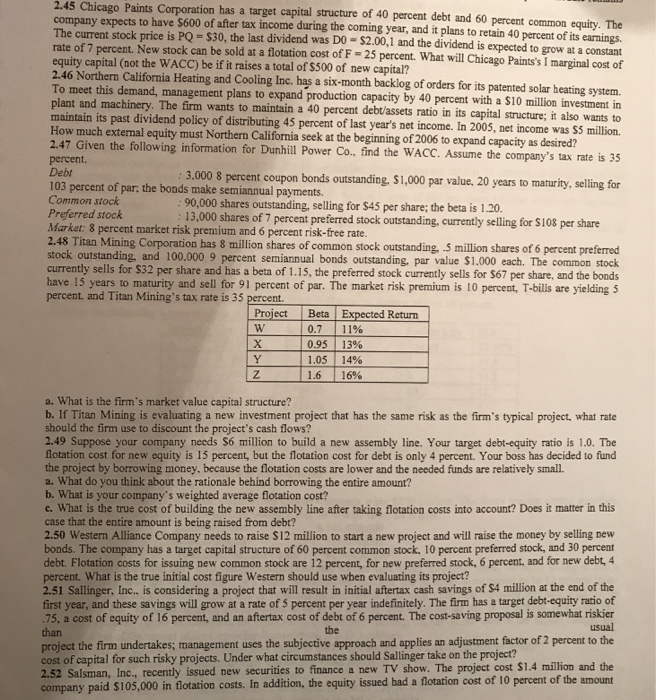

2.45 Chicago Paints Corporation has a target capital structure of 40 percent debt and 60 percent common equity. The $600 of after tax income during the coming year, and it plans to retain 40 percent of its earnings company expects to have The current stock price is PQ-$30, the last dividend was DO $2.00,1 and the dividend is expected to grow at a constant rate of 7 percent. New stock can be sold at a flotation cost of F 25 percent. What will Chicago Paints's I marginal cost of equity capital (not the WACC) be if it raises a total of $500 of new capital? 2.46 Northern California Heating and Cooling Inc. has a six-month backlog of orders for its patented solar heating system. To meet this demand, management plans to expand production capacity by 40 percent with a s plant and machinery. maintain its past dividend policy of distributing 45 percent of last year's net income How much external equity must Northern California seek at the beginning of 2006 to expand capacity as desired? 2.47 Given the following information percent. Debt 103 percent of par, the bonds make semiannual payments. Common stock Preferred stock The firm wants to maintain a 40 percent debt/assets ratio in its capital structure; it also wants to . In 2005, net income was S5 million. for Dunhill Power Co., find the WACC. Assume the company's tax rate is 35 3.000 8 percent coupon bonds outstanding, $1,000 par value. 20 years to maturity, selling for 90,000 shares outstanding, selling for $45 per share; the beta is 1.20 percent preferred stock outstanding, currently selling for 8 percent market risk premium and 6 percent risk-free rate. 2.48 Titan Mining Corporation has 8 million shares of common stock outstanding, 5 million shares of 6 percent preferred stock outstanding, and 100.000 9 percent semiannual bonds outstanding, par value $1.000 each. The common stock S32 per share and has a beta of 1.15, the preferred stock currently sells for $67 per share, and the bonds years to maturity and sell for 91 percent of par. The market risk premium is 10 percent, T-bills are yielding5 percent and Titan Mining's tax rate is 35 percent. Project Beta Expected Return 0.7 | 11% 0.95 | 13% 1.05 | 14% 1.6 | 16% a. What is the firm's market value capital structure? b. If Titan Mining is evaluating a new investment project that has the same risk as the firm's typical project, what rate should the firm use to discount the project's cash flows? 2.49 Suppose your company needs S6 million to build a new assembly line. Your target debt-equity ratio is 1.0. The flotation cost for new equity is 15 percent, but the flotation cost for debt is only 4 percent. Your boss has decided to fund the project by borrowing money, because the flotation costs are lower and the needed funds are relatively small. What do you think about the rationale behind borrowing the entire amount? b. What is your company's weighted average flotation cost? What is the true cost of building the new assembly line after taking flotation costs into account? Does it matter in this case that the entire amount is being raised from debt? 2.50 Western Alliance Company needs to raise S12 million to start a new project and will raise the money by selling new bonds. The company has a target capital structure of 60 percent common stock, 10 percent preferred stock, and 30 percent debt. Flotation costs for issuing new common stock are 12 percent, for new preferred stock, 6 percent, and for new debt, 4 percent. What is the true initial cost figure Western should use wben evaluating its project? 2.51 Sallinger, Inc. is considering a project that will result in initial aftertax cash savings of S4 million at the end of the first year, and these savings will grow at a rate of 5 percent per year indefinitely. The firm has a target debt-equity ratio of 75, a cost of equity of 16 percent, and an aftertax cost of debt of 6 percent. The cost-saving proposal is somewhat riskier than usual the the firm undertakes; management uses the subjective approach and applies an adjustment factor of 2 percent to the ost of capital for such risky projects. Under what circumstances should Sallinger take on the project? 2.52 Salsman, Inc., recently issued new securities to finance a new TV show. The project cost $1.4 million and the company pai d $105,000 in flotation costs. In addition, the equity issued had a flotation cost of 10 percent of the amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts