Question: help please ASAP - look at both photos please answer all part of question 1 and 2 thank you!! Assume that you wrife a column

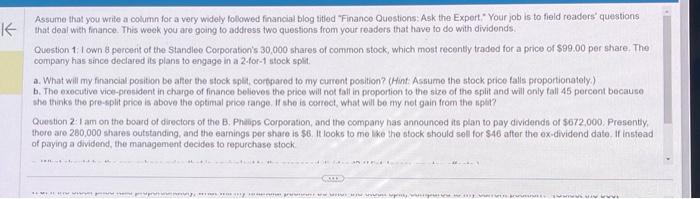

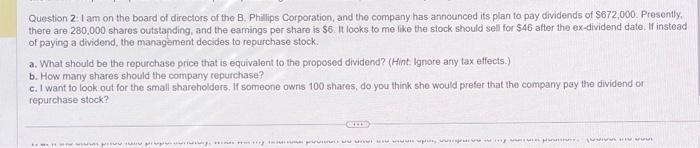

Assume that you wrife a column for a very widely folkowed financial blog titied "Finance Ouestions: Ask the Expert," Your job is to field readers' questions that deal with finance. This week you are going to address two questions from your roaders that have to do with dividends. Question 1: I own 8 percent of the Standieo Corporation's 30,000 shares of common stock, which most recently traded for a price of $99.00 per share, The company has since declared its plans to engage in a 2 -for-1 stock split. a. What will my financial position be after the stock splt, corfpared to my cument position? (Hint: Assiume the stock price falls proportionately.) b. The executive vice-president in chargo of finance believes the price will not fall in proportion to the size of the split and will only tall 45 percent because she thenks the pre-split price is above the optimal price range. It she is cerrect, What will be my not gain from the npli? Question 2. I am on the board of direciors of the B. Pheips Corporation, and the company has announced its plan to pay dividends of s672,000. Presently, there are 280,000 shares outstanding, and the earnings per share is $6. It looks to mo lke the stock should sel for $46 after the ex-dividend date. If instead of paying a dividend, the management decides to repurchase stock. Question 2: 1 am on the board of directors of the B. Phillips Corporation, and the company has announced its plan to pay dividends of \$672,000. Presently, there are 280,000 shares outstanding, and the earnings per share is $6. It looks to me like the slock should sell for $46 after the ex-dividend date, If instead of paying a dividend, the management decides to repurchase stock. a. What should be the repurchase price that is equivalent to the proposed dividend? (Hint. Ignore any tax effects.) b. How many shares should the company ropurchase? c. I want to look out for the small shareholders. If someone owns 100 shares, do you think she would prefer that the company pay the dividend or repurchase stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts