Question: help please ! J & J Enterprises is considering a cash acquisition of Patterson Steel Company for $5,400,000. Patterson will provide the following pattern of

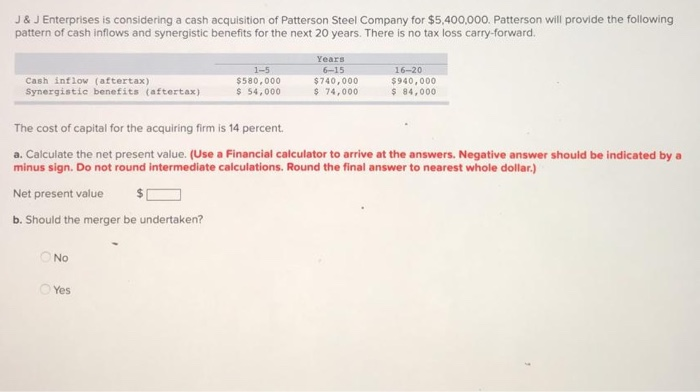

J & J Enterprises is considering a cash acquisition of Patterson Steel Company for $5,400,000. Patterson will provide the following pattern of cash inflows and synergistic benefits for the next 20 years. There is no tax loss carry-forward. Cash inflow (aftertax) Synergistic benefits (aftertax) 1-5 $580,000 $ 54,000 Years 6-15 $740,000 $ 74,000 16-20 $940.000 $ 84,000 The cost of capital for the acquiring firm is 14 percent a. Calculate the net present value. (Use a Financial calculator to arrive at the answers. Negative answer should be indicated by a minus sign. Do not round intermediate calculations. Round the final answer to nearest whole dollar.) Net present value $ b. Should the merger be undertaken? No Yes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts