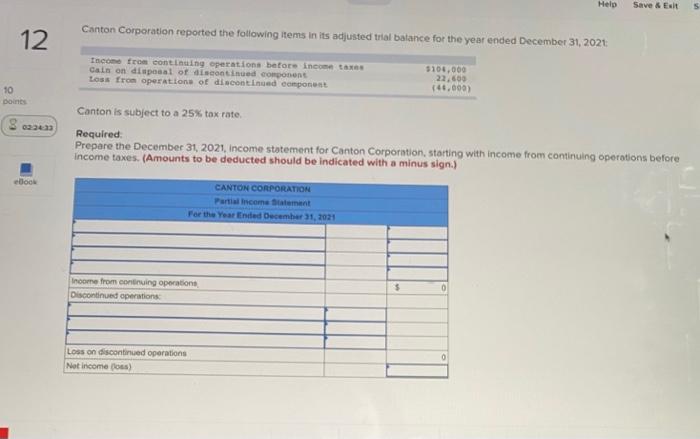

Question: HELP PLEASE!!!!! Help Save & Esit Canton Corporation reported the following items in its adjusted trial balance for the year ended December 31, 2021 12

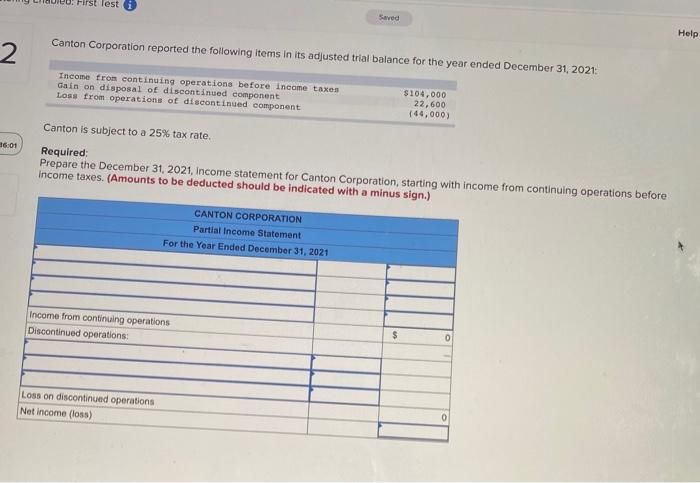

Help Save & Esit Canton Corporation reported the following items in its adjusted trial balance for the year ended December 31, 2021 12 Income from continuing operations before income taxes Cal on disposal of discontinued component Loss from operations of discontinued component $100,000 22.600 40,000) 10 Doints 0224 Canton is subject to a 25% tax rate, Required Prepare the December 31, 2021, Income statement for Canton Corporation, starting with income from continuing operations before Income taxes. (Amounts to be deducted should be indicated with a minus sign.) CANTON CORPORATION Partial income talent For the Year Ended December 31, 2021 Income from continuing operations Discontinued operations $ Loss on discontinued operations Not income) 0 First lest i Saved Help Canton Corporation reported the following items in its adjusted trial balance for the year ended December 31, 2021: 2 Income from continuing operations before income taxes Gain on disposal of discontinued component Loss from operations of discontinued component $104,000 22,600 144,000) 3601 Canton is subject to a 25% tax rate. Required: Prepare the December 31, 2021, Income statement for Canton Corporation, starting with income from continuing operations before Income taxes. (Amounts to be deducted should be indicated with a minus sign.) CANTON CORPORATION Partial Income Statement For the Year Ended December 31, 2021 Income from continuing operations Discontinued operations: $ 0 Loss on discontinued operations Net Income (los)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts