Question: help please :) Current Attempt in Progress The management of Cullumber Manufacturing Company is trying to decide whether to continue manulacturing a part or to

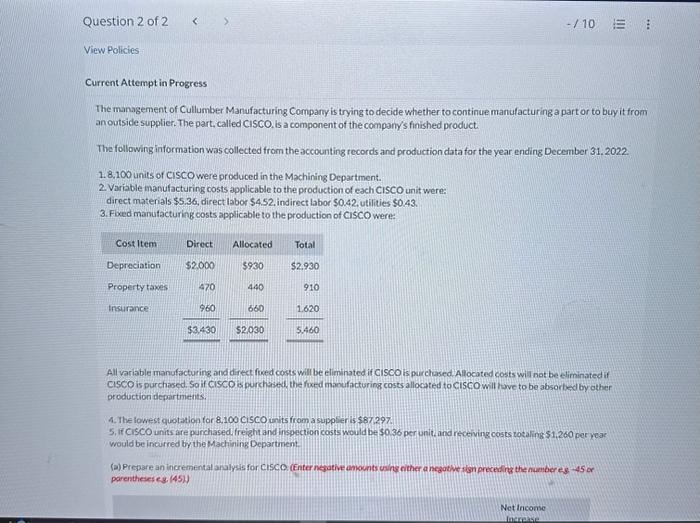

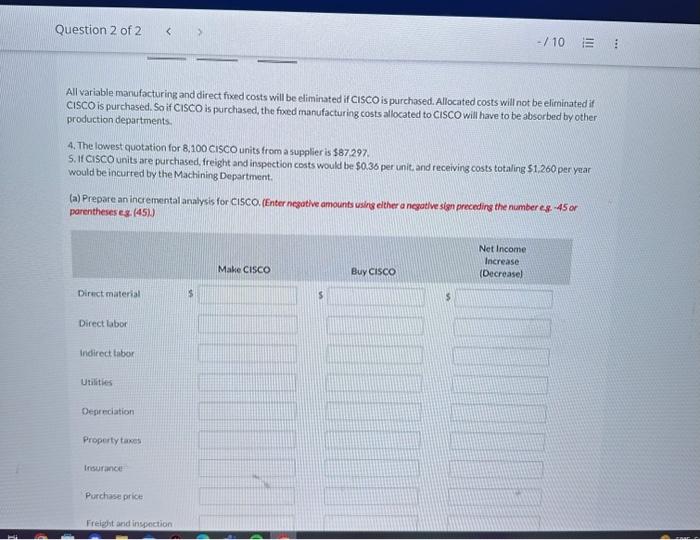

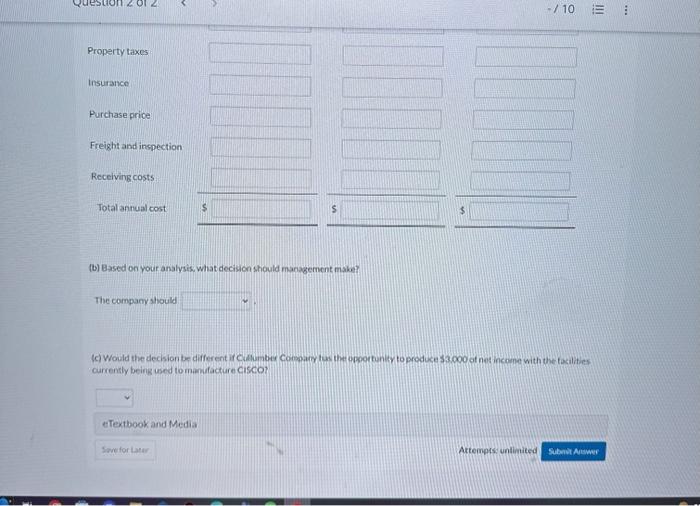

Current Attempt in Progress The management of Cullumber Manufacturing Company is trying to decide whether to continue manulacturing a part or to buy it from an outside supplier. The part, called CiSCO. is a component of the company/s finished product. The following information was collected from theaccounting records and production data for the year ending December 31.2022. 1.8,100 units of CiscO were produced in the Machining Department. 2. Variable manufacturing costs applicable to the production of each CIScO unit were: direct materials $5.36, direct labor $4.52, indirect labor $0.42, utilities $0.43. 3. Foed manufacturing costs applicable to the production of CISCO were: All variable manufacturing and direct fised conts will be eliminated if Cisco is purchased. A located costs wia nat be eliminated if CiSCO is purchascd. So if CISCO ispurchased, the fuxed manufacturing costs allocated to CIsCO will have to be absorbed by other production departments. 4. The iowest quotation for 8,100 Cisco units from a supplier is $87,297 5. it CisCO units are purchased, freight and inspection costs would be $036 per unit, and receiving costs tota ling $1,260 per year would be incurred by the Machining Departiment. (a) Prepare an incremental andlysis for CISCO. (Enter negutive anownts wing cither a negotive ilsn preceding the number eg 445 or parentheseses. (45) All variable manufacturing and direct fixed costs will be eliminated if CISCO is purchased. Allocated costs will not be eliminated it CISCO is purchased. So if CISCO is purchased, the foxed manufacturing costs allocated to CISCO will have to be absorbed by other production departments. 4. The lowest quotation for 8,100 CisCO units fram a supplier is $87297. 5. If CISCO units are purchased, freight and inspection costs would be $0.36 per unit. and receiving costs totaling $1,260 per year would be incurred by the Machining Department. (a) Prepare an incremental analysis for CISCO, (Enter nezotive amounts wing elcher a negotlve sign preceding the number eg -45 or parentheses eg. (45) (b) Based on your analysis. What deciscon should management make? The compans should (c) Would the decision be different if Cudlumber Coweperc tuw the opportunity to produce 53000 ot net incuine with the tacilities currensly being used to mandfacture crsco

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts