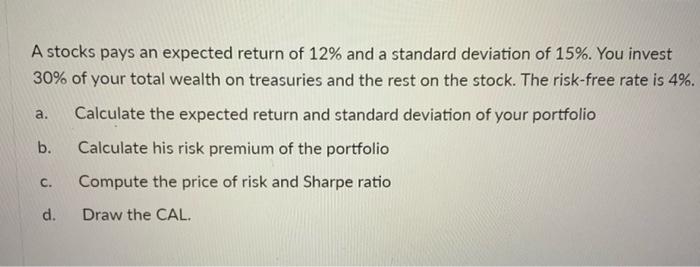

Question: help please asap! show work please abc&d A stocks pays an expected return of 12% and a standard deviation of 15%. You invest 30% of

A stocks pays an expected return of 12% and a standard deviation of 15%. You invest 30% of your total wealth on treasuries and the rest on the stock. The risk-free rate is 4%. Calculate the expected return and standard deviation of your portfolio b. Calculate his risk premium of the portfolio Compute the price of risk and Sharpe ratio a. C. d. Draw the CAL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts