Question: Help please. I have the solution, but I need help understanding how they go the answer. Thank you. Two Risky Assets-practice question Example 2 risky

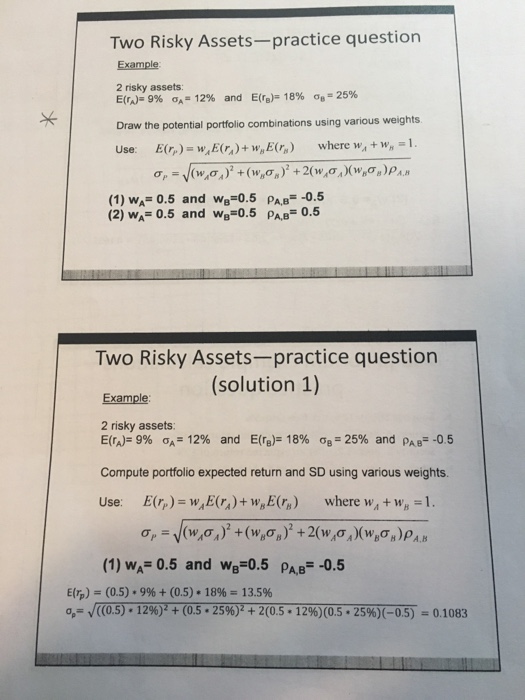

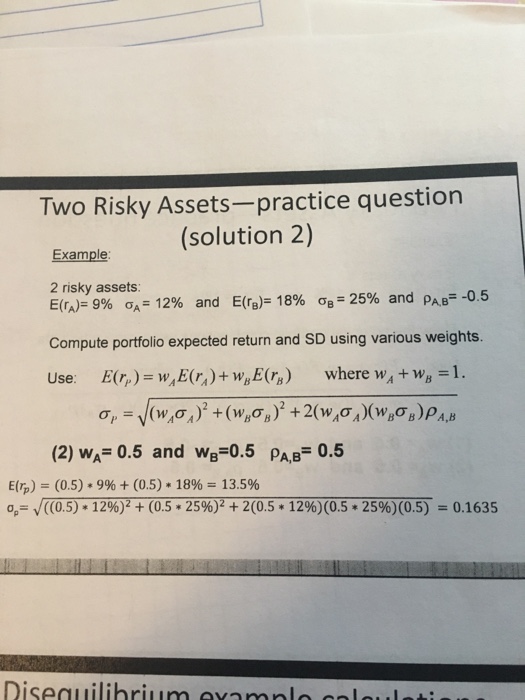

Two Risky Assets-practice question Example 2 risky assets: E(ra)-9% .-12% and E(fg); 18% .-25% Draw the potential portfolio combinations using various weights Use E)E+, E) where w+W, 1 (1) WA= 0.5 (2) WA= 0.5 and we=0.5 and wa=0.5 pA,B=-0.5 PAB= 0.5 Two Risky Assets-practice question Emple (solution 1) 2 risky assets E(ra): 9% ^-12% and E(r) 18% -25% and pAB-0.5 Compute portfolio expected return and SD using various weights Use: Er)-WE)+w, EG where w,+w,1 A,B (1)WA= 0.5 and wB=0.5 PAB=-0.5 E(5) (0.5) * 996 + (0.5) * 1896 = 13.5% qs v/((0.5) . 1296)2 + (0.5 2596)2 + 2(0.51296) (0.525%)(-0.5)-0.1083

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts