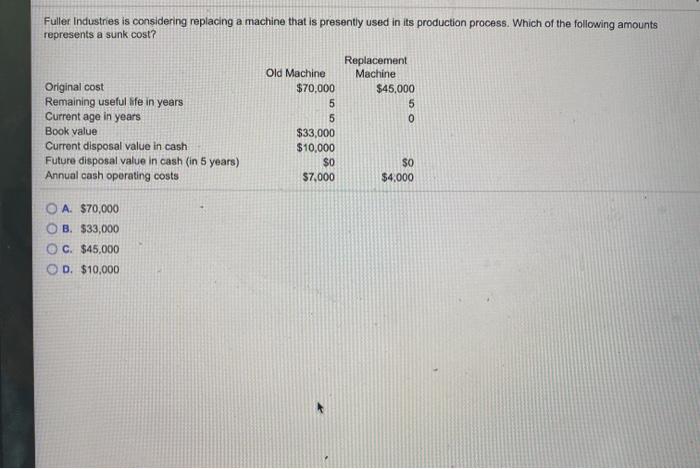

Question: HELP PLEASE Fuller Industries is considering replacing a machine that is presently used in its production process. Which of the following amounts represents a sunk

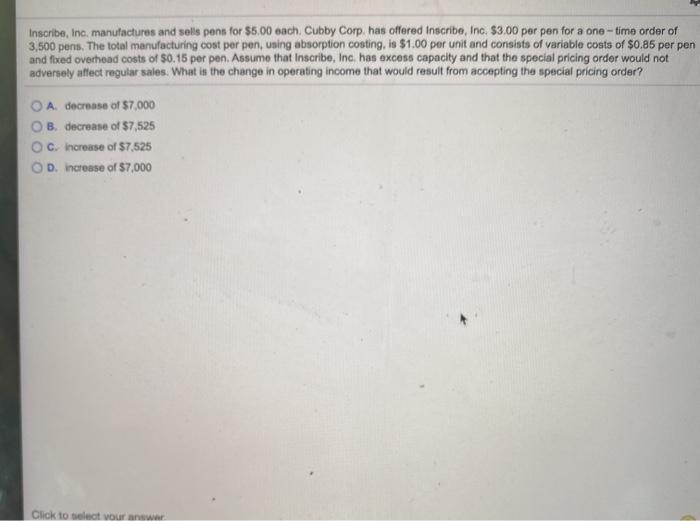

Fuller Industries is considering replacing a machine that is presently used in its production process. Which of the following amounts represents a sunk cost? Replacement Machine $45,000 5 0 Original cost Remaining useful life in years Current age in years Book value Current disposal value in cash Future disposal value in cash (in 5 years) Annual cash operating costs Old Machine $70,000 5 5 $33,000 $10,000 $0 $7,000 SO $4,000 O A $70,000 B. $33,000 C. $45,000 OD. $10,000 Inscribe, Inc, manufactures and sells pens for $5.00 each. Cubby Corp has offered inscribe, Inc. $3.00 per pen for a one-time order of 3,500 pens. The total manufacturing cost per pen, using absorption costing, is $1.00 per unit and consists of variable costs of $0.85 per pen and fixed overhead costs of $0.15 per pen. Assume that Inscribe, Inc. has excess capacity and that the special pricing order would not adversely affect regular sales. What is the change in operating income that would result from accepting the special pricing order? O A decrease of $7,000 B. decrease of $7,525 Cincrease of $7.525 OD. increase of $7,000 Click to select your war

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts