Question: Help please! Chapter9 Quiz True / False 1. The Allowance for Uncollectible Accounts is a contra-asset account. 2. The percentage of net sales method of

Help please!

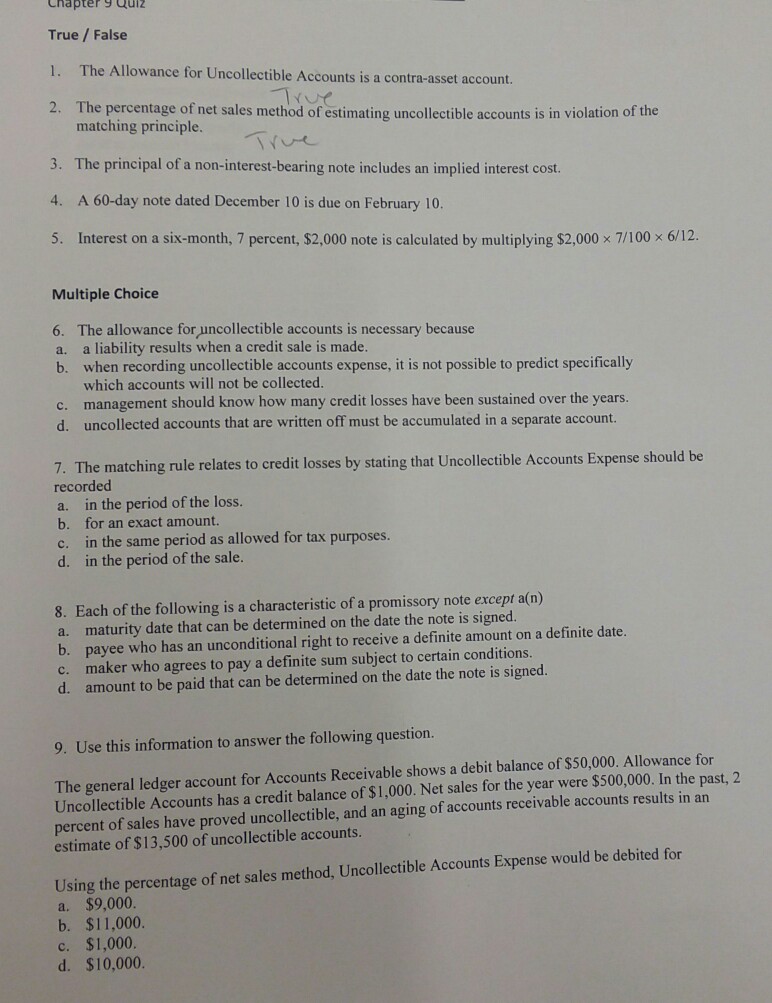

Chapter9 Quiz True / False 1. The Allowance for Uncollectible Accounts is a contra-asset account. 2. The percentage of net sales method of estimating uncollectible accounts is in violation of the matching principle 3. The principal of a non-interest-bearing note includes an implied interest cost. 4. A 60-day note dated December 10 is due on February 10. 5. Interest on a six-month, 7 percent, $2,000 note is calculated by multiplying $2,000 x 7/100 x 6/12. Multiple Choice 6. The allowance for uncollectible accounts is necessary because a. a liability results when a credit sale is made. b. when recording uncollectible accounts expense, it is not possible to predict specifically which accounts will not be collected. management should know how many credit losses have been sustained over the years. d. c. uncollected accounts that are written off must be accumulated in a separate account. 7. The matching rule relates to credit losses by stating that Uncollectible Accounts Expense should be recorded a. in the period of the loss. b. for an exact amount. c. in the same period as allowed for tax purposes. d. in the period of the sale. 8. Each of the following is a characteristic of a promissory note except a(n) ed on the date the note is signed. payee who has an unconditional right to receive a definite amount on a definite date. maker who agrees to pay a definite sum subject to certain conditions. amount to be paid that can be determined on the date the note is signed. b. c. d. 9. Use this information to answer the following question. The general ledger account for Accounts Receivable shows a debit balance of $50,000. Allowance for Uncollectible Accounts has a credit balance of $1,000. Net sales for the year were $500,000. In the past, 2 percent of sales have proved uncollectible, and an aging of accounts receivable accounts results in an estimate of $13,500 of uncollectible accounts. Using the percentage of net sales method, Uncollectible Accounts Expense would be debited for a. $9,000 b. $11,000. c. $1,000 d. $10,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts