Question: help please!! Entries for Bad Debt Expense Under the Direct Write-Off and Allowance Methods Seaforth International wrote off the following accounts receivable as uncollectible for

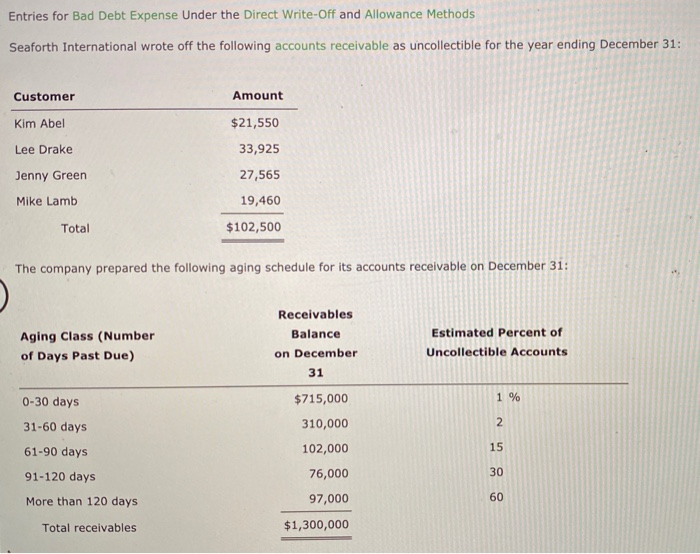

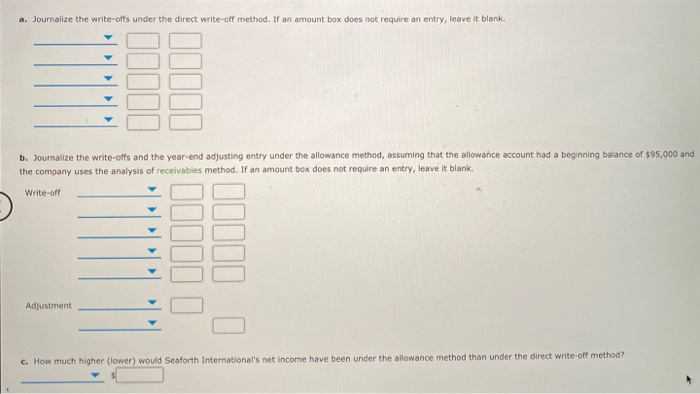

Entries for Bad Debt Expense Under the Direct Write-Off and Allowance Methods Seaforth International wrote off the following accounts receivable as uncollectible for the year ending December 31: Customer Amount Kim Abel $21,550 Lee Drake 33,925 Jenny Green 27,565 Mike Lamb 19,460 Total $102,500 The company prepared the following aging schedule for its accounts receivable on December 31: Aging Class (Number of Days Past Due) Receivables Balance on December 31 Estimated Percent of Uncollectible Accounts $715,000 1 % 0-30 days 31-60 days 61-90 days 310,000 2. 102,000 15 91-120 days 30 76,000 97,000 60 More than 120 days Total receivables $1,300,000 a. Journalize the write-offs under the direct write-off method. If an amount box does not require an entry, leave it blank. b. Journalize the write-offs and the year-end adjusting entry under the allowance method, assuming that the allowance account had a beginning balance of $95,000 and the company uses the analysis of receivables method. If an amount box does not require an entry, leave it blank. Write-off Adjustment c. How much higher (lower) would Seaforth International's net income have been under the allowance method than under the direct write-off method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts