Question: help please due soon(very clear pics) 1. Use the PV function in Excel to calculate the issue price of the bonds. 2. Prepare an effective-interest

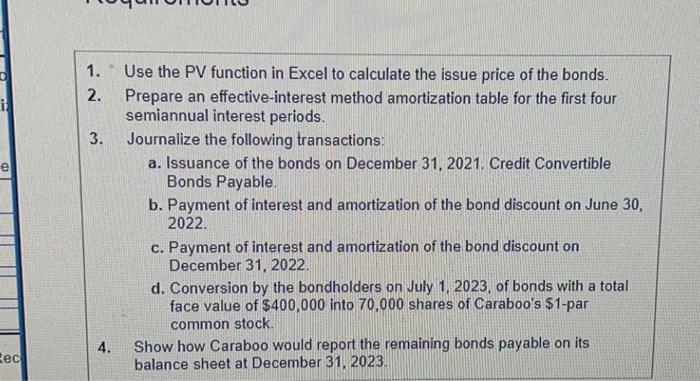

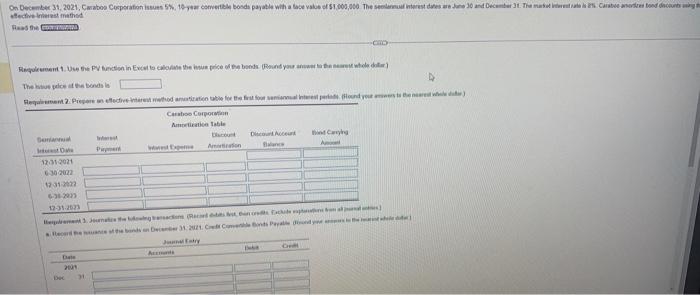

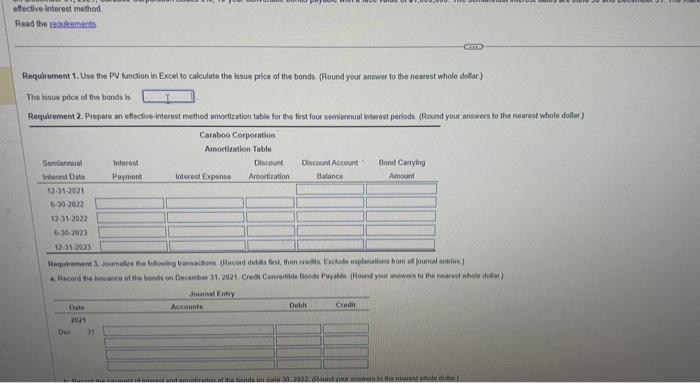

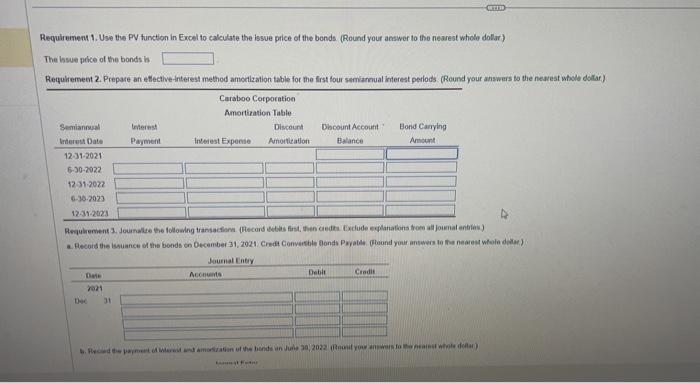

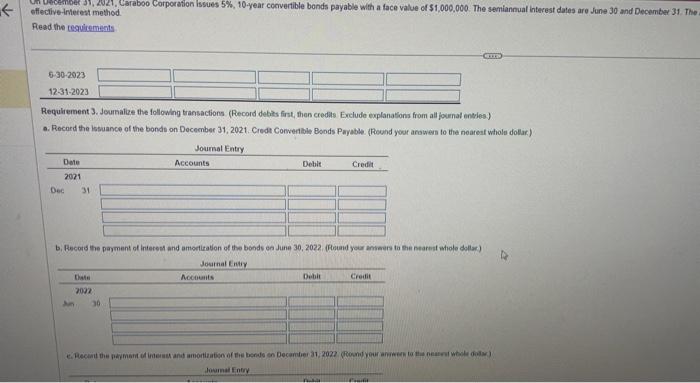

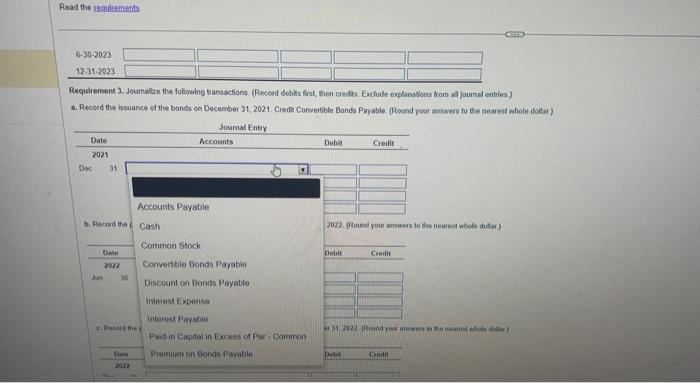

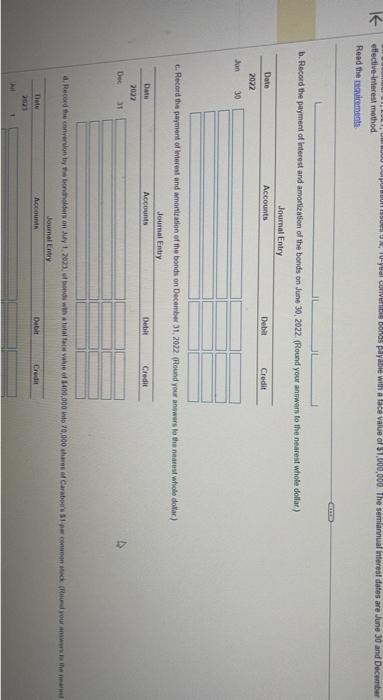

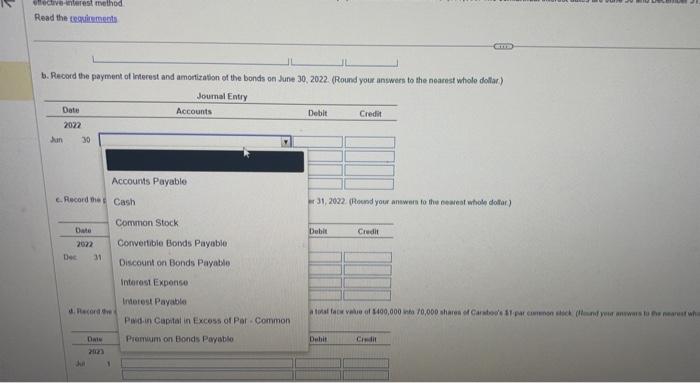

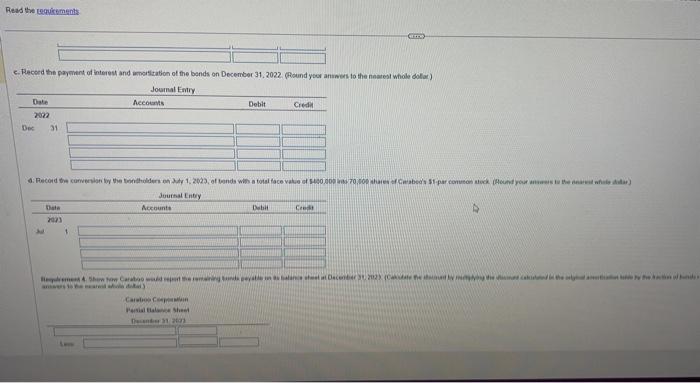

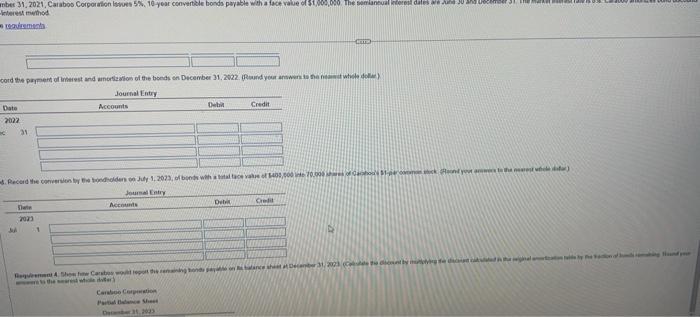

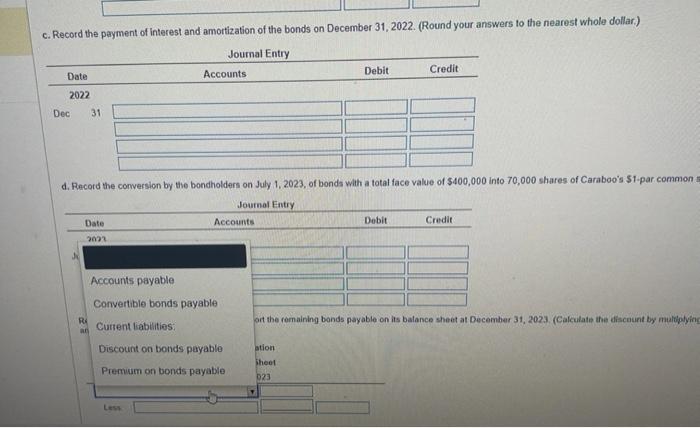

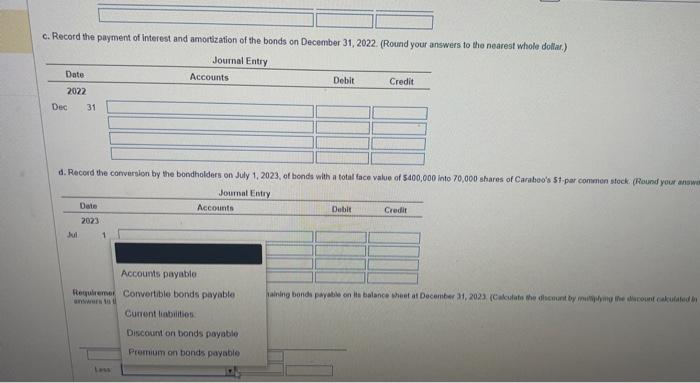

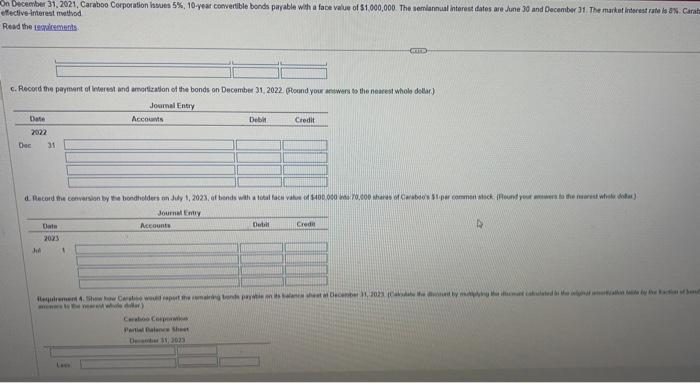

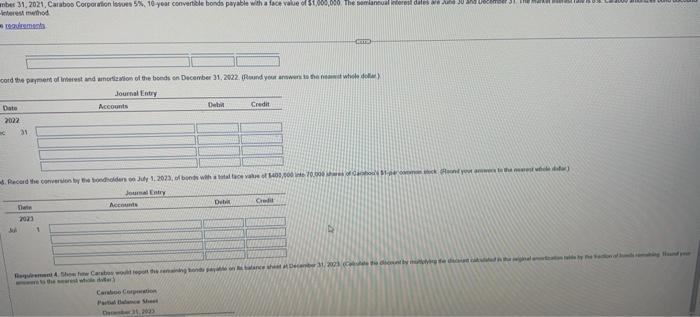

1. Use the PV function in Excel to calculate the issue price of the bonds. 2. Prepare an effective-interest method amortization table for the first four semiannual interest periods. 3. Journalize the following transactions: a. Issuance of the bonds on December 31,2021 . Credit Convertible Bonds Payable. b. Payment of interest and amortization of the bond discount on June 30 , 2022. c. Payment of interest and amortization of the bond discount on December 31, 2022. d. Conversion by the bondholders on July 1, 2023, of bonds with a total face value of $400,000 into 70,000 shares of Caraboo's $1-par common stock. 4. Show how Caraboo would report the remaining bonds payable on its balance sheet at December 31, 2023. Fiobs the The istus palce it thin tronds las Requirement 1. Use the PY bunction in Excel to calculate the issue price of the bonds. (Reund your answer to the nearest whole difar ) The hisue pice of the bonds la Requitemest 2. Prepare an effective-interest method amortization tabie for the first four cemiannual interest periods (Round your ansiners to the nearest wholo doller) Requirement 1. Use the PV function in Excel to calculate the issue pice of the bonds. (Round your answer to the nearest wholib dollar) The ksue picice of the bonds is. Requirement 2. Prepare an etlective interest method amoctization table for the first four semiannual interest perlods. (Reund your answers to the neavest whole dotaf) effective Interest mothod efiective inerestmethod Requliement 3. Jeumalize the following transactions (Record defits first, then crodits Exclude explanations from all journal anteles) a. Record the issuance of the bonde on Docember 31, 2021. Credit Convertble Bonds Payable. (Recund yoet araweis to the neareat whole dollar.) Requirement 3. Joxinalize the folowing trantactions. (Recond debils fint, then credis. Exilude explanations from al jaursal eatries.) a. Record the issuance of the bonds on December 31, 2021. Credi Conwertble Bonds Payable. (Round your answens to the nearest whole tollar) the nearest witchin dotar) Hfective-interest mothod. Read the regricoments. b. Record the payment of Interest and amorization of the bonds on dune 30,2022 . (Round your answers to the nearnst whole dollar) Read the troukiements c. Recoed the payment of interest and unvertitation of the bands on December 31. 2022. (Pound yoor antwers to the naatest whole dolat) Hesenter hi 2t11 Carwes Coipention c. Record the payment of interest and amortization of the bonds on December 31, 2022. (Round your answers to the nearest whole dollar.) c. Record the payment of interest and amortization of the bonds on December 31, 2022. (Round your answers to the nearest whole dollaz.) d. Record the conversilon by the bondholders on July 1, 2023, of bonds with a total face value of 5400,000 into 70,000 shares of Caraboo's 51 -par canmen stock. (Round your answe Cective-interest mettiod besd the recrictmefts Carwes Coipention 1. Use the PV function in Excel to calculate the issue price of the bonds. 2. Prepare an effective-interest method amortization table for the first four semiannual interest periods. 3. Journalize the following transactions: a. Issuance of the bonds on December 31,2021 . Credit Convertible Bonds Payable. b. Payment of interest and amortization of the bond discount on June 30 , 2022. c. Payment of interest and amortization of the bond discount on December 31, 2022. d. Conversion by the bondholders on July 1, 2023, of bonds with a total face value of $400,000 into 70,000 shares of Caraboo's $1-par common stock. 4. Show how Caraboo would report the remaining bonds payable on its balance sheet at December 31, 2023. Fiobs the The istus palce it thin tronds las Requirement 1. Use the PY bunction in Excel to calculate the issue price of the bonds. (Reund your answer to the nearest whole difar ) The hisue pice of the bonds la Requitemest 2. Prepare an effective-interest method amortization tabie for the first four cemiannual interest periods (Round your ansiners to the nearest wholo doller) Requirement 1. Use the PV function in Excel to calculate the issue pice of the bonds. (Round your answer to the nearest wholib dollar) The ksue picice of the bonds is. Requirement 2. Prepare an etlective interest method amoctization table for the first four semiannual interest perlods. (Reund your answers to the neavest whole dotaf) effective Interest mothod efiective inerestmethod Requliement 3. Jeumalize the following transactions (Record defits first, then crodits Exclude explanations from all journal anteles) a. Record the issuance of the bonde on Docember 31, 2021. Credit Convertble Bonds Payable. (Recund yoet araweis to the neareat whole dollar.) Requirement 3. Joxinalize the folowing trantactions. (Recond debils fint, then credis. Exilude explanations from al jaursal eatries.) a. Record the issuance of the bonds on December 31, 2021. Credi Conwertble Bonds Payable. (Round your answens to the nearest whole tollar) the nearest witchin dotar) Hfective-interest mothod. Read the regricoments. b. Record the payment of Interest and amorization of the bonds on dune 30,2022 . (Round your answers to the nearnst whole dollar) Read the troukiements c. Recoed the payment of interest and unvertitation of the bands on December 31. 2022. (Pound yoor antwers to the naatest whole dolat) Hesenter hi 2t11 Carwes Coipention c. Record the payment of interest and amortization of the bonds on December 31, 2022. (Round your answers to the nearest whole dollar.) c. Record the payment of interest and amortization of the bonds on December 31, 2022. (Round your answers to the nearest whole dollaz.) d. Record the conversilon by the bondholders on July 1, 2023, of bonds with a total face value of 5400,000 into 70,000 shares of Caraboo's 51 -par canmen stock. (Round your answe Cective-interest mettiod besd the recrictmefts Carwes Coipention

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts