Question: Help please Joanna is trying to decide whether or not to take out a standard health insurance policy from Bupa (a private healthcare company). Joanna

Help please

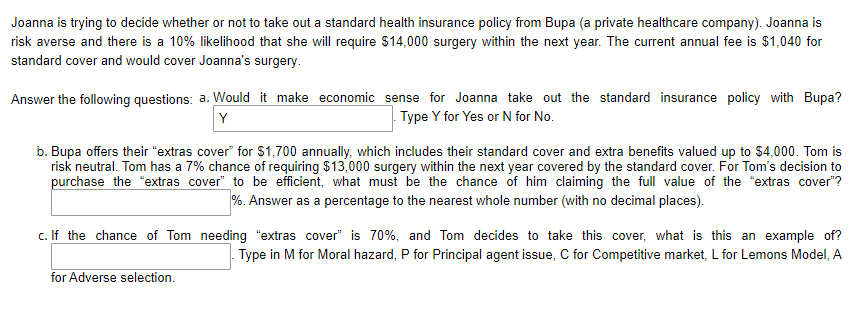

Joanna is trying to decide whether or not to take out a standard health insurance policy from Bupa (a private healthcare company). Joanna is risk averse and there is a 10% likelihood that she will require $14,000 surgery within the next year. The current annual fee is $1,040 for standard cover and would cover Joanna's surgery. Answer the following questions: a. Would it make economic sense for Joanna take out the standard insurance policy with Bupa? Y Type Y for Yes or N for No. b. Bupa offers their "extras cover" for $1,700 annually, which includes their standard cover and extra benefits valued up to $4,000. Tom is risk neutral. Tom has a 7% chance of requiring $13,000 surgery within the next year covered by the standard cover. For Tom's decision to purchase the "extras cover" to be efficient, what must be the chance of him claiming the full value of the "extras cover"? %. Answer as a percentage to the nearest whole number (with no decimal places). c. If the chance of Tom needing "extras cover" is 70%, and Tom decides to take this cover, what is this an example of? Type in M for Moral hazard, P for Principal agent issue, C for Competitive market, L for Lemons Model, A for Adverse selection

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts