Question: help please do the graph5 Required information The following information applies to the questions displayed below) Following is information on an investment considered by Hudson

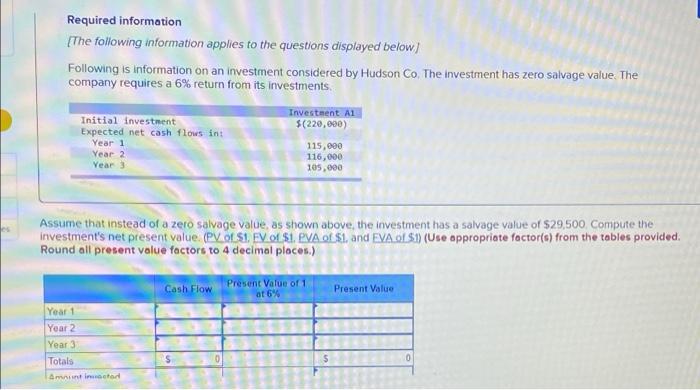

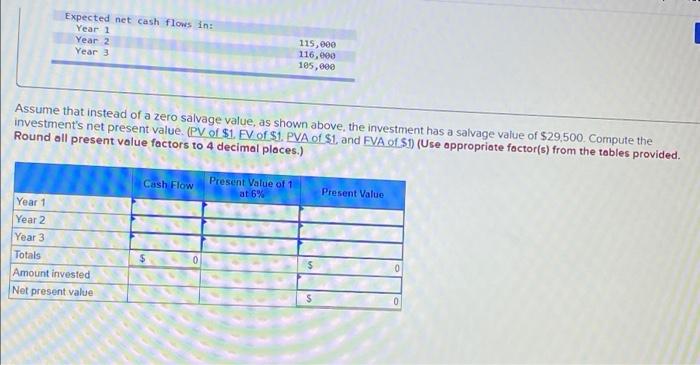

Required information The following information applies to the questions displayed below) Following is information on an investment considered by Hudson Co. The investment has zero salvage value. The company requires a 6% return from its investments Investment A1 $(220,000) Initial Investment Expected net cash flows int Year 1 Year 2 Year 3 115,000 116,000 105,000 Assume that instead of a zero salvage value as shown above, the investment has a salvage value of $29,500 Compute the investment's net present value. (PV of S1. FV 01 $1. PVA of $1, and EVA 01 S1) (Use appropriate factor(e) from the tables provided. Round all present value factors to 4 decimal places.) Cash Flow Present Value of 1 at 6 Present Value Year 1 Year 2 Year 3 Totals Amina 0 Expected net cash flows in Year 1 Year 2 Year 3 115,000 116,000 105,000 Assume that instead of a zero salvage value, as shown above, the investment has a salvage value of $29,500. Compute the investment's net present value. (PV of $1. EV of S1. PVA of SL and FVA 01:51) (Use appropriate factor(s) from the tables provided. Round all present value factors to 4 decimal places.) Cash Flow Present Value of 1 at 6% Present Value Year 1 Year 2 Year 3 Totals Amount invested Net present value 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts