Question: HELP!!! please explain!!! Thank you. There is a example below this question can help to solve this problem List three or more features of VC

HELP!!! please explain!!! Thank you. There is a example below this question can help to solve this problem

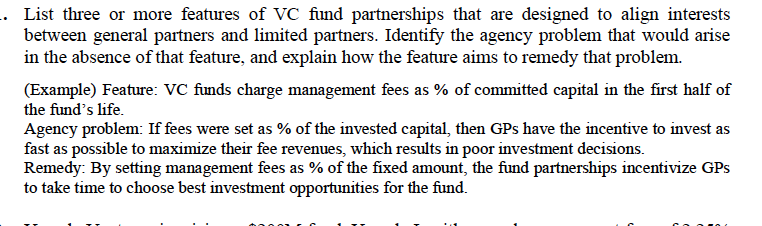

List three or more features of VC fund partnerships that are designed to align interests between general partners and limited partners. Identify the agency problem that would arise in the absence of that feature, and explain how the feature aims to remedy that problem. (Example) Feature: VC funds charge management fees as % of committed capital in the first half of the fund's life. Agency problem: If fees were set as % of the invested capital, then GPs have the incentive to invest as fast as possible to maximize their fee revenues, which results in poor investment decisions Remedy: By setting management fees as % of the fixed amount, the fund partnerships incentivize GPS to take time to choose best investment opportunities for the fund. List three or more features of VC fund partnerships that are designed to align interests between general partners and limited partners. Identify the agency problem that would arise in the absence of that feature, and explain how the feature aims to remedy that problem. (Example) Feature: VC funds charge management fees as % of committed capital in the first half of the fund's life. Agency problem: If fees were set as % of the invested capital, then GPs have the incentive to invest as fast as possible to maximize their fee revenues, which results in poor investment decisions Remedy: By setting management fees as % of the fixed amount, the fund partnerships incentivize GPS to take time to choose best investment opportunities for the fund

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts