Question: help please. i need this done soon. John owns all 100 shares of stock in Jamaica Corporation, which has $100,000 of current E&P- John would

help please. i need this done soon.

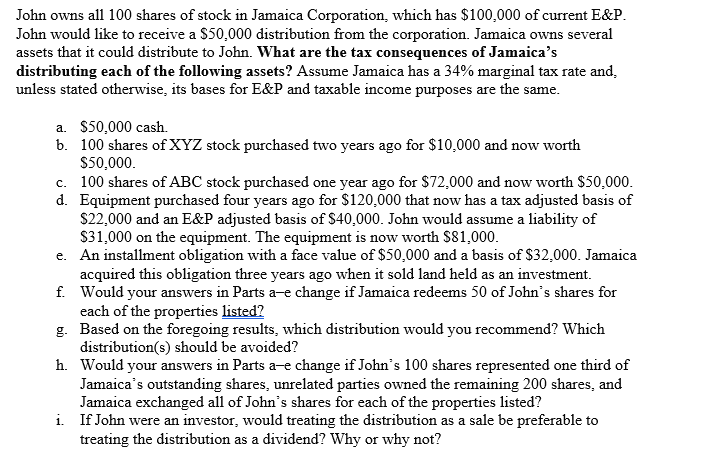

John owns all 100 shares of stock in Jamaica Corporation, which has $100,000 of current E&P- John would like to receive a $50,000 distribution from the corporation. Jamaica owns several assets that it could distribute to John. What are the tax consequences of Jamaica's distributing each of the following assets? Assume Jamaica has a 34% marginal tax rate and, unless stated otherwise, its bases for Ed'cP and taxable income purposes are the same. a. b. c. d. $50,000 cash. 100 shares ofXYZ stock purchased two years ago for $10,000 andnorw worth $50,000. 100 shares of ABC stock purchased one year ago for $?2,000 and now worth $50,000. Equipment purchased four years ago for $120,000 that now has a tax adjusted basis of $22,000 and an E851} adjusted basis of $40,000. John would assume a liability of $31,000 on the equipment. The equipment is now worth $31,000. An installment obligation with a face value of $50,000 and a basis of $32,000. Jamaica acquired this obligation three years ago when it sold land held as an investment. Would your answers in Parts ae change if Jamaica redeems 50 of John's shares for each of the properties 1:150:11? Based on the foregoing results, which distribution would you recommend? Which distributionlis) should be avoided? Wouldyour answers in Parts ae change ii'John's 100 shares represented one third of Jamaica's outstanding shares, unrelated parties owned the remaining 200 shares, and Jamaica exchanged all of John's shares for each of the properties listed? If John were an investor, would treating the distribution as a sale be preferable to treating the distribution as a dividend? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts