Question: help please i need it with formula at the excel RealRetro Company's dividends per share are expected to grow indefinitely by 6% per year. a.

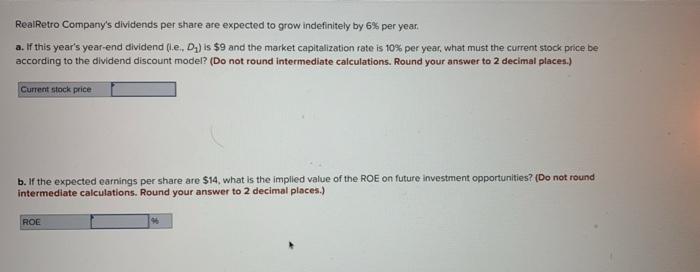

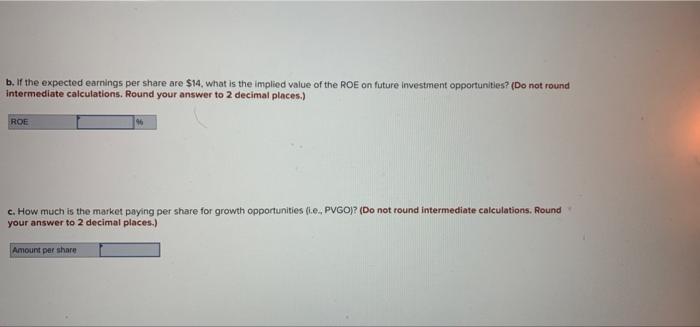

RealRetro Company's dividends per share are expected to grow indefinitely by 6% per year. a. If this year's year-end dividend (i.e., D) is $9 and the market capitalization rate is 10% per year, what must the current stock price be according to the dividend discount model? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Current stock price b. If the expected earnings per share are $14, what is the implied value of the ROE on future investment opportunities? (Do not round intermediate calculations. Round your answer to 2 decimal places.) ROE b. If the expected earnings per share are $14, what is the implied value of the ROE on future investment opportunities? (Do not round intermediate calculations. Round your answer to 2 decimal places.) ROE 16 c. How much is the market paying per share for growth opportunities (i.e., PVGO)? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Amount per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts