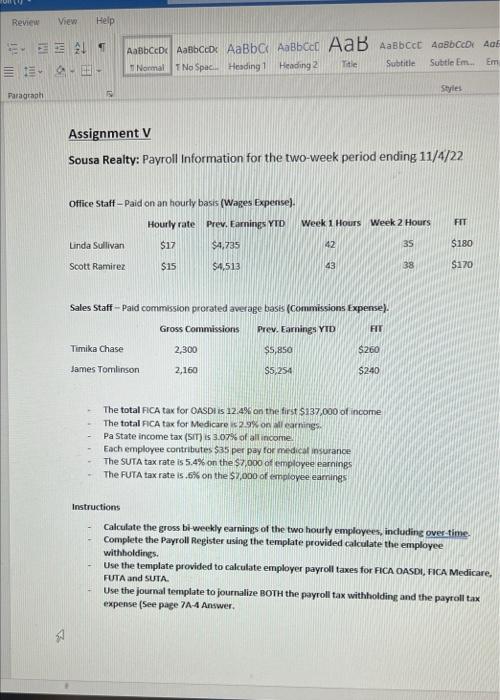

Question: Help please Assignment V Sousa Realty: Payroll Information for the two-week period ending 11/4/22 Office Staff - Paid on an hourly basis (Wages Expense). Sales

Assignment V Sousa Realty: Payroll Information for the two-week period ending 11/4/22 Office Staff - Paid on an hourly basis (Wages Expense). Sales Staff - Paid commission prorated average basis (Commissions Expense). - The total FICA tax for OASDI is 12.4% on the first 5137,000 of income - The total FICA tax for Medicare i52.9\% on all earnings. - Pa State income tax (5iT) i5 3.0756 of all income. - Each employee contributes $35 per pay for medicat insurance - The SUTA tax rate is 5.4% on the $7.000 of employee earnings - The FUTA tax rate is, 676 on the $7,000 of cinployee earnings Instructions - Calculate the gross bi-weckly earnings of the two hourfy employees, including over-time. - Complete the Payroll Register using the template provided calculate the employee withholdings. - Use the template provided to calculate employer payroll taxes for FiCA OASDI, FICA Medicare, UTA and SUTA. - Use the journal template to journalize BOTH the payroll tax withholding and the payroll tax expense (See page 7A-4 Answer, Assignment V Sousa Realty: Payroll Information for the two-week period ending 11/4/22 Office Staff - Paid on an hourly basis (Wages Expense). Sales Staff - Paid commission prorated average basis (Commissions Expense). - The total FICA tax for OASDI is 12.4% on the first 5137,000 of income - The total FICA tax for Medicare i52.9\% on all earnings. - Pa State income tax (5iT) i5 3.0756 of all income. - Each employee contributes $35 per pay for medicat insurance - The SUTA tax rate is 5.4% on the $7.000 of employee earnings - The FUTA tax rate is, 676 on the $7,000 of cinployee earnings Instructions - Calculate the gross bi-weckly earnings of the two hourfy employees, including over-time. - Complete the Payroll Register using the template provided calculate the employee withholdings. - Use the template provided to calculate employer payroll taxes for FiCA OASDI, FICA Medicare, UTA and SUTA. - Use the journal template to journalize BOTH the payroll tax withholding and the payroll tax expense (See page 7A-4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts