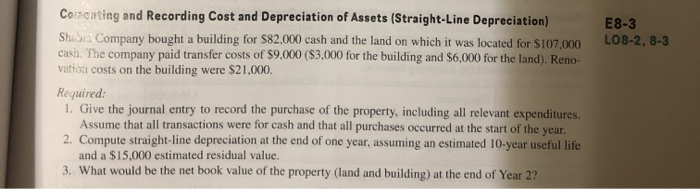

Question: help please E8-3 -2. Cooting and Recording Cost and Depreciation of Assets (Straight-Line Depreciation) Shan Company bought a building for $82,000 cash and the land

E8-3 -2. Cooting and Recording Cost and Depreciation of Assets (Straight-Line Depreciation) Shan Company bought a building for $82,000 cash and the land on which it was located for $107.000 cash. The company paid transfer costs of $9.000 ($3,000 for the building and $6,000 for the land). Reno- vation costs on the building were $21,000. Required: 1. Give the journal entry to record the purchase of the property, including all relevant expenditures. Assume that all transactions were for cash and that all purchases occurred at the start of the year 2. Compute straight-line depreciation at the end of one year, assuming an estimated 10-year useful life and a $15,000 estimated residual value. 3. What would be the net book value of the property (land and building) at the end of Year 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts