Question: help please E6-1 E6-3 E6-1 L06-1. Reporting Net Sales with Credit Sales and Sales Discounts During the months of January and February, Hancock Corporation sold

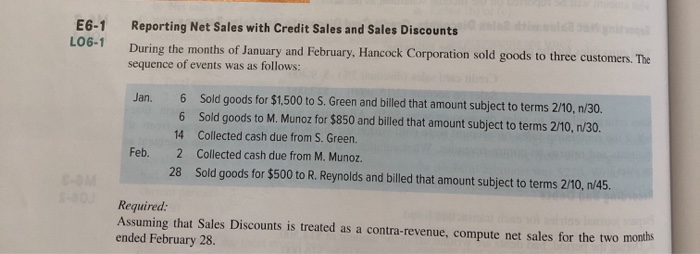

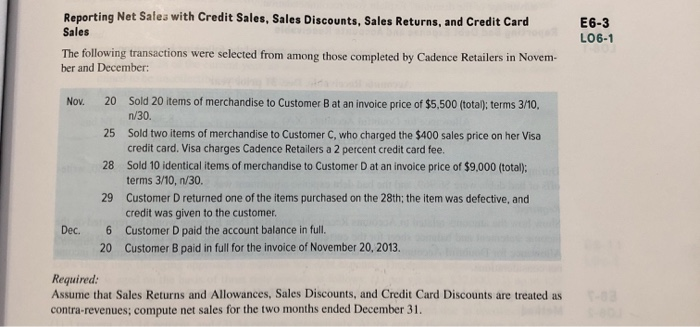

E6-1 L06-1. Reporting Net Sales with Credit Sales and Sales Discounts During the months of January and February, Hancock Corporation sold goods to three customers. The sequence of events was as follows: Jan. 6 6 14 2 28 Sold goods for $1,500 to S. Green and billed that amount subject to terms 2/10,n/30. Sold goods to M. Munoz for $850 and billed that amount subject to terms 2/10, 1/30. Collected cash due from S. Green. Collected cash due from M. Munoz. Sold goods for $500 to R. Reynolds and billed that amount subject to terms 2/10,n/45. Feb. Required: Assuming that Sales Discounts is treated as a contra-revenue, compute net sales for the two months ended February 28 E6-3 LO6-1 Reporting Net Sales with Credit Sales, Sales Discounts, Sales Returns, and Credit Card Sales The following transactions were selected from among those completed by Cadence Retailers in Novem ber and December: Nov. 20 Sold 20 items of merchandise to Customer B at an invoice price of $5,500 (total): terms 3/10, n/30. 25 Sold two items of merchandise to Customer C, who charged the $400 sales price on her Visa credit card, Visa charges Cadence Retailers a 2 percent credit card fee. 28 Sold 10 identical items of merchandise to Customer Dat an invoice price of $9,000 (total): terms 3/10,n/30 29 Customer returned one of the items purchased on the 28th; the item was defective, and credit was given to the customer. 6 Customer D paid the account balance in full. 20 Customer B paid in full for the invoice of November 20, 2013. Dec. Required: Assume that Sales Returns and Allowances, Sales Discounts, and Credit Card Discounts are treated as contra-revenues; compute net sales for the two months ended December 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts