Question: help please, it will be preferable if u can do this in excel Goodwin Technologies, a relatively young company, has been wildiy successtul but has

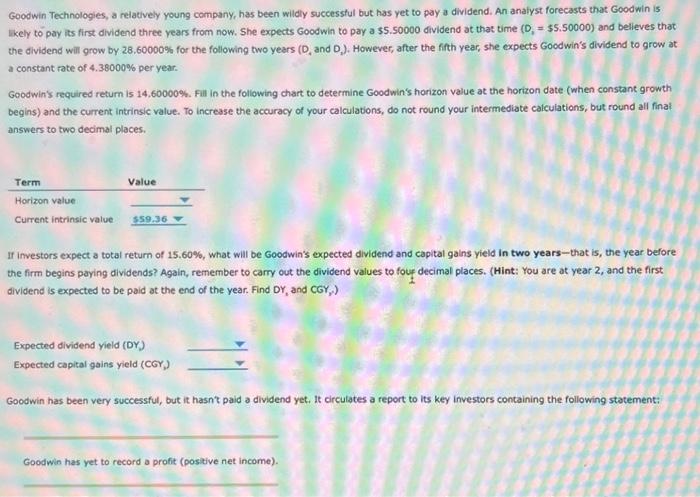

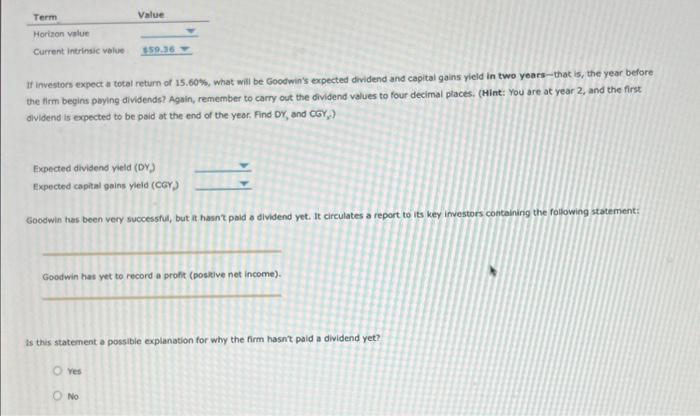

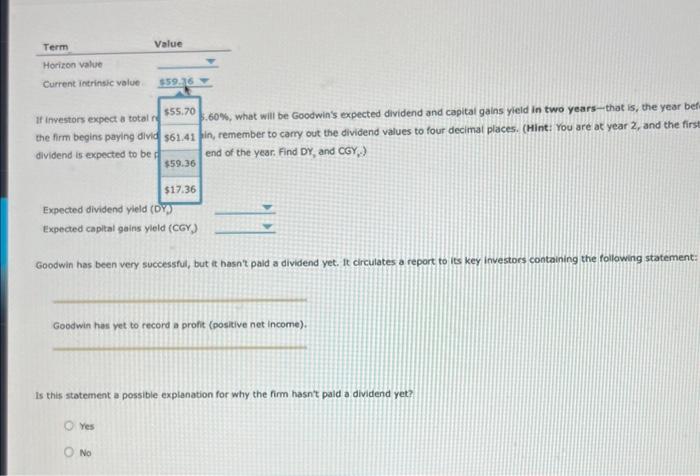

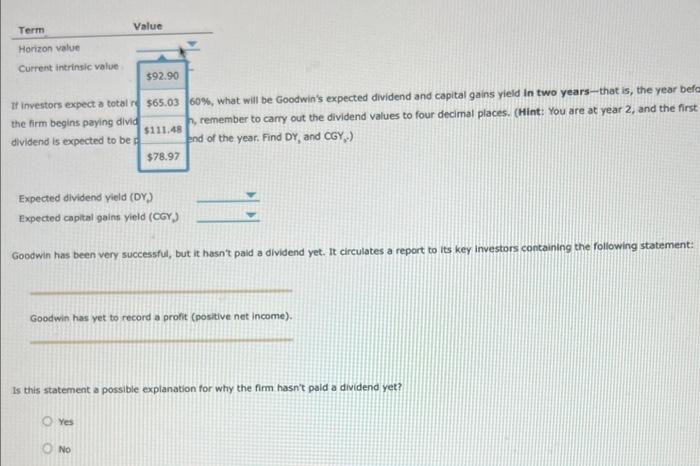

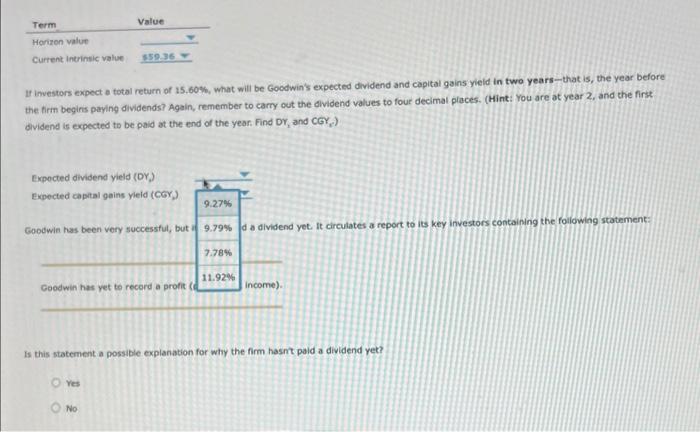

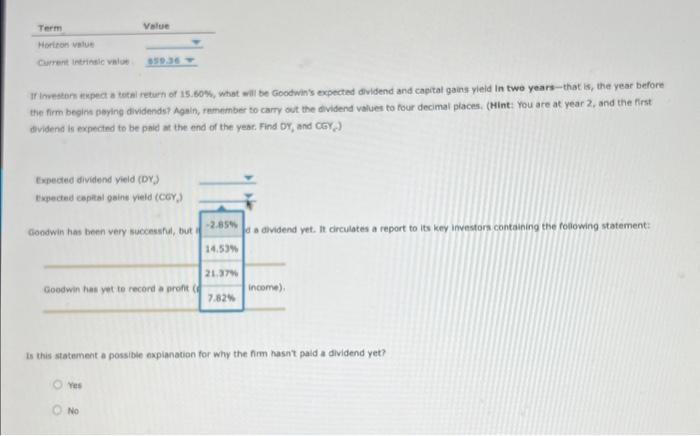

Goodwin Technologies, a relatively young company, has been wildiy successtul but has yet to pay a dividend. An anafyst forecasts that Goodwin is Whely to pay its first dividend three years from now. She expects Goodwin to pay a $5.50000 dividend at that time (D1=$5.50000) and believes that the dividend will grow by 28,60000% for the following two years (D, and D2). However, after the fift year, she expects Goodwin's dividend to grow at a constant rate of 4.38000% per year. Goodwin's required retum is 14,60000%. Fill in the following chart to determine Goodwin's horizon value at the horizon date (when constant growth begins) and the current intrinsic value. To increase the accuracy of your calculations, do not round your intermediate calculations, but round all final answers to two decimal places. If investors expect a total return of 15.60%, what will be Goodwin's expected dividend and capital gains yield in two years - that is, the year before the firm begins paying dividends? Again, remember to carry out the dividend values to fouf decimal places. (Hint: You are at year 2 , and the first dividend is expected to be paid at the end of the year. Find DY, and CGYy ) Goodwin has been very successful, but it hasnt paid a dividend yet. It circulates a report to its key investors containing the following statement: Goodwin has yet to record a profit (positive net income). If investors expect an total return of 15.60\%, what will be Goodwin's expected dividend and capital gains yield in two years-that is, the year before the firm begins poying dividendst Again, remember to carry out the dividend values to four decimal places, (Hint: You are at year 2 , and the first olvidend is expected to be poid at the end of the yeor. Find DY,andcor, ? Goodwin has been very successful, but at hasnt paid a dividend yet. it circulates a report to its key imvestors containing the following statement: Goodwin has yet to record a proft (posklve net income). Is this statenent a possible explanation for why the firm hasnt paid a dividend yet? Yes No If investors expect a total nf 555.70 , 60\%, what will be Goodwin's expected dividend and capitai gains yield in two years--that is, the year be the firm begins paying divid 561.41 in, remember to camy out the dividend values to four decimal places. (Hint: You are at year 2 , and the firs dividend is expected to be of $559.36 $17.36 Expected dividend yield (DY) Expected capital gains yleid (CGY) Goodwin has been very successful, but at hasnt paid a dividend yet. ft circulates a report to its key investors containing the following statement: Goodwin has yet to record a proft (positive net income). Is this statement a possible explanation for why the fim hasnt paid a dividend yet? Yes Goodwin has yet to record a profit (positive net income). Is this statement a possible explanation for why the fim hasn't paid a dividend yet? Yes No If investors expect a total return of 15,60\%, what will be Goodwin's expected dividend and capital gains yield in two years - that is, the year before the firm begins paying dividends? Again, remember to carry out the dividend values to four decimal places. (Hint: You are at year 2, and the first dividend is expected to be paid at the end of the year Find Dr2 and CGYe ) Expocted dividend yield (DY Expected capital gains yield (CCY) \begin{tabular}{|l|l|l|l|} \hline Goodwin has been very successful, but i & 9.27% & \\ \hline & 7.79% & d a dividend yet. \\ \hline Goodwin has yet to record a profit (d & 11.92%% & \\ \hline \end{tabular} Is this statement a possible explanation for why the fim hasmt paid a dividend yet? ves If inpesabrn ikpect a tethi return of 15.60%, what will be Goodwin's expected dividend and capital gains yleld In two years-that is, the year before the firm begint poylng dividends? Again, remember to carry out the dividend valuen to four decimal piaces, (Hint: You are at year 2 , and the first. dovidend is expected to be paid at the end of the year. Find DY, and CGr, Goodwin Technologies, a relatively young company, has been wildiy successtul but has yet to pay a dividend. An anafyst forecasts that Goodwin is Whely to pay its first dividend three years from now. She expects Goodwin to pay a $5.50000 dividend at that time (D1=$5.50000) and believes that the dividend will grow by 28,60000% for the following two years (D, and D2). However, after the fift year, she expects Goodwin's dividend to grow at a constant rate of 4.38000% per year. Goodwin's required retum is 14,60000%. Fill in the following chart to determine Goodwin's horizon value at the horizon date (when constant growth begins) and the current intrinsic value. To increase the accuracy of your calculations, do not round your intermediate calculations, but round all final answers to two decimal places. If investors expect a total return of 15.60%, what will be Goodwin's expected dividend and capital gains yield in two years - that is, the year before the firm begins paying dividends? Again, remember to carry out the dividend values to fouf decimal places. (Hint: You are at year 2 , and the first dividend is expected to be paid at the end of the year. Find DY, and CGYy ) Goodwin has been very successful, but it hasnt paid a dividend yet. It circulates a report to its key investors containing the following statement: Goodwin has yet to record a profit (positive net income). If investors expect an total return of 15.60\%, what will be Goodwin's expected dividend and capital gains yield in two years-that is, the year before the firm begins poying dividendst Again, remember to carry out the dividend values to four decimal places, (Hint: You are at year 2 , and the first olvidend is expected to be poid at the end of the yeor. Find DY,andcor, ? Goodwin has been very successful, but at hasnt paid a dividend yet. it circulates a report to its key imvestors containing the following statement: Goodwin has yet to record a proft (posklve net income). Is this statenent a possible explanation for why the firm hasnt paid a dividend yet? Yes No If investors expect a total nf 555.70 , 60\%, what will be Goodwin's expected dividend and capitai gains yield in two years--that is, the year be the firm begins paying divid 561.41 in, remember to camy out the dividend values to four decimal places. (Hint: You are at year 2 , and the firs dividend is expected to be of $559.36 $17.36 Expected dividend yield (DY) Expected capital gains yleid (CGY) Goodwin has been very successful, but at hasnt paid a dividend yet. ft circulates a report to its key investors containing the following statement: Goodwin has yet to record a proft (positive net income). Is this statement a possible explanation for why the fim hasnt paid a dividend yet? Yes Goodwin has yet to record a profit (positive net income). Is this statement a possible explanation for why the fim hasn't paid a dividend yet? Yes No If investors expect a total return of 15,60\%, what will be Goodwin's expected dividend and capital gains yield in two years - that is, the year before the firm begins paying dividends? Again, remember to carry out the dividend values to four decimal places. (Hint: You are at year 2, and the first dividend is expected to be paid at the end of the year Find Dr2 and CGYe ) Expocted dividend yield (DY Expected capital gains yield (CCY) \begin{tabular}{|l|l|l|l|} \hline Goodwin has been very successful, but i & 9.27% & \\ \hline & 7.79% & d a dividend yet. \\ \hline Goodwin has yet to record a profit (d & 11.92%% & \\ \hline \end{tabular} Is this statement a possible explanation for why the fim hasmt paid a dividend yet? ves If inpesabrn ikpect a tethi return of 15.60%, what will be Goodwin's expected dividend and capital gains yleld In two years-that is, the year before the firm begint poylng dividends? Again, remember to carry out the dividend valuen to four decimal piaces, (Hint: You are at year 2 , and the first. dovidend is expected to be paid at the end of the year. Find DY, and CGr

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts