Question: help please GRADED Homework Help Save & CI E9-10 (Algo) Calculating Variable Overhead Variances [LO 9-5) Parker Plastic, Inc., manufactures plastic mats to use with

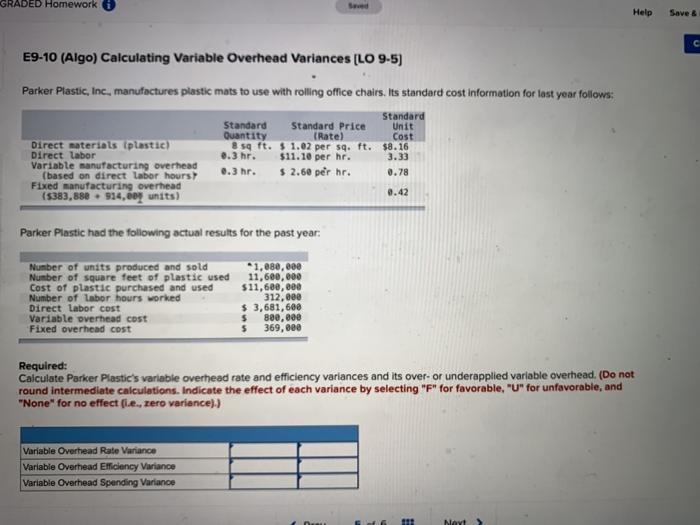

GRADED Homework Help Save & CI E9-10 (Algo) Calculating Variable Overhead Variances [LO 9-5) Parker Plastic, Inc., manufactures plastic mats to use with rolling office chairs. Its standard cost information for last year follows: Standard Standard Standard Price Unit Quantity (Rate) Cost Direct materials (plastic) 8 sq ft. $ 1.02 per sq. ft. $8.16 Direct labor 0.3 hr. $11.10 per hr. 3.33 Variable manufacturing overhead (based on direct labor hours $ 2.60 per hr. 0.78 Fixed manufacturing overhead 0.42 (5383,888 914,60 units) Parker Plastic had the following actual results for the past year: Number of units produced and sold Number of square feet of plastic used Cost of plastic purchased and used Number of Labor hours worked Direct labor cost Variable overhead cost Fixed overhead cost *1,080,000 11,600,000 $11,600,000 312,000 $ 3,681,600 $ 800,000 5 369,000 Required: Calculate Parker Plastic's variable overhead rate and efficiency variances and its over- or underapplied variable overhead. (Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect fie, zero variance):) Variable Overhead Rate Variance Variable Overhead Efficiency Variance Variable Overhead Spending Variance 111 Nort

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts