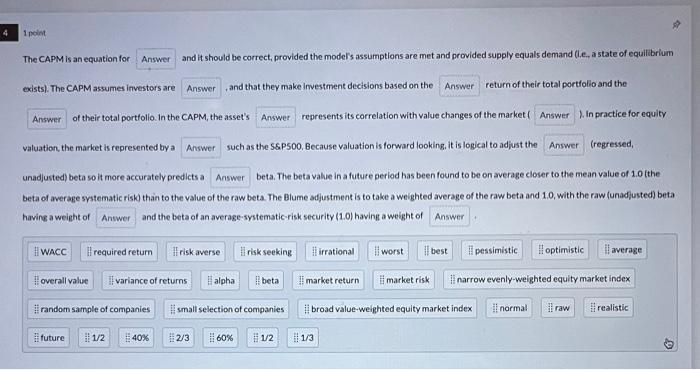

Question: help please inoint The CAPM is an equation for ___ and it should be correct, provided the models assumptions are met and provided supply equals

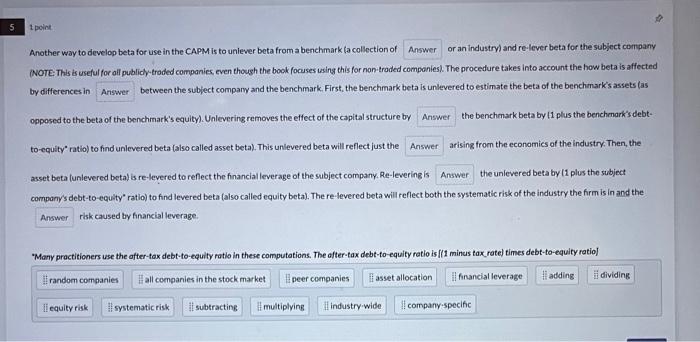

inoint The CAPM is an equation for ___ and it should be correct, provided the models assumptions are met and provided supply equals demand (l.e., a state of equilibrium exists). The CAPM assumes investors are , and that they make investment decisions based on the return of their total portifiolio and the of their total portfollo. In the CAPM, the asset's represents its correlation with value changes of the market ( 1. In practice for equity valuation, the market is represented by a such as the S\$.PS00, Because valuation is forward looking. it is logical to adjust the (regressed, unadjusted) beta so it more accurately predicts a beta. The beta vakie in a future period has been found to be on average closer to the mean value of 1.0 (the beta of average systematic riskl thain to the value of the raw beta. The Blume adjustment is to take a weighted average of the raw beta and 1.0, with the raw (unadjusted) beta having a weight of and the beta of an average-systematic-risk security (1.0) having a weight of Another way to develop beta for use in the CAPM is to uniever beta from a benchmark fa collection of or an industryl and re-lever beta for the subject company NOTE: This is useful for oll publichy-traded companics, even though the book focuses using this for non-troded componies). The procedure takes into account the how beta is affected by differences in between the subject compary and the benchmark. First, the benchmark beta is unlevered to estimate the beta of the benchmark's assets (as opposed to the beta of the benchmark's equity). Unlevering removes the effect of the capital structure by the benchmark beta by l1 plus the benchmark's debtto-equity" ratio) to find unlevered beta (also called asset beta). This unlevered beta will reflect just the arising from the econamics of the industry. Then, the asset beta funlevered beta) is re-levered to reflect the financial leverage of the subject company. Re-levering is the unlevered beta by [1 plus the subject company's debt-to-equity" ratio) to find levered beta (also called equity beta). The re-levered beta will reflect both the systematic risk of the industry the firm is in and the risk caused by financial leverage. "Many proctitioners use the ofter-tax debt-to-equity ratio in these computations. The ofter-tax debt-to-equity ratio is [(1 minus tax, ratel times debt-to-equity ratio]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts