Question: help please. Can you show how to solve this? Explain. 8.9 and 8.10. The maker of a $240,000,6%, 90-day not receivable failed to pay the

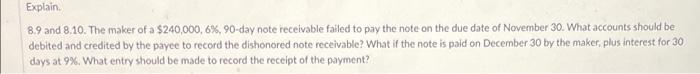

Explain. 8.9 and 8.10. The maker of a $240,000,6%, 90-day not receivable failed to pay the note on the due date of November 30. What accounts should be debited and credited by the payee to record the dishonored note receivable? What if the note is paid on December 30 by the maker, plus interest for 30 days at 9%. What entry should be made to record the receipt of the payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts