Question: Help please I would greatly be greatful for the help. I don't get this. lpl ConneLLI8R Example 11-2 (page 495) Oxbow Inc. is contemplating a

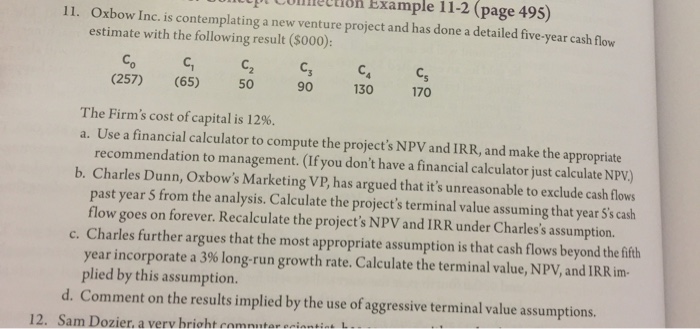

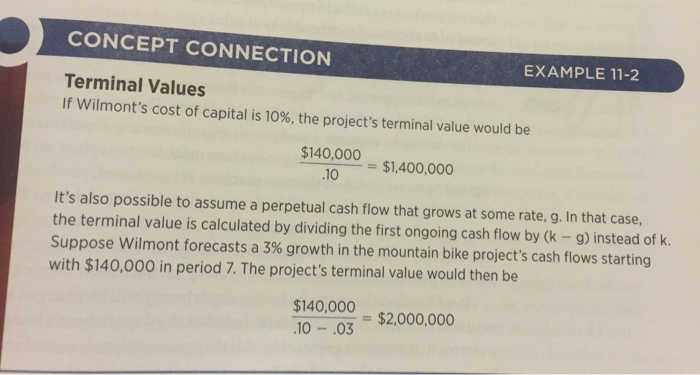

lpl ConneLLI8R Example 11-2 (page 495) Oxbow Inc. is contemplating a new venture project and has done a detailed five-year cash flow estimate with the following result ($000): 11. C, C2 (257) (65) 50 90 130 70 The Firm's cost of capital is 12%. a. Use a financial calculator to compute the project's NPV and IRR, and make the appropriate recommendation to management. (If you don't have a financial calculator just calculate NPV.) b. Charles Dunn, Oxbow's Marketing VP, has argued that it's unreasonable to exclude cash flows past year 5 from the analysis. Calculate the project's terminal value assuming that year S's cash flow goes on forever. Recalculate the project's NPV and IRR under Charles's assumption. c. Charles further argues that the most appropriate assumption is that cash flows beyond the fifth year incorporate a 3% long-run growth rate. Calculate the terminal value, NPV, and IRR in- plied by this assumption. d. Comment on the results implied by the use of aggressive te 12. Sam Dozier, a verv brioht comnutor ecinns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts