Question: HELP PLEASE! answer all! Problem 7.31A (Algo) Accounting for an installment note payable LO 7.5 The following transactions apply to Pecan Co for Year 1,

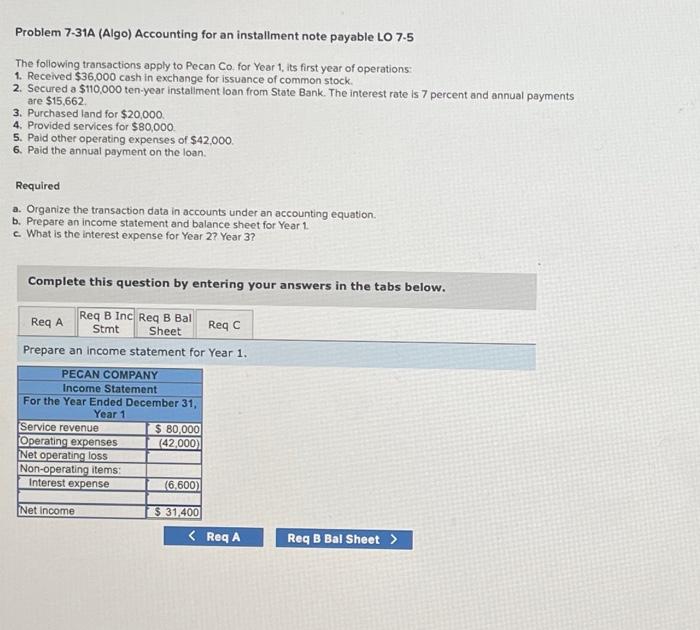

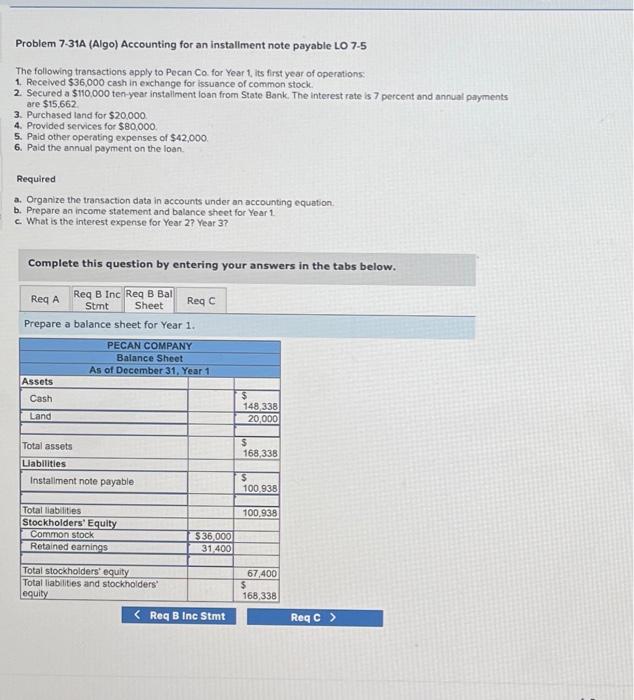

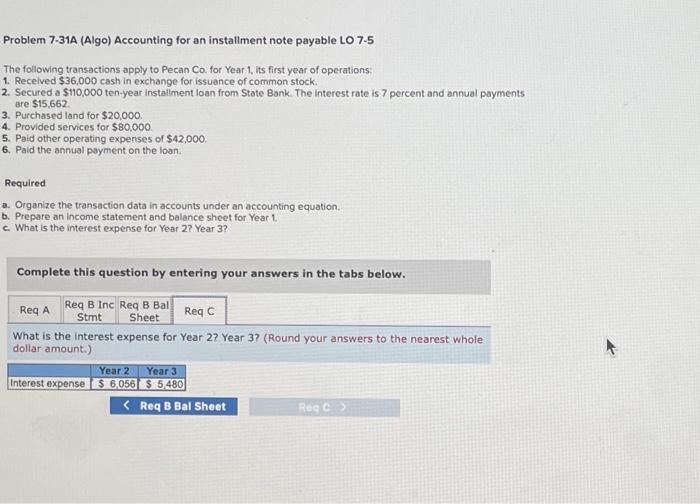

Problem 7.31A (Algo) Accounting for an installment note payable LO 7.5 The following transactions apply to Pecan Co for Year 1, its first year of operations: 1. Received $36,000 cash in exchange for issuance of common stock. 2. Secured a $110,000 ten-year installment loan from State Bank. The interest rate is 7 percent and annual payments are $15,662 3. Purchased land for $20,000 4. Provided services for $80,000 5. Paid other operating expenses of $42,000. 6. Paid the annual payment on the loan. Required a. Organize the transaction data in accounts under an accounting equation. b. Prepare an income statement and balance sheet for Year 1 . c. What is the interest expense for Year 2? Year 3? Complete this question by entering your answers in the tabs below. Prepare an income statement for Year 1. Problem 7.31A (Algo) Accounting for an installment note payable LO 7.5 The following transactions apply to Pecan Co. for Year 1, its first year of operations: 1. Received $36,000 cash in exchange for issuance of common stock. 2. Secured a $110,000 ten-year instaliment ioan from State Bank. The interest rate is 7 percent and annual payments are $15,662 3. Purchased land for $20,000 4. Provided services for $80,000. 5. Paid other operating expenses of $42,000. 6. Paid the annual payment on the loan. Required a. Organize the transaction data in accounts under an accounting equation. b. Prepare an income statement and balance sheet for Year 1 c. What is the interest expense for Year 2? Year 3? Complete this question by entering your answers in the tabs below. Prepare a balance sheet for Year 1. Problem 7.31A (Algo) Accounting for an installment note payable LO 7.5 The following transactions apply to Pecan Co. for Year 1, its first year of operations: 1. Received $36,000 cash in exchange for issuance of common stock. 2. Secured a $110,000 ten-year installment loan from State Bank. The interest rate is 7 percent and annual payments are $15,662 3. Purchased land for $20,000 : 4. Provided services for $80,000. 5. Paid other operating expenses of $42,000. 6. Paid the annual payment on the loan. Required a. Organize the transaction data in accounts under an accounting equation. b. Prepare an income statement and balance sheet for Year 1 . c. What is the interest expense for Year 2? Year 3? Complete this question by entering your answers in the tabs below. What is the interest expense for Year 2? Year 3? (Round your answers to the nearest whole dollar amount.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts