Question: Help please!! also, please try to ahow your work!! ILL LEAVE A LIKE!! B E7-5 (Algo) Calculating Ending Inventory and Cost of Goods Sold Under

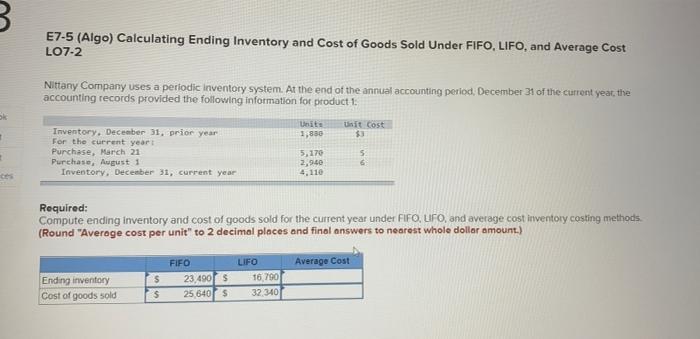

B E7-5 (Algo) Calculating Ending Inventory and Cost of Goods Sold Under FIFO, LIFO, and Average Cost LO7-2 ok Nittany Company uses a periodic inventory system. At the end of the annual accounting period, December 31 of the current year, the accounting records provided the following information for product 1: Units Unit Cost Inventory. December 31, prior year 1,830 For the current year Purchase, March 21 5.170 Purchase, August 1 2,940 Inventory, December 31, current year 4.110 $3 5 6 Required: Compute ending inventory and cost of goods sold for the current year under FIFO, uro, and average cost inventory costing methods. (Round "Average cost per unit" to 2 decimal places and final answers to nearest whole dollar amount.) Average Cost Ending inventory Cost of goods sold $ $ FIFO 23.49075 25 640 5 LIFO 16790 32 340

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts