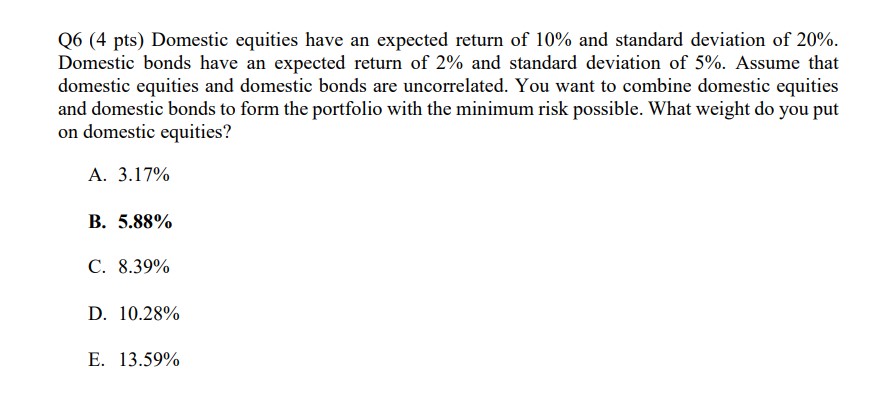

Question: HELP Please! I'm trying to figure out how to use the formulas below to solve this problem. Please provide extensive work and explanations I want

HELP Please! I'm trying to figure out how to use the formulas below to solve this problem. Please provide extensive work and explanations I want to understand!

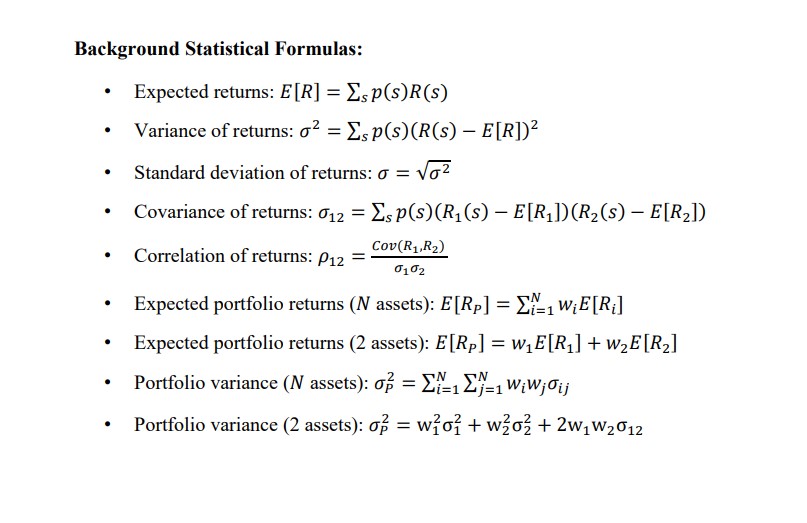

Background Statistical Formulas: - Expected returns: E[R]=sp(s)R(s) - Variance of returns: 2=sp(s)(R(s)E[R])2 - Standard deviation of returns: =2 - Covariance of returns: 12=sp(s)(R1(s)E[R1])(R2(s)E[R2]) - Correlation of returns: 12=12Cov(R1,R2) - Expected portfolio returns ( N assets): E[RP]=i=1NwiE[Ri] - Expected portfolio returns (2 assets): E[RP]=w1E[R1]+w2E[R2] - Portfolio variance ( N assets): P2=i=1Nj=1Nwiwjij - Portfolio variance (2 assets): P2=w1212+w2222+2w1w212

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock