Question: Help please Chapter 1 1 Current Llabilities and Payroll Accounting 4 2 5 connect Serial problem began in Chapter 1 . If previous chapter segments

Help please

Chapter

Current Llabilities and Payroll Accounting

connect

Serial problem began in Chapter If previous chapter segments were not completed, the serial problem coun begin at this point. It is available in Connect with an algorithmic option.

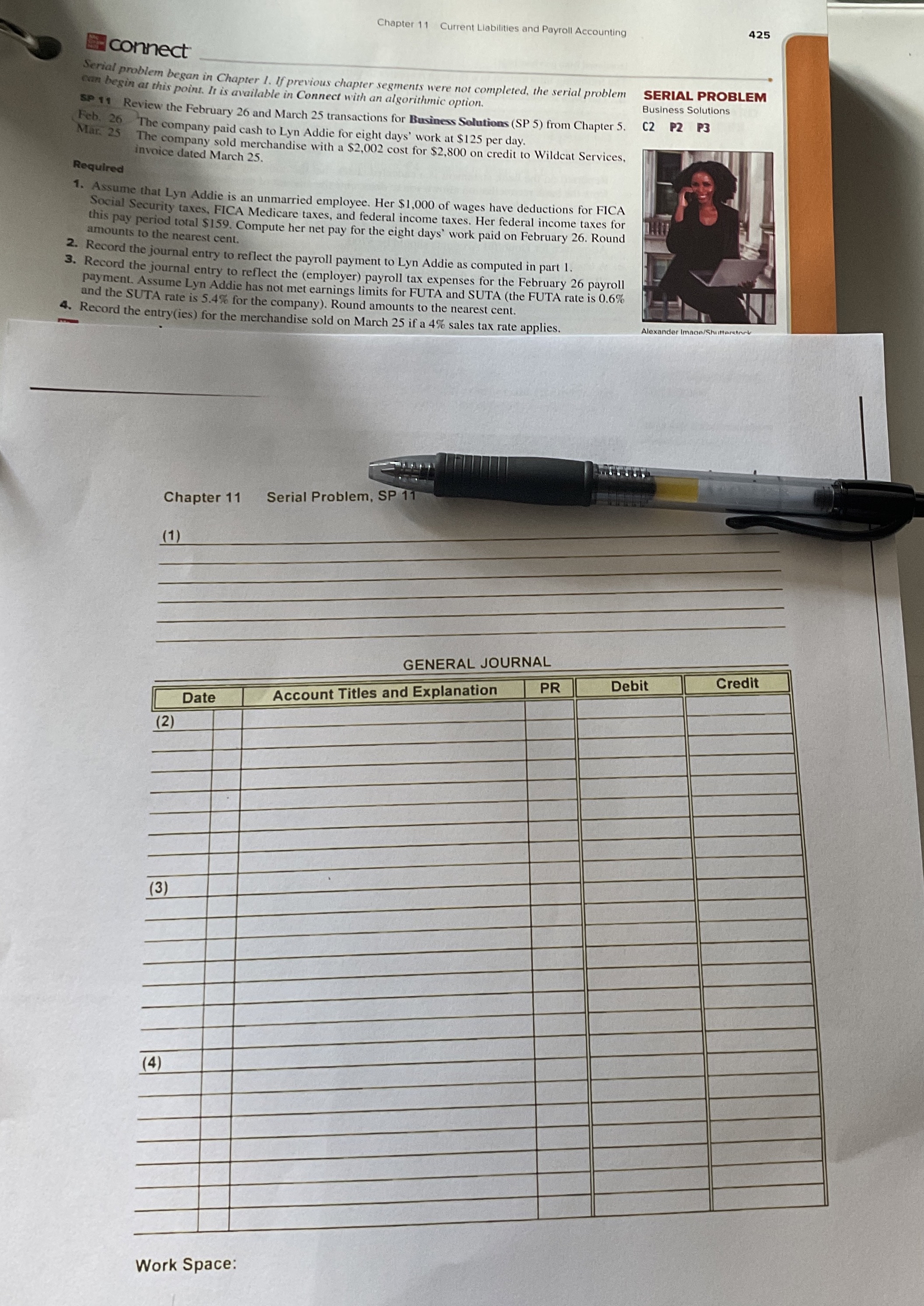

Sp Review the February and March transactions for Business Solutions SP from Chapter Feb. The company paid cash to Lyn Addie for eight days' work at $ per day.

Mar. The company sold merchandise with a $ cost for $ on credit to Wildeat Services, invoice dated March

Required

Assume that Lyn Addie is an unmarried employee. Her $ of wages have deductions for FICA Social Security taxes, FICA Medicare taxes, and federal income taxes. Her federal income taxes for this pay period total $ Compute her net pay for the eight days' work paid on February Round amounts to the nearest cent.

Record the journal entry to reflect the payroll payment to Lyn Addie as computed in part

Record the journal entry to reflect the employer payroll tax expenses for the February payroll payment. Assume Lyn Addie has not met earnings limits for FUTA and SUTA the FUTA rate is and the SUTA rate is for the company Round amounts to the nearest cent.

Record the entryies for the merchandise sold on March if a sales tax rate applies.

SERIAL PROBLEM

Business Solutions

C

P

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock