Question: Help please, correct the wrong answers. Kindly Consider (use population standard deviation (divide by N) rather than the sample standard deviation (for which we used

Help please, correct the wrong answers.

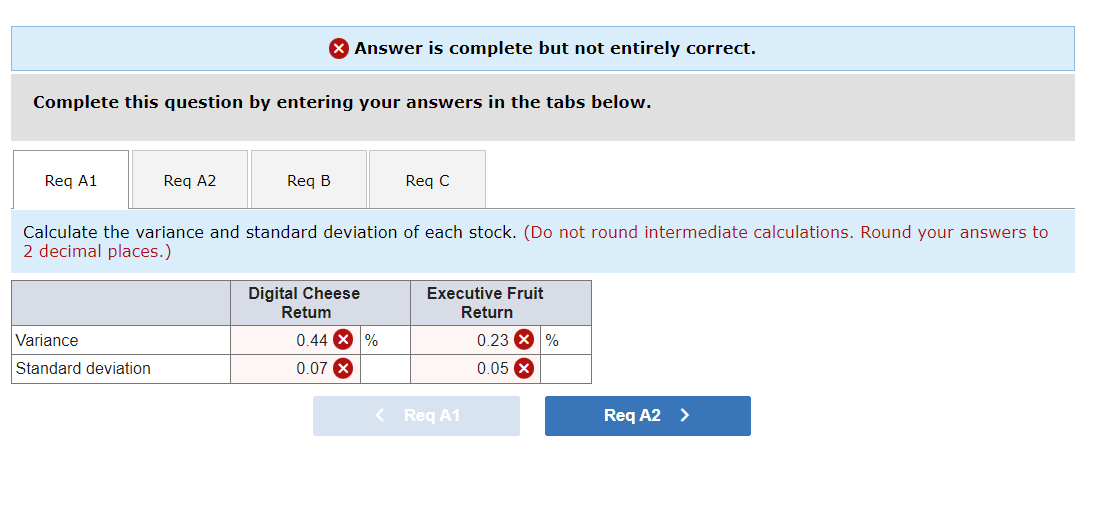

Kindly Consider (use population standard deviation (divide by N) rather than the sample standard deviation (for which we used to divide by N-1))

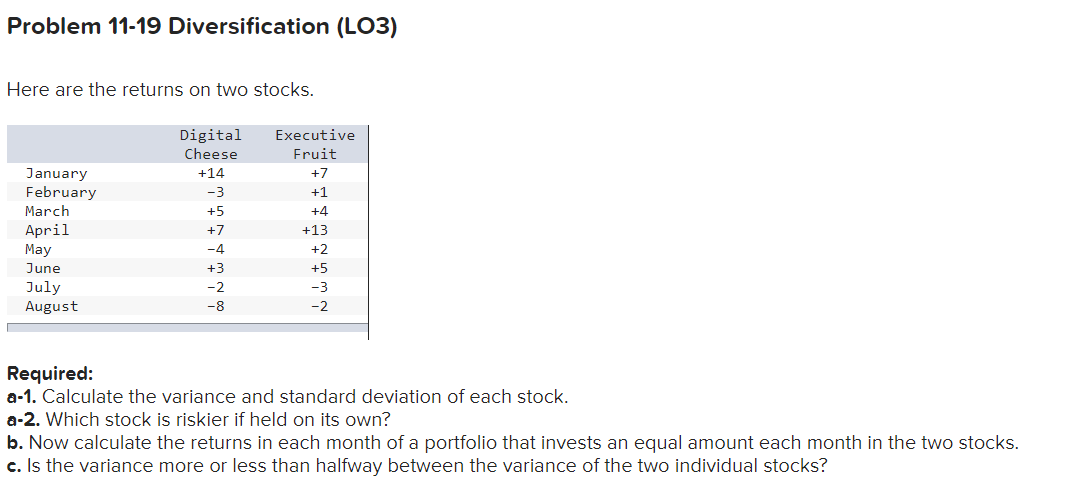

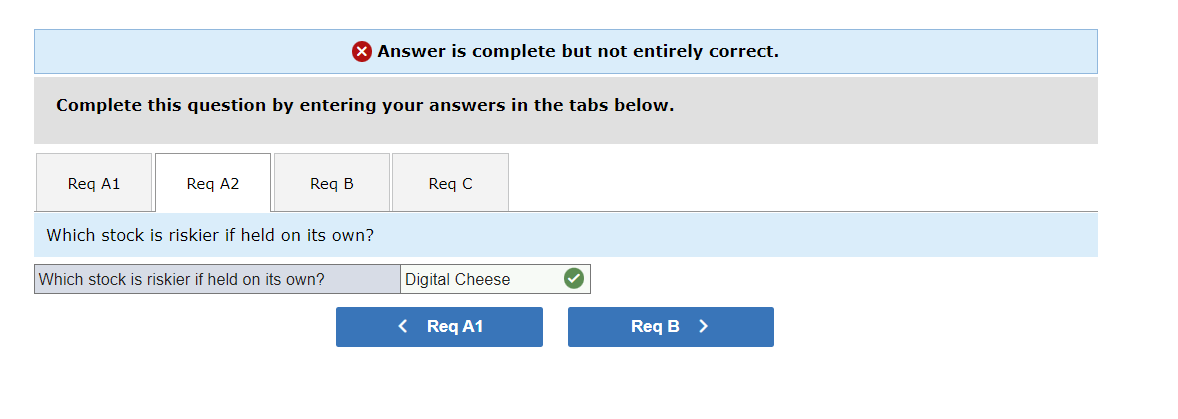

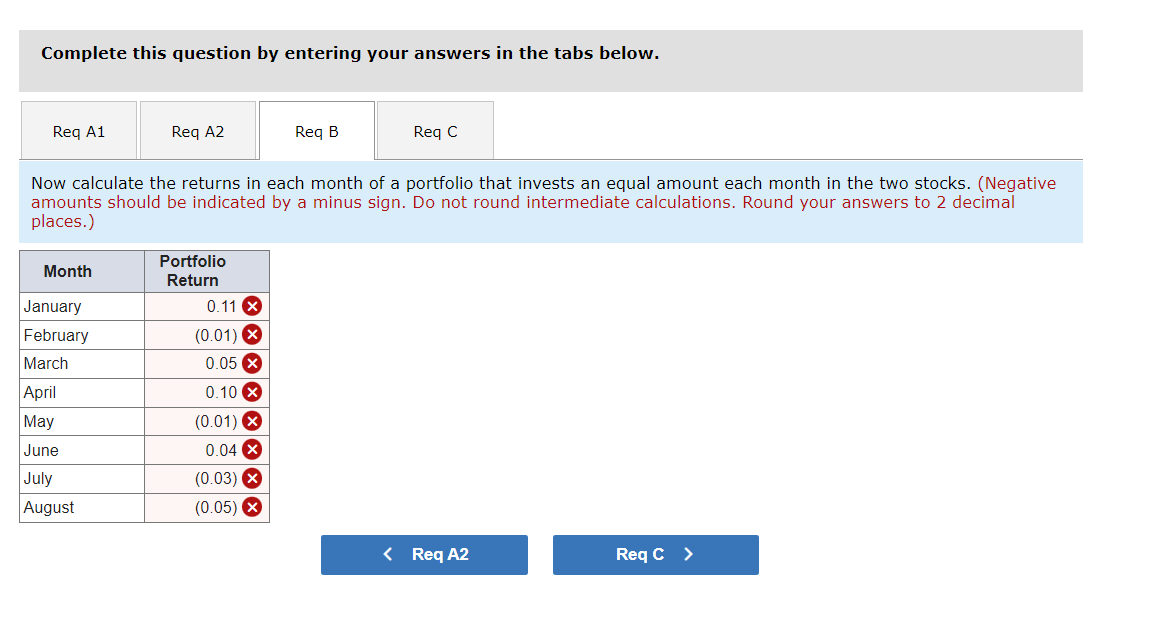

Problem 11-19 Diversification (L03) Here are the returns on two stocks. January February March April May June July August Digital Cheese +14 -3 +5 +7 -4 +3 -2 -8 so t to w Executive Fruit +7 +1 +4 +13 +2 +5 -3 -2 Required: a-1. Calculate the variance and standard deviation of each stock. a-2. Which stock is riskier if held on its own? b. Now calculate the returns in each month of a portfolio that invests an equal amount each month in the two stocks. c. Is the variance more or less than halfway between the variance of the two individual stocks? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Req A1 Req A2 Req B ReqC Calculate the variance and standard deviation of each stock. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Digital Cheese Retum 0.44 X % Executive Fruit Return 0.23 X % Variance Standard deviation 0.07 X 0.05 X Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Req A1 Req A2 Reg B Reqc Which stock is riskier if held on its own? Which stock is riskier if held on its own? Digital Cheese Complete this question by entering your answers in the tabs below. Req A1 Req A2 Req B Reg C Now calculate the returns in each month of a portfolio that invests an equal amount each month in the two stocks. (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to 2 decimal places.) Month Portfolio Return 0.11 x (0.01) X 0.05 X January February March April | May June July August 0.10 X (0.01) X 0.04 X (0.03) X (0.05) X X Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Reg A1 Req A2 Req B Reg C Is the variance more or less than halfway between the variance of the two individual stocks? Is the variance more or less than halfway between the variance of the two individual stocks? Less

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts